Burger King 2009 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2009 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

The fair value of the Company’s foreign currency forward contracts and interest rate swaps was determined based on the present

value of expected future cash flows considering the risks involved, including nonperformance risk, and using discount rates appropriate

for the duration.

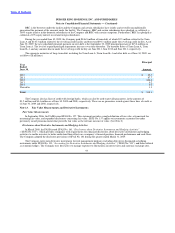

Interest Rate Swaps

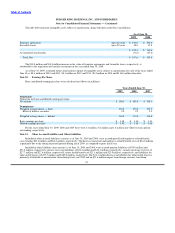

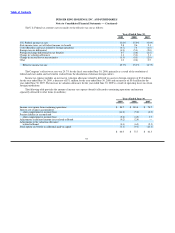

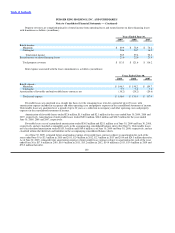

The Company enters into receive−variable, pay−fixed interest rate swap contracts to hedge a portion of the Company’s forecasted

variable−rate interest payments on its underlying Term Loan A and Term Loan B debt (the “Term Debt”). Interest payments on the

Term Debt are made quarterly and the variable rate on the Term Debt is reset at the end of each fiscal quarter. The interest rate swap

contracts are designated as cash flow hedges and to the extent they are effective in offsetting the variability of the variable−rate interest

payments, changes in the derivatives’ fair value are not included in current earnings but are included in accumulated other

comprehensive income (AOCI) in the accompanying consolidated balance sheets. These changes in fair value are subsequently

reclassified into earnings as a component of interest expense each quarter as interest payments are made on the Term Debt. At June 30,

2009, interest rate swap contracts with a notional amount of $595.0 million were outstanding.

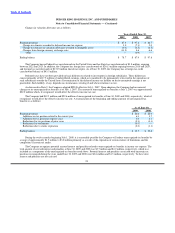

In September 2006, the Company settled interest rate swaps designated as cash flow hedges, which had a fair value of

$11.5 million, and terminated the hedge relationship. In accordance with SFAS No. 133, this fair value is recorded in AOCI and is

being recognized as a reduction to interest expense each quarter over the remaining term of the Term Debt. At June 30, 2009,

$2.0 million remained in AOCI.

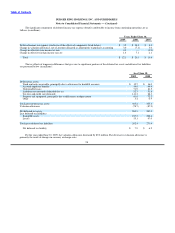

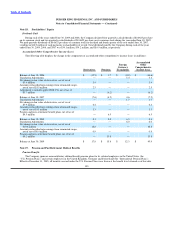

Foreign Currency Forward Contracts

The Company enters into foreign currency forward contracts, which typically have maturities between three and fifteen months, to

economically hedge the remeasurement of foreign currency−denominated intercompany loan receivables and other foreign−currency

denominated assets recorded in the Company’s consolidated balance sheets. The Company also enters into foreign currency forward

contracts in order to manage the foreign exchange variability in forecasted royalty cash flows due to fluctuations in exchange rates.

Remeasurement represents changes in the expected amount of cash flows to be received or paid upon settlement of the intercompany

loan receivables and other foreign−currency denominated assets and liabilities resulting from a change in foreign currency exchange

rates. At June 30, 2009, foreign currency forward contracts with a notional amount of $397.0 million were outstanding.

Credit Risk

By entering into derivative instrument contracts, the Company exposes itself, from time to time, to counterparty credit risk.

Counterparty credit risk is the failure of the counterparty to perform under the terms of the derivative contract. When the fair value of a

derivative contract is in an asset position, the counterparty has a liability to the Company, which creates credit risk for the Company.

The Company attempts to minimize this risk by selecting counterparties with investment grade credit ratings, limiting its exposure to

any single counterparty and regularly monitoring its market position with each counterparty.

The Company’s derivative valuations consider credit risk adjustments that are necessary to reflect the probability of default by the

counterparty or itself.

Credit−Risk Related Contingent Features

The Company’s derivative instruments do not contain any credit−risk related contingent features.

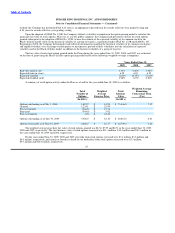

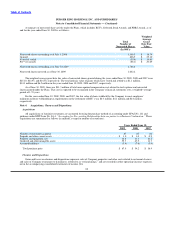

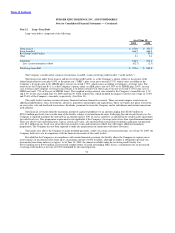

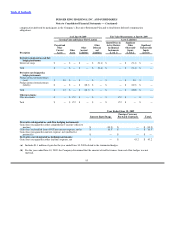

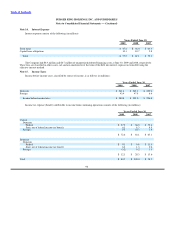

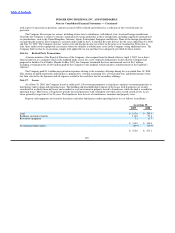

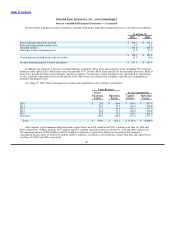

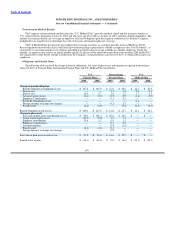

The following tables present the required quantitative disclosures (in millions) under SFAS No. 157 and SFAS No. 161, on a

combined basis, for the Company’s financial instruments, which include derivatives designated as cash flow hedging instruments,

derivatives not designated as hedging instruments, and other investments, which consists of money market accounts and mutual funds

held in a Rabbi trust established by the Company to invest

94