Delta Airlines 2008 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

Application of Critical Accounting Policies

Critical Accounting Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires

management to make certain estimates and assumptions. We periodically evaluate these estimates and assumptions, which are based on historical experience,

changes in the business environment and other factors that management believes to be reasonable under the circumstances. Actual results may differ

materially from these estimates.

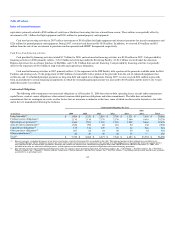

Frequent Flyer Programs. We have a frequent flyer program (the "SkyMiles Program") offering incentives to increase travel on Delta. This program

allows participants to earn mileage credits by flying on Delta, Contract Carriers and participating airlines, as well as through participating companies such as

credit card companies, hotels and car rental agencies. We also sell mileage credits to other airlines and to non-airline businesses. Mileage credits can be

redeemed for free or upgraded air travel on Delta and participating airlines, for membership in our Crown Room Club and for other program awards.

In the Merger, we assumed Northwest's frequent flyer program (the "WorldPerks Program"). We are consolidating the SkyMiles and WorldPerks

Programs, which will ultimately provide for the combining of miles from each program at a one-to-one ratio. The WorldPerks Program is accounted for under

the same methodology as the SkyMiles Program.

We use the residual method for revenue recognition of mileage credits. The fair value of the mileage credit component is determined based on prices at

which we sell mileage credits to other airlines, currently $0.0054 per mile and is re-evaluated at least annually. Under the residual method, the portion of the

revenue from the sale of mileage credits that approximates fair value is deferred and recognized as passenger revenue when miles are redeemed and services

are provided based on the weighted- average price of all miles that have been deferred. The portion of the revenue received in excess of the fair value is

recognized in income immediately and classified as other, net revenue.

For mileage credits which we estimate are not likely to be redeemed ("Breakage"), we recognize the associated value proportionally during the period

in which the remaining mileage credits are expected to be redeemed. The estimate of Breakage is based on historical redemption patterns. A change in

assumptions as to the period over which mileage credits are expected to be redeemed, the actual redemption activity for mileage credits or our estimate of the

fair value of mileage credits expected to be redeemed could have a material impact on our revenue in the year in which the change occurs and in future years.

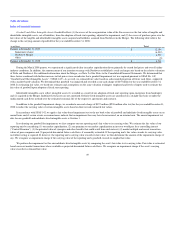

At December 31, 2008, the aggregate deferred revenue balance associated with our frequent flyer programs was $5.1 billion. A hypothetical 1% change in our

outstanding number of miles estimated to be redeemed would result in a $49 million impact on our deferred revenue liability.

Purchase Accounting Measurements. On the Closing Date, Northwest revalued its assets and liabilities at fair value in accordance with Statement of

Financial Accounting Standards ("SFAS") No. 141, "Business Combinations" ("SFAS 141"). These changes in value did not result in gains or losses, but were

instead an input to the calculation of goodwill related to the excess of purchase price over the fair value of the tangible and identifiable intangible assets

acquired and liabilities assumed from Northwest in the Merger. Additional changes in the fair values of these assets and liabilities from the current estimated

values, as well as changes in other assumptions, could significantly impact the reported value of goodwill.

The fair value of Northwest's debt and capital lease obligations was determined by estimating the present value of amounts to be paid at appropriate

interest rates as of the Closing Date. These rates were determined with swap rates, LIBOR rates and market spreads as of the Closing Date. The market

spreads, which were determined with the assistance of third party financial institutions, took into consideration the credit risk and the structure of the

instruments as well as the underlying collateral supporting the instruments.

47