Delta Airlines 2008 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

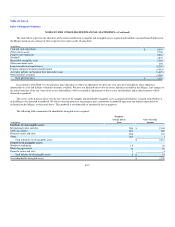

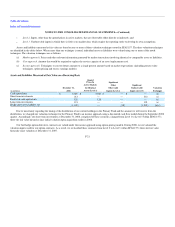

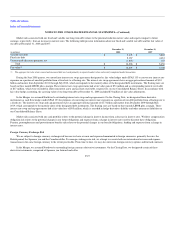

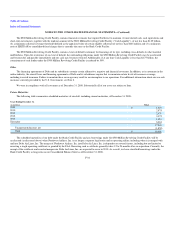

Market risk associated with our fixed and variable rate long-term debt relates to the potential reduction in fair value and negative impact to future

earnings, respectively, from an increase in interest rates. The following table presents information about our fixed and variable rate debt and the fair value of

our debt at December 31, 2008 and 2007:

(in millions)

December 31,

2008

December 31,

2007

Variable rate debt $ 9,678 $ 3,820

Fixed rate debt 8,187 4,481

Unamortized (discount) premium, net (1,859) 155

Total $ 16,006 $ 8,456

Fair value(1) $ 12,695 $ 8,148

(1) The aggregate fair value of our secured and unsecured debt was based primarily on reported market values and recently completed market transactions.

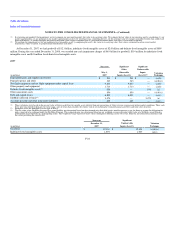

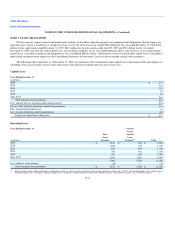

During the June 2008 quarter, we entered into interest rate swap agreements designated as fair value hedges under SFAS 133 to convert our interest rate

exposure on a portion of our debt portfolio from a fixed rate to a floating rate. The interest rate swap agreements have an aggregate notional amount of $1.0

billion and mature from September 2011 through July 2012, which corresponds to the maturity dates of the designated debt instruments. The floating rates are

based on three month LIBOR plus a margin. These interest rate swap agreements had a fair value gain of $74 million and a corresponding interest receivable

of $17 million, which were recorded in other noncurrent assets and accounts receivable, respectively, on our Consolidated Balance Sheet. In accordance with

fair value hedge accounting, the carrying value of our long-term debt at December 31, 2008 included $74 million of fair value adjustments.

In the Merger, we assumed Northwest's outstanding interest rate swap and cap agreements. On the Closing Date, we designated these derivative

instruments as cash flow hedges under SFAS 133 for purposes of converting our interest rate exposure on a portion of our debt portfolio from a floating rate to

a fixed rate. The interest rate swap and cap agreements have an aggregate notional amount of $1.7 billion and mature from December 2009 through May

2019, which corresponds to the maturity dates of the designated debt instruments. The floating rates are based on three month LIBOR plus a margin. These

interest rate swap and cap agreements had a fair value loss of $95 million, which is recorded in hedge derivatives liability and other noncurrent liabilities on

our Consolidated Balance Sheet.

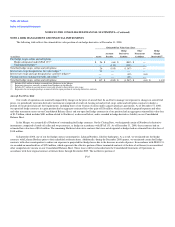

Market risk associated with our cash portfolio relates to the potential change in interest income from a decrease in interest rates. Workers' compensation

obligation risk relates to the potential changes in our future obligations and expenses from a change in interest rates used to discount these obligations.

Pension, postemployment and postretirement benefits risk relates to the potential changes in our benefit obligations, funding and expenses from a change in

interest rates.

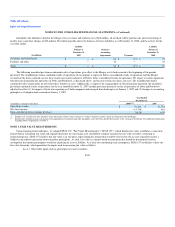

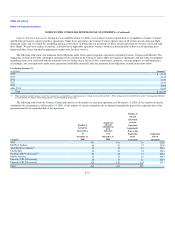

Foreign Currency Exchange Risk

We are subject to foreign currency exchange risk because we have revenue and expense denominated in foreign currencies, primarily the euro, the

British pound, the Japanese yen and the Canadian dollar. To manage exchange rate risk, we attempt to execute both our international revenue and expense

transactions in the same foreign currency to the extent practicable. From time to time, we may also enter into foreign currency options and forward contracts.

In the Merger, we assumed Northwest's outstanding foreign currency derivative instruments. On the Closing Date, we designated certain of these

derivative instruments, comprised of Japanese yen forward and collar

F-27