Delta Airlines 2008 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

employees or passengers) for claims resulting from acts of terrorism, war or similar events. At the same time, aviation insurers significantly increased the

premiums for such coverage and for aviation insurance in general. Since September 24, 2001, the U.S. government has been providing U.S. airlines with war-

risk insurance to cover losses, including those resulting from terrorism, to passengers, third parties (ground damage) and the aircraft hull. The coverage

currently extends through March 31, 2009, and the Secretary of Transportation has discretion to extend coverage through May 31, 2009. The withdrawal of

government support of airline war-risk insurance would require us to obtain war-risk insurance coverage commercially, if available. Such commercial

insurance could have substantially less desirable coverage than currently provided by the U.S. government, may not be adequate to protect our risk of loss

from future acts of terrorism, may result in a material increase to our operating expense or may not be obtainable at all, resulting in an interruption to our

operations.

Other

We have certain contracts for goods and services that require us to pay a penalty, acquire inventory specific to us or purchase contract specific

equipment, as defined by each respective contract, if we terminate the contract without cause prior to its expiration date. Because these obligations are

contingent on our termination of the contract without cause prior to its expiration date, no obligation would exist unless such a termination occurs.

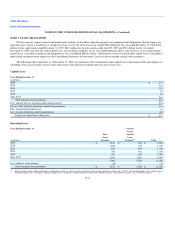

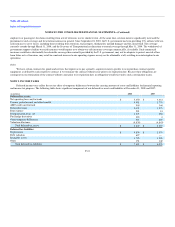

NOTE 9. INCOME TAXES

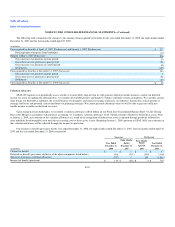

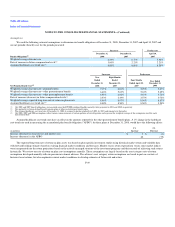

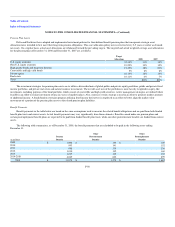

Deferred income taxes reflect the net tax effect of temporary differences between the carrying amounts of assets and liabilities for financial reporting

and income tax purposes. The following table shows significant components of our deferred tax assets and liabilities at December 31, 2008 and 2007:

(in millions) 2008 2007

Deferred tax assets:

Net operating loss carryforwards $ 5,450 $ 3,461

Pension, postretirement and other benefits 4,491 1,778

AMT credit carryforward 505 346

Deferred revenue 2,339 1,273

Rent expense 291 81

Reorganization items, net 1,375 988

Fuel hedge derivatives 663 4

Other temporary differences 565 469

Valuation allowance (9,830) (4,843)

Total deferred tax assets $ 5,849 $ 3,557

Deferred tax liabilities:

Depreciation $ 4,856 $ 3,079

Debt valuation 627 —

Intangible assets 1,795 1,049

Other 151 142

Total deferred tax liabilities $ 7,429 $ 4,270

F-41