Delta Airlines 2008 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

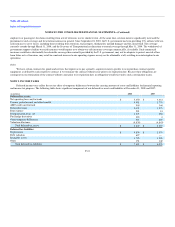

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

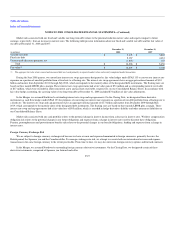

NOTE 6. DEBT

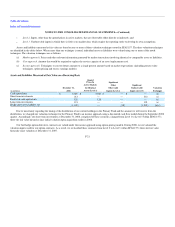

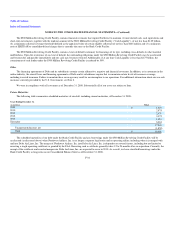

The following table summarizes our debt at December 31, 2008 and 2007:

December 31,

(in millions) 2008 2007

Senior Secured Exit Financing Facility due from 2012 to 2014, 3.9%% to 5.1%(1)(2) $ 2,448 $1,463

Bank Credit Facility due 2010, 2.6% to 3.4%(1)(3) 904 —

General Electric Capital Corporation ("GECC") Agreements due in installments from 2011 to 2014, 3.6% to 8.8%(1)(4) 469 542

Pass-Through Trust Certificates and Enhanced Equipment Trust Certificates (collectively, the "Certificates") due in installments from 2009

to 2023, 3.0% to 10.5%(5) 5,844 4,615

Revolving Credit Facility due from 2009 to 2011(1)(6) — —

Aircraft financings due in installments from 2009 to 2025, 1.0% to 9.9%(1)(7) 6,224 1,415

Other secured financings due in installments from 2009 to 2031, 1.7% to 8.8% 711 —

Total secured debt 16,600 8,035

American Express Agreement(8) 1,000 —

Other unsecured debt due in installments from 2009 to 2030, 3.0% to 9.1% 265 266

Total unsecured debt 1,265 266

Total secured and unsecured debt 17,865 8,301

Unamortized (discount) premium, net(9) (1,859) 155

Total debt 16,006 8,456

Less: current maturities (1,068) (929)

Total long-term debt $14,938 $7,527

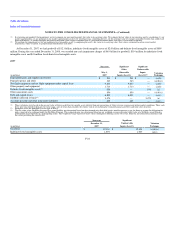

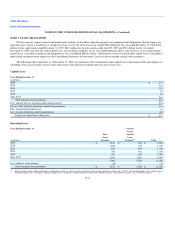

(1) Our variable interest rate long-term debt is shown using interest rates which represent LIBOR or an index rate plus a specified margin. The rates shown were in effect at December 31,

2008, if applicable.

(2) On the Effective Date, we entered into a senior secured exit financing facility (the "Exit Facilities") to borrow up to $2.5 billion. For additional information, see "Delta Exit Financing"

below.

(3) In August 2006, Northwest entered into a $1.2 billion senior corporate credit facility (the "Bank Credit Facility"). For additional information, see "Bank Credit Facility" below.

(4) As of December 31, 2008, Delta has two outstanding financing arrangements with GECC referred to as the "Spare Engines Loan" and the "Spare Parts Loan". The Spare Engines Loan

and the Spare Parts Loan are secured by certain spare Mainline aircraft engines ("Engine Collateral") and certain Mainline aircraft spare parts that we own ("Spare Parts Collateral"). The

Engine Collateral and Spare Parts Collateral also secure leases for up to 22 CRJ-200 aircraft and, on a subordinated basis, certain other aircraft lease obligations to GECC and its

affiliates. The Spare Engines Loan is not repayable at our election prior to maturity.

(5) As of December 31, 2008, the Certificates are secured by 148 aircraft. Included in the amount as of December 31, 2008 shown in the table is an aggregate of $1.3 billion in Certificates

issued in 2007, which have a weighted average interest rate of 7.4%, are due in installments through 2022 and are collateralized by 36 aircraft.

(6) In October 2008, Northwest entered into a $500 million revolving credit facility (the "$500 Million Revolving Credit Facility"). For additional information, see "$500 Million Revolving

Credit Facility" below.

(7) As of December 31, 2008, we have $6.2 billion of secured loans secured by 285 aircraft, not including aircraft securing the Certificates. During 2008, we entered into agreements to

borrow up to $1.6 billion to finance the purchase of 35 aircraft. In 2008, we took delivery of and financed 23 aircraft.

(8) In December 2008, we announced a multi-year extension of the American Express Agreement. As part of the American Express Agreement, we received $1.0 billion from American

Express for an advance purchase of SkyMiles, which amount is classified as long-term debt. This obligation will not be satisfied by cash payments, but through the purchases of SkyMiles

by American Express over an expected two year period beginning in December 2010.

F-31