Delta Airlines 2008 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2008 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

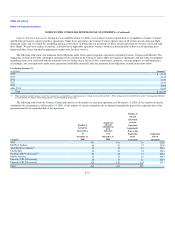

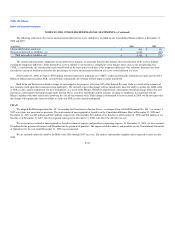

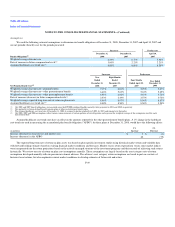

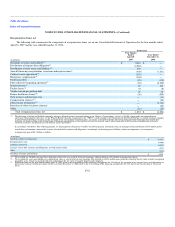

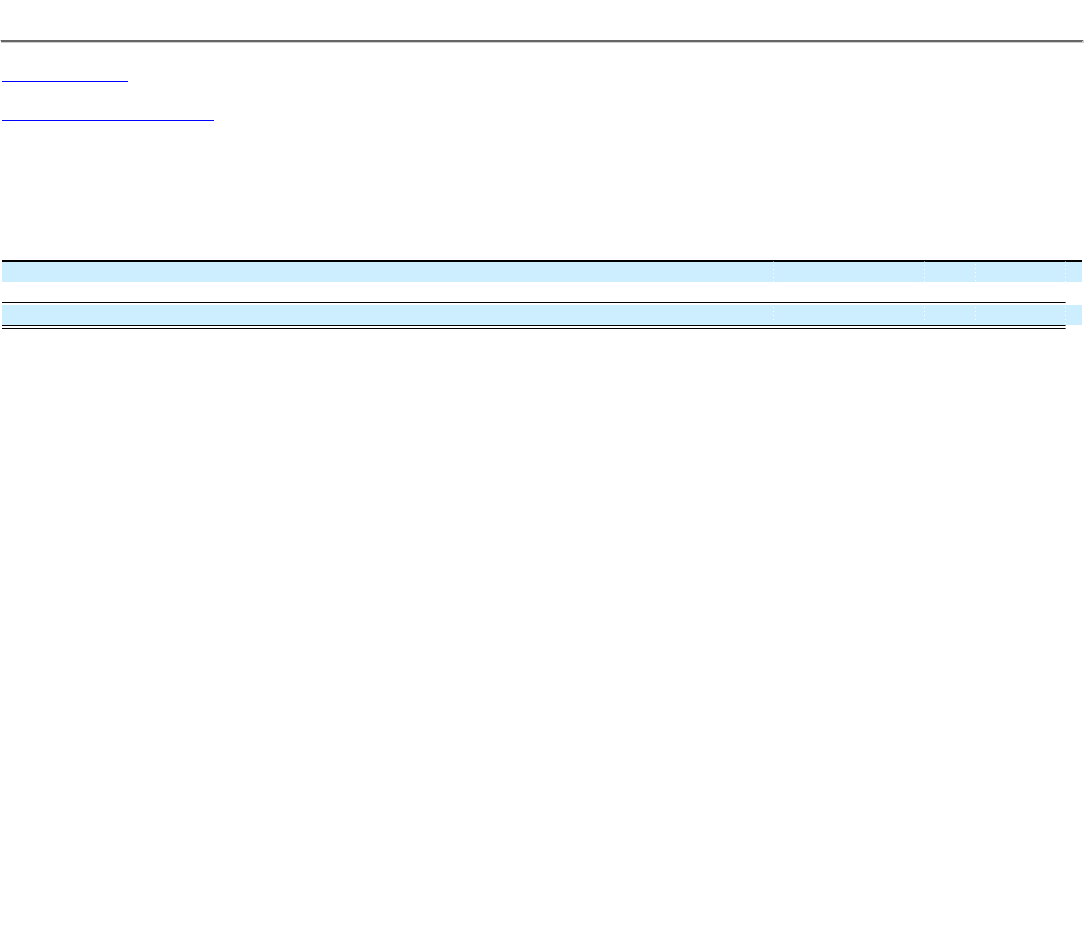

The following table shows the current and noncurrent deferred tax assets (liabilities), recorded on our Consolidated Balance Sheets at December 31,

2008 and 2007:

(in millions) 2008 2007

Current deferred tax assets, net $ 401 $ 142

Noncurrent deferred tax liabilities, net (1,981) (855)

Total deferred tax liabilities, net $ (1,580) $ (713)

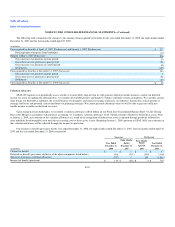

The current and noncurrent components of our deferred tax balances are generally based on the balance sheet classification of the asset or liability

creating the temporary difference. If the deferred tax asset or liability is not based on a component of our balance sheet, such as our net operating loss

("NOL") carryforwards, the classification is presented based on the expected reversal date of the temporary difference. Our valuation allowance has been

classified as current or noncurrent based on the percentages of current and noncurrent deferred tax assets to total deferred tax assets.

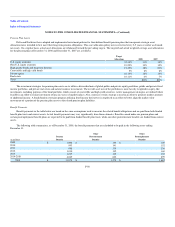

At December 31, 2008, we had (1) $505 million of federal alternative minimum tax ("AMT") credit carryforwards, which do not expire and (2) $14.5

billion of federal and state pretax NOL carryforwards, substantially all of which will not begin to expire until 2022.

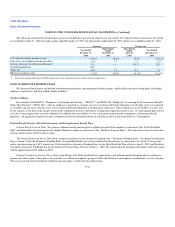

Both Delta and Northwest realized a change of ownership for the purposes of Section 382 of the Internal Revenue Code as a result of the issuance of

new common stock upon their emergence from bankruptcy. We currently expect this change will not significantly limit our ability to utilize our AMT credit

or NOLs in the carryforward period. On the Closing Date, as a result of the Merger, Northwest experienced a subsequent ownership change. Delta also may

experience a subsequent ownership change under Section 382 as a result of the Merger and the issuance of equity to employees in connection with the

Merger, together with other transactions involving the sale of our common stock. If the change is determined to have occurred in 2008, we do not expect that

this change will significantly limit our ability to utilize our NOLs in the carryforward period.

FIN 48

We adopted FASB Interpretation No. 48, "Accounting for Uncertainty in Income Taxes—an interpretation of FASB Statement No. 109," on January 1,

2007 to evaluate our uncertain tax positions. The total amount of unrecognized tax benefits on the Consolidated Balance Sheet at December 31, 2008 and

December 31, 2007 are $29 million and $143 million, respectively. This includes $10 million of tax benefits as of December 31, 2008 and $38 million of tax

benefits as of December 31, 2007, that if recognized subsequent to December 31, 2008, will affect the effective tax rate.

We accrue interest related to unrecognized tax benefits in interest expense and penalties in operating expense. At December 31, 2008, we have accrued

$5 million for the payment of interest and $8 million for the payment of penalties. The impact related to interest and penalties on our Consolidated Statements

of Operations for the year ended December 31, 2008 was not material.

We are currently under the audit by the IRS for the 2005 through 2007 tax years. The audit is substantially complete and is expected to close in early

2009.

F-42