Delta Airlines 2008 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

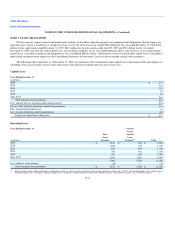

At December 31, 2008, we operated 258 aircraft under operating leases and 81 aircraft under capital leases. Our contract carriers operated 443 aircraft

under operating leases. Leases for aircraft operated by us and our contract carriers have expiration dates ranging from 2009 to 2025. During the four months

ended April 30, 2007 and the year ended December 31, 2006, we recorded estimated claims relating to the restructuring of the financing arrangements for

many of our aircraft and the rejection of certain of our leases in connection with our bankruptcy proceedings.

NOTE 8. PURCHASE COMMITMENTS AND CONTINGENCIES

Aircraft Order Commitments

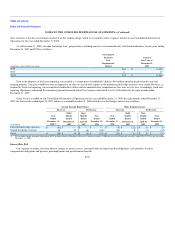

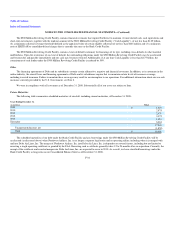

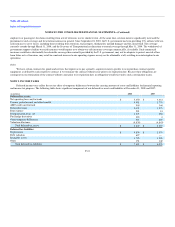

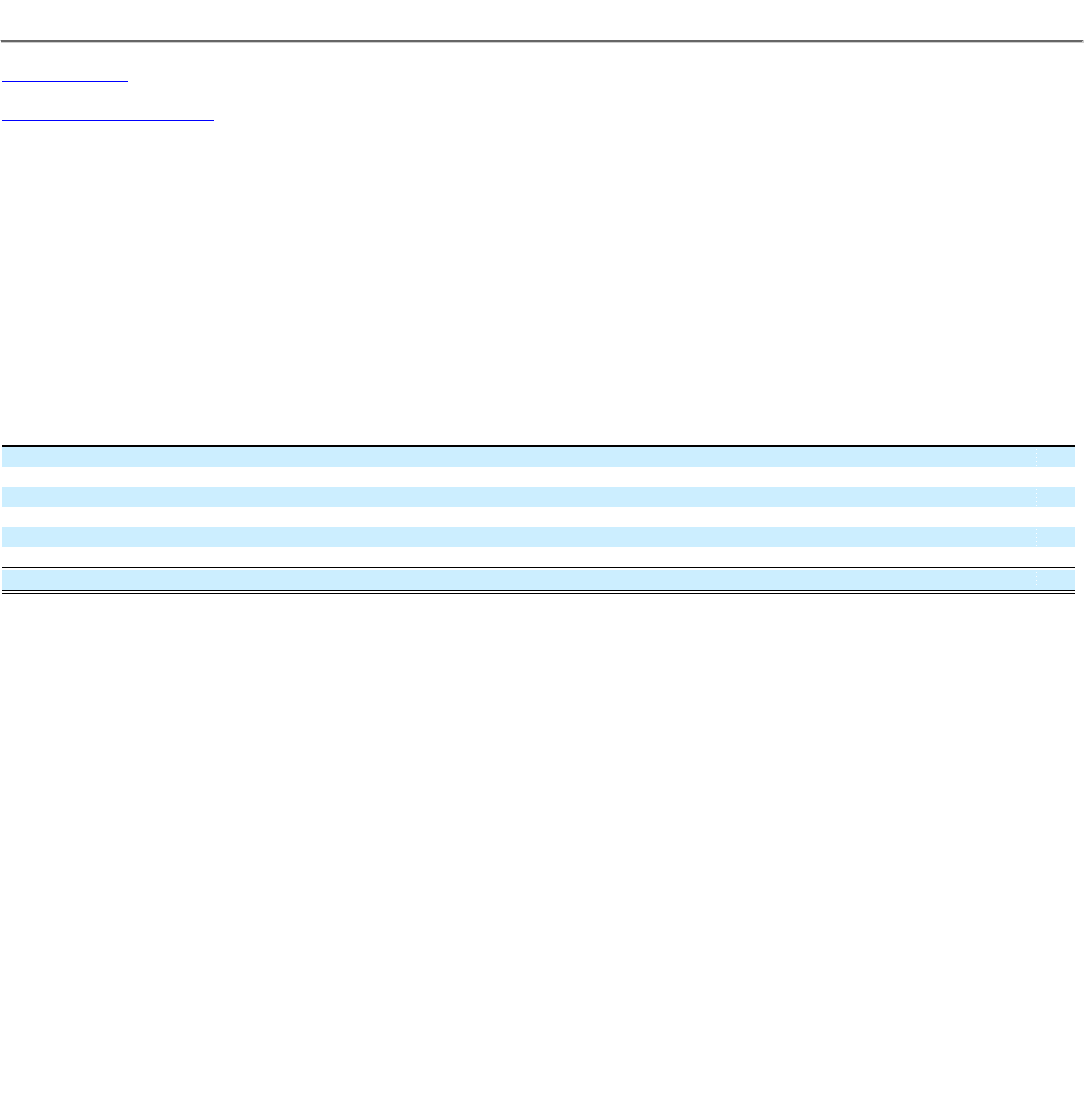

Future commitments for aircraft on firm order as of December 31, 2008 are estimated to be approximately $2.9 billion. The following table shows the

timing of these commitments:

Years Ending December 31,

(in millions)

2009 $1,520

2010 990

2011 60

2012 110

2013 90

After 2013 130

Total $2,900

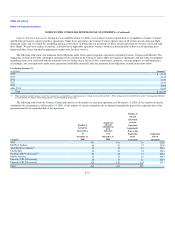

Our aircraft order commitments as of December 31, 2008 consist of firm orders to purchase eight B-777-200LR aircraft, five B-737-700 aircraft, 33

B-737-800 aircraft, two A320-200 aircraft, five A319-100 aircraft and 10 CRJ-900 aircraft.

We have excluded from the table above our order for 18 B-787-8 aircraft. The Boeing Company ("Boeing") has informed us that Boeing will be unable

to meet the contractual delivery schedule for these aircraft. We are in discussions with Boeing regarding this situation.

Our firm orders to purchase 33 B-737-800 aircraft include 31 B-737-800 aircraft, which we have entered into definitive agreements to sell to two third

parties immediately following delivery of these aircraft to us by the manufacturer. We have not received any notice that these parties have defaulted on their

purchase obligations. These sales will reduce our future commitments by approximately $1.3 billion during the period from 2009 through 2011 ($490 million,

$730 million and $40 million for 2009, 2010 and 2011, respectively).

We have financing commitments from third parties, cancellation rights or, with respect to the 31 B-737-800 aircraft referred to above, definitive

agreements to sell, all Mainline and CRJ-900 aircraft on firm order as of December 31, 2008. Under these financing commitments, third parties have agreed to

finance, on a long-term secured basis, a substantial portion of the purchase price of the covered aircraft,

Our firm orders to purchase 10 CRJ-900 aircraft include two CRJ-900 aircraft, which we have assigned to a Contract Carrier. We are required to cure

any default by the Contract Carrier of its purchase obligation, and have certain indemnification rights against the Contract Carrier for costs incurred in

effecting such a cure.

Contract Carrier Agreements

During the year ended December 31, 2008, we had Contract Carrier agreements with 12 Contract Carriers, including our wholly-owned subsidiaries,

Comair, Compass and Mesaba.

F-36