Delta Airlines 2008 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

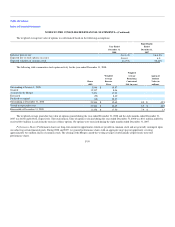

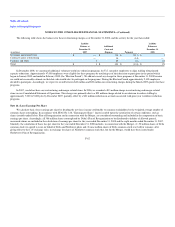

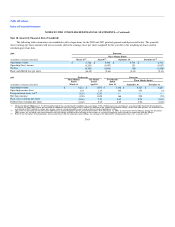

Note 18. Quarterly Financial Data (Unaudited)

The following table summarizes our unaudited results of operations for the 2008 and 2007 quarterly periods ended presented below. The quarterly

(loss) earnings per share amounts will not necessarily add to the earnings (loss) per share computed for the year due to the weighting of shares used in

calculating per share data.

2008 Successor

Three Months Ended

(in millions, except per share data) March 31(1) June 30(1) September 30 December 31(2)

Operating revenue $ 4,766 $ 5,499 $ 5,719 $ 6,713

Operating (loss) income (6,261) (1,087) 131 (1,097)

Net loss (6,390) (1,044) (50) (1,438)

Basic and diluted loss per share (16.15) (2.64) (0.13) (2.11)

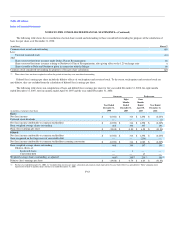

2007 Predecessor Successor

Three Months

Ended

March 31

One Month

Ended

April 30

Two Months

Ended

June 30

Three Months Ended

(in millions, except per share data) September 30 December 31

Operating revenue $ 4,241 $ 1,555 $ 3,448 $ 5,227 $ 4,683

Operating income (loss) 155 145 345 453 (2)

Reorganization items, net(3) (124) 1,339 — — —

Net (loss) income (130) 1,428 164 220 (70)

Basic (loss) earnings per share (0.66) 7.24 0.42 0.56 (0.18)

Diluted (loss) earnings per share (0.66) 5.19 0.42 0.56 (0.18)

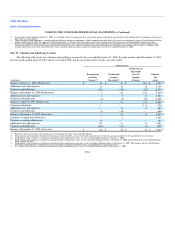

(1) During the March 2008 quarter, we determined goodwill was impaired and recorded a non-cash charge of $6.1 billion based on a preliminary assessment. We finalized the impairment

test during the June 2008 quarter and recorded an additional non-cash charge of $839 million. In addition to the goodwill impairment charge, in the June 2008 quarter, we recorded a non-

cash charge of $357 million to reduce the carrying value of certain intangible assets based on their revised estimated fair values.

(2) Our results of operations for the December 2008 quarter include Northwest for the period from October 30 to December 31, 2008. In connection with the Merger, during the December

2008 quarter, we recorded a one-time primarily non-cash charge of $969 million relating to the issuance or vesting of employee equity awards in connection with the Merger.

(3) Prior to our emergence from bankruptcy and in connection with our bankruptcy proceedings, our earnings were impacted by reorganization items, net, as shown above.

F-65