Delta Airlines 2008 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

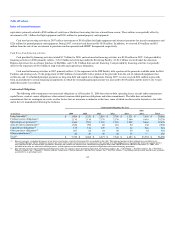

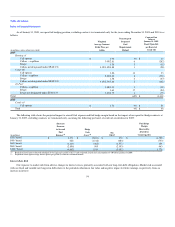

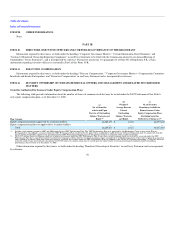

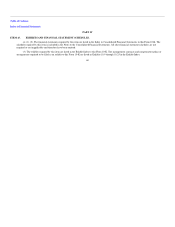

As of January 31, 2009, our open fuel hedging position, excluding contracts we terminated early for the years ending December 31, 2009 and 2010 is as

follows:

(in millions, unless otherwise stated)

Weighted

Average Contract

Strike Price per

Gallon

Percentage of

Projected

Fuel

Requirements

Hedged

Contract Fair

Value at

January 31, 2009

Based Upon $42

per Barrel of

Crude Oil

2009

Heating oil

Call options $ 1.90 3% $ 14

Collars —cap/floor 3.05/2.81 6 (282)

Swaps 1.56 5 (15)

Collars not designated under SFAS 133 4.15/3.42/4.88 1 (28)

Crude Oil

Call options 1.86 14 33

Collars—cap/floor 2.84/2.46 8 (376)

Swaps 1.58 4 (47)

Collars not designated under SFAS 133 3.15/2.73/3.80 2 (142)

Jet Fuel

Collars—cap/floor 3.48/3.31 1 (39)

Swaps 1.63 17 (54)

Swaps not designated under SFAS 133 3.83/4.75 1 (75)

Total 62% $ (1,011)

2010

Crude oil

Call options $ 1.71 9% $ 55

Total 9% $ 55

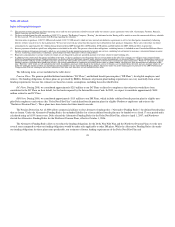

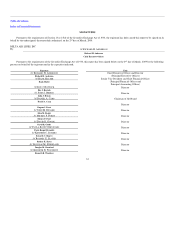

The following table shows the projected impact to aircraft fuel expense and fuel hedge margin based on the impact of our open fuel hedge contracts at

January 31, 2009, excluding contracts we terminated early, assuming the following per barrel of crude oil sensitivities for 2009:

(in millions)

(Increase)

Decrease

to Aircraft

Fuel

Expense(1)

Hedge

Gain

(Loss)(2) Net

impact

Fuel Hedge

Margin

Received by

(Posted to)

Counterparties

$20 / barrel $ 2,371 $ (2,101) $ 270 $ (1,758)

$40 / barrel 628 (1,312) (684) (753)

$60 / barrel (1,115) (462) (1,577) 108

$80 / barrel (2,858) 505 (2,353) 943

$100 / barrel (4,602) 1,519 (3,083) 1,776

(1) Projection based upon estimated unhedged jet fuel price per gallon of $1.83 and estimated aircraft fuel consumption of 4.0 billion gallons for 2009.

(2) Projection based upon average futures prices per gallon by contract settlement month.

Interest Rate Risk

Our exposure to market risk from adverse changes in interest rates is primarily associated with our long-term debt obligations. Market risk associated

with our fixed and variable rate long-term debt relates to the potential reduction in fair value and negative impact to future earnings, respectively, from an

increase in interest

54