Delta Airlines 2008 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

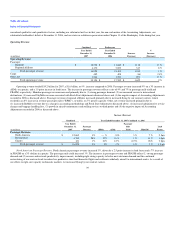

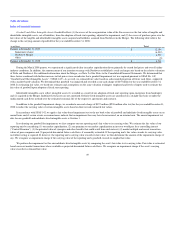

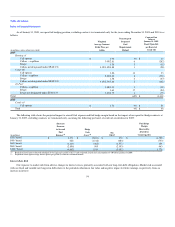

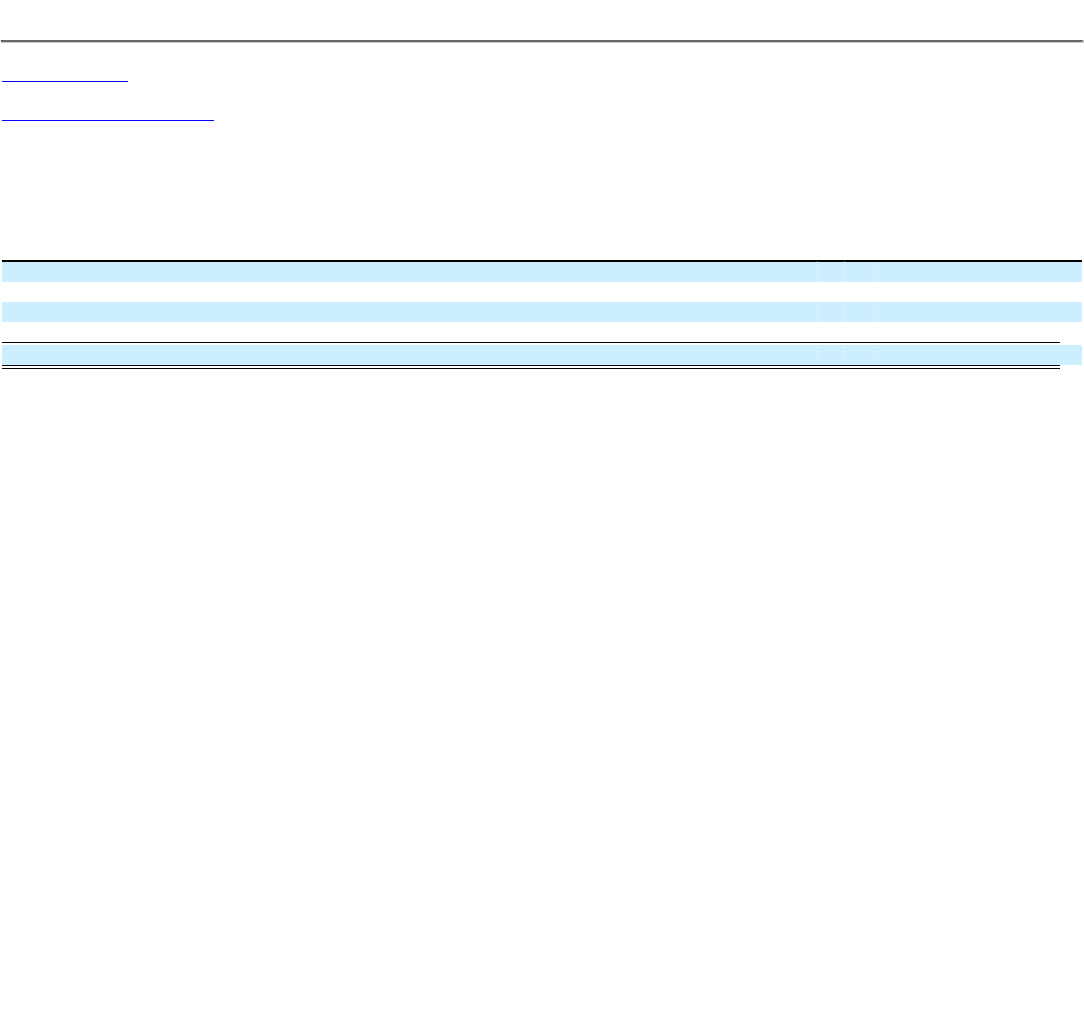

Goodwill and Other Intangible Assets. Goodwill reflects (1) the excess of the reorganization value of the Successor over the fair value of tangible and

identifiable intangible assets, net of liabilities, from the adoption of fresh start reporting, adjusted for impairment, and (2) the excess of purchase price over the

fair values of the tangible and identifiable intangible assets acquired and liabilities assumed from Northwest in the Merger. The following table reflects the

change in the carrying amount of goodwill for the year ended December 31, 2008:

(in millions) Total

Balance at December 31, 2007 $ 12,104

Impairment charge (6,939)

Northwest Merger 4,572

Other (6)

Balance at December 31, 2008 $ 9,731

During the March 2008 quarter, we experienced a significant decline in market capitalization driven primarily by record fuel prices and overall airline

industry conditions. In addition, the announcement of our intention to merge with Northwest established a stock exchange ratio based on the relative valuation

of Delta and Northwest. For additional information about the Merger, see Note 2 of the Notes to the Consolidated Financial Statements. We determined that

these factors combined with further increases in fuel prices were an indicator that a goodwill impairment test was required pursuant to SFAS No. 142,

"Goodwill and Other Intangible Assets" ("SFAS 142"). As a result, we estimated fair value based on a discounted projection of future cash flows, supported

with a market-based valuation. We determined that goodwill was impaired and recorded a non-cash charge of $6.9 billion for the year ended December 31,

2008. In estimating fair value, we based our estimates and assumptions on the same valuation techniques employed and levels of inputs used to estimate the

fair value of goodwill upon adoption of fresh start reporting.

Identifiable intangible assets reflect intangible assets (1) recorded as a result of our adoption of fresh start reporting upon emergence from bankruptcy

and (2) acquired in the Merger. Indefinite-lived assets are not amortized. Definite-lived intangible assets are amortized on a straight-line basis or under the

undiscounted cash flows method over the estimated economic life of the respective agreements and contracts.

In addition to the goodwill impairment charge, we recorded a non-cash charge of $357 million ($238 million after tax) for the year ended December 31,

2008 to reduce the carrying value of certain intangible assets based on their revised estimated fair values.

In accordance with SFAS 142, we apply a fair value-based impairment test to the net book value of goodwill and indefinite-lived intangible assets on an

annual basis and, if certain events or circumstances indicate that an impairment loss may have been incurred, on an interim basis. The annual impairment test

date for our goodwill and indefinite-lived intangible assets is October 1.

In evaluating our goodwill for impairment, we first compare our one reporting unit's fair value to its carrying value. We estimate the fair value of our

reporting unit by considering (1) our market capitalization, (2) any premium to our market capitalization an investor would pay for a controlling interest

("Control Premium"), (3) the potential value of synergies and other benefits that could result from such interest, (4) market multiple and recent transaction

values of peer companies and (5) projected discounted future cash flows, if reasonably estimable. If the reporting unit's fair value exceeds its carrying value,

no further testing is required. If, however, the reporting unit's carrying value exceeds its fair value, we then determine the amount of the impairment charge, if

any. We recognize an impairment charge if the carrying value of the reporting unit's goodwill exceeds its implied fair value.

We perform the impairment test for our indefinite-lived intangible assets by comparing the asset's fair value to its carrying value. Fair value is estimated

based on recent market transactions where available or projected discounted future cash flows. We recognize an impairment charge if the asset's carrying

value exceeds its estimated fair value.

49