Delta Airlines 2008 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

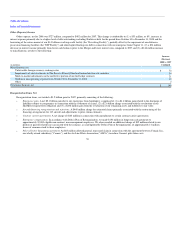

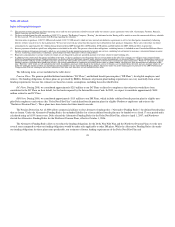

• Pilot collective bargaining agreement. A $2.1 billion allowed general, unsecured claim in connection with our comprehensive agreement with

ALPA reducing our pilot labor costs.

• Aircraft financing renegotiations and rejections. A $1.7 billion charge for estimated claims associated with restructuring the financing

arrangements for 188 aircraft and the rejection of 16 aircraft leases.

• Retiree healthcare benefit claims. A $539 million charge for allowed general, unsecured claims in connection with agreements that we reached

with committees representing both pilot and non-pilot retired employees reducing their postretirement healthcare benefits.

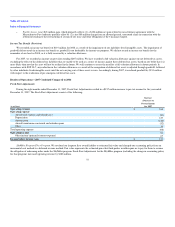

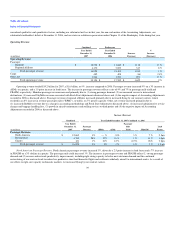

Income Tax (Provision) Benefit

For 2007, we recorded an income tax provision totaling $207 million. For additional information about this provision, see "Results of Operations—

2008 Compared to 2007 Combined."

For 2006, we recorded an income tax benefit totaling $765 million. The amount primarily reflects a decrease to our deferred tax asset valuation

allowances from the reversal of accrued pension liabilities associated with the Delta Pilot Plan and pilot non-qualified plan obligations upon each plan's

termination.

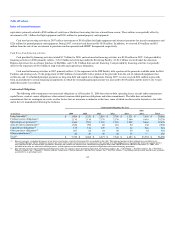

Financial Condition and Liquidity

Our cash and cash equivalents and short-term investments were $4.5 billion at December 31, 2008 compared to $2.8 billion at December 31, 2007. This

increase primarily reflects our Merger with Northwest, in which we acquired $2.4 billion of cash and cash equivalents, $1.0 billion we received from

American Express for an advance purchase of SkyMiles and the borrowing of $1.0 billion under the Revolving Facility that is a part of our senior secured exit

financing facilities (the "Exit Facilities"), partially offset by $1.2 billion of fuel hedge margin that we were required to post with counterparties.

The counterparties under our fuel hedge contracts have the right to require us to secure our obligations under those contracts by posting the margin

associated with any loss position on those contracts. Our contracts related to the margin balance as of the end of 2008 generally settle during the first half of

2009. If fuel prices continue to fall, we may be required to post additional collateral under those contracts.

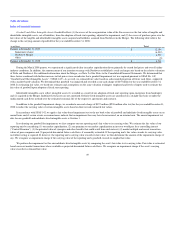

We expect to meet our cash needs for 2009 from cash flows from operations, cash and cash equivalents, short-term investments and financing

arrangements. We have an undrawn $500 million revolving credit facility. With respect to our aircraft order commitments at December 31, 2008, we have

financing commitments from third parties, cancellation rights or definitive agreements to sell certain aircraft to third parties immediately following delivery of

those aircraft to us by the manufacturer.

While we do not currently anticipate a need to access the capital markets to meet our cash needs in 2009, the continued credit crisis and related turmoil

in the global financial system may restrict our ability to access the markets at a time when we would like, or need, to do so. These conditions could have an

impact on our flexibility to react to changing economic and business conditions. In addition, our ability to obtain additional financing on acceptable terms for

future needs could be affected by the fact that substantially all of our assets are subject to liens.

The financing agreements of Delta and its subsidiaries contain certain affirmative, negative and financial covenants. We were in compliance with all

covenants as of December 31, 2008.

42