Delta Airlines 2008 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

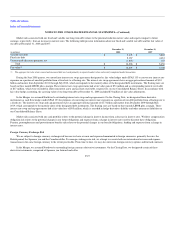

The $500 Million Revolving Credit Facility contains financial covenants that require Northwest to maintain (1) unrestricted cash, cash equivalents and

short-term investments, together with the undrawn amount of the $500 Million Revolving Credit Facility ("Cash Liquidity"), of not less than $1.25 billion,

(2) a minimum collateral coverage threshold (defined as the appraised value of certain eligible collateral) of not less than $625 million and (3) a minimum

ratio of EBITDAR to consolidated fixed charges that is currently the same as the Bank Credit Facility.

The $500 Million Revolving Credit Facility contains events of default customary for financings of its type, including cross-defaults to other material

indebtedness. Upon the occurrence of an event of default, the outstanding obligations under the $500 Million Revolving Credit Facility may be accelerated

and become due and payable immediately and our cash may become restricted. Additionally, if at any time Cash Liquidity is less than $2.75 billion, the

commitment of each lender under the $500 Million Revolving Credit Facility is reduced by 50%.

Other

The financing agreements of Delta and its subsidiaries contain certain affirmative, negative and financial covenants. In addition, as is customary in the

airline industry, the aircraft lease and financing agreements of Delta and its subsidiaries require that we maintain certain levels of insurance coverage,

including war-risk insurance. Failure to maintain these coverages may result in an interruption to our operations. For additional information about our war-risk

insurance currently provided by the U.S. Government, see Note 8.

We were in compliance with all covenants as of December 31, 2008. Substantially all of our assets are subject to liens.

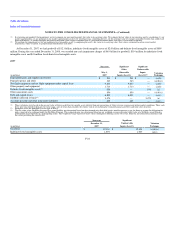

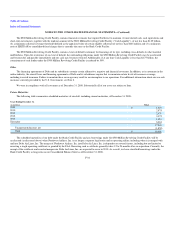

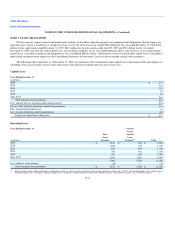

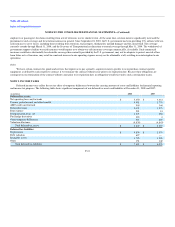

Future Maturities

The following table summarizes scheduled maturities of our debt, including current maturities, at December 31, 2008:

Years Ending December 31,

Total

(in millions)

2009 $ 1,424

2010 2,875

2011 2,479

2012 3,372

2013 1,051

Thereafter 6,664

17,865

Unamortized discount, net (1,859)

Total $ 16,006

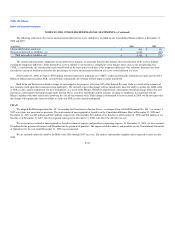

The scheduled maturities of our debt under the Bank Credit Facility and any borrowings under the $500 Million Revolving Credit Facility will be

accelerated (as discussed above) when Northwest Airlines, Inc. is no longer a separate legal entity and an operating airline, including when it is merged with

and into Delta Air Lines, Inc. The merger of Northwest Airlines, Inc. into Delta Air Lines, Inc. is dependent on several factors, including but not limited to

receiving a single operating certificate as granted by the FAA. Receiving such a certificate generally takes 12 to 24 months after an acquisition. Currently, the

receipt of the certificate and eventual merger into Delta Air Lines, Inc. are expected to occur in 2010. As a result, we have classified borrowings under the

Bank Credit Facility as long-term on our Consolidated Balance Sheet as of December 31, 2008.

F-34