Delta Airlines 2008 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

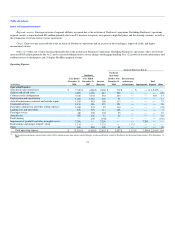

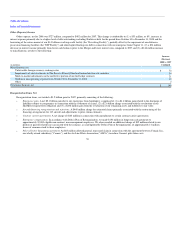

Depreciation and amortization. Depreciation expense decreased primarily due to (1) a lower depreciable asset base resulting from $127 million in Fresh

Start Adjustments discussed above and (2) 2006 adjustments to accelerate depreciation on certain limited life parts and aircraft. These decreases were partially

offset by amortization expense of $146 million related to intangibles created in connection with the Fresh Start Adjustments discussed above.

Contracted services. The increase in contracted services is primarily due to (1) higher outsourcing related to information technology, cargo handling

services and our aircraft cleaning services, (2) international expansion and (3) New York-JFK facility improvements.

Landing fees and other rents. Landing fees and other rents decreased primarily due to a charge recorded in 2006 associated with Accounting

Adjustments discussed above and due to benefits of restructuring certain contracts and lease obligations in bankruptcy.

Aircraft Rent. The decline in aircraft rent expense is primarily due to the renegotiation and rejection of certain leases in connection with our

restructuring under Chapter 11 and Fresh Start Adjustments discussed above.

Profit sharing. Our broad-based employee profit sharing plan provides that, for each year in which we have an annual pre-tax profit (as defined), we

will pay at least 15% of that profit to eligible employees. Based on our pre-tax earnings, we accrued $158 million under the profit sharing plan for 2007.

Operating Income and Operating Margin

We reported operating income of $1.1 billion and $58 million for 2007 and 2006, respectively. Operating margin, which is the ratio of operating income

to operating revenues, was 6% and less than 1% for 2007 and 2006, respectively.

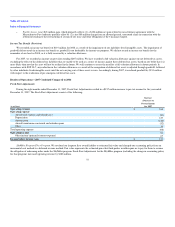

Other (Expense) Income

Other expense, net for 2007 was $492 million, compared to $820 million for 2006. This change is substantially attributable to (1) a 25%, or $218

million, net decrease in interest expense primarily due to the repayment of the DIP Facility in connection with our emergence from Chapter 11 and Fresh Start

Adjustments discussed above, partially offset by interest expense on borrowings under a senior secured exit financing facility, which we entered into in

conjunction with our emergence from bankruptcy (the "Exit Facilities"), (2) a $59 million increase in interest income primarily from interest earned due to

bankruptcy initiatives that was classified within reorganization items, net, in 2006 and (3) a $51 million increase to miscellaneous, net, primarily related to

fuel hedge losses in 2006 and foreign currency gains in 2007 due to an increased number of transactions denominated in foreign currencies.

Reorganization Items, Net

Reorganization items, net totaled a $1.2 billion gain for 2007. For additional information about these items, see "Results of Operations—2008

Compared to 2007 Combined."

Reorganization items, net totaled a $6.2 billion charge for 2006, primarily consisting of the following:

• Pilot pension termination. $2.2 billion and $801 million allowed general, unsecured claims in connection with our settlement agreements with the

Pension Benefit Guaranty Corporation ("the PBGC") and a group representing retired pilots, respectively. Charges for these claims were offset by

$1.3 billion in settlement gains associated with the derecognition of the previously recorded obligations for the qualified defined benefit pension

plan for Delta pilots (the "Delta Pilot Plan") and the related pilot non-qualified plans upon the termination of these plans.

41