Burger King 2009 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2009 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

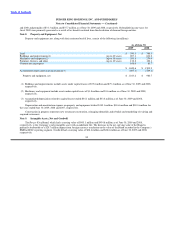

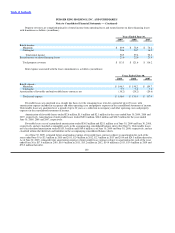

BKC is the borrower under the facility and the Company and certain subsidiaries have jointly and severally unconditionally

guaranteed the payment of the amounts under the facility. The Company, BKC and certain subsidiaries have pledged, as collateral, a

100% equity interest in the domestic subsidiaries of the Company and BKC with certain exceptions. Furthermore, BKC has pledged as

collateral a 65% equity interest in certain foreign subsidiaries.

During the year ended June 30, 2009, the Company paid $146.8 million of term debt, of which $2.5 million related to the Term

Loan A and $144.3 million related to the revolving credit facility and borrowed $94.3 million under the revolving credit facility. As of

June 30, 2009, the next scheduled principal payment on term debt is the September 30, 2009 principal payment of $15.6 million on

Term Loan A. The level of required principal repayments increases over time thereafter. The maturity dates of Term Loan A, Term

Loan B−1, and any amounts drawn under the revolving credit facility are June 2011, June 2012 and June 2011, respectively.

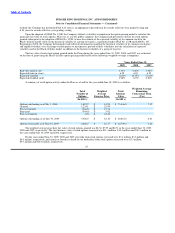

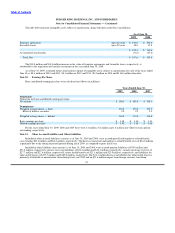

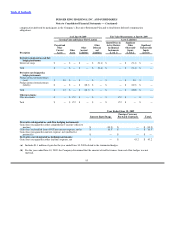

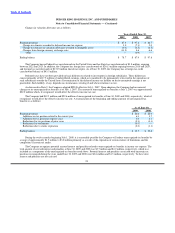

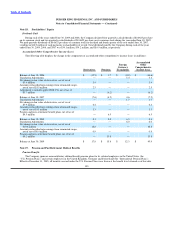

The aggregate maturities of long−term debt, including the Term Loan A, Term Loan B−1 and other debt as of June 30, 2009, are

as follows (in millions):

Principal

Year

Ended

June 30, Amount

2010 $ 62.7

2011 87.7

2012 666.4

2013 0.2

2014 0.2

Thereafter 1.1

Total $ 818.3

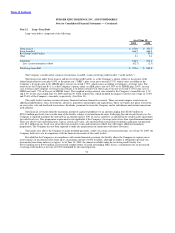

The Company also has lines of credit with foreign banks, which can also be used to provide guarantees, in the amounts of

$3.5 million and $4.4 million as of June 30, 2009 and 2008, respectively. There are no guarantees issued against these lines of credit as

of June 30, 2009 and 2008, respectively.

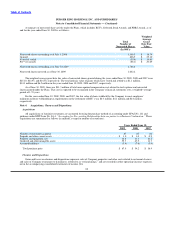

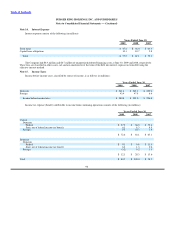

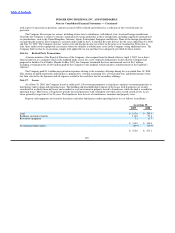

Note 13. Fair Value Measurements and Derivative Instruments

Fair Value Measurements

In September 2006, the FASB issued SFAS No. 157. This statement provides a single definition of fair value, a framework for

measuring fair value, and expanded disclosures concerning fair value. SFAS No. 157 applies to instruments accounted for under

previously issued pronouncements that prescribe fair value as the relevant measure of value. (See Note 2)

Disclosures about Derivative Instruments and Hedging Activities

In March 2008, the FASB issued SFAS No. 161, “Disclosures about Derivative Instruments and Hedging Activities”

(“SFAS No. 161”), which provides companies with requirements for enhanced disclosures about derivative instruments and hedging

activities to enable investors to better understand their effects on a company’s financial position, financial performance and cash flows.

The Company adopted the disclosure provisions of SFAS No. 161 during the quarter ended March 31, 2009.

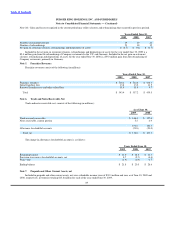

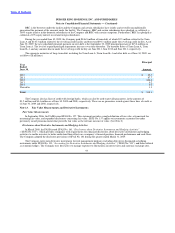

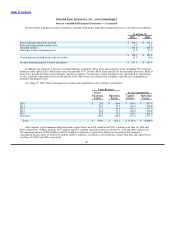

The Company enters into derivative instruments for risk management purposes, including derivatives designated as hedging

instruments under SFAS No. 133, “Accounting for Derivative Instruments and Hedging Activities” (“SFAS No. 133”) and those utilized

as economic hedges. The Company uses derivatives to manage exposure to fluctuations in interest rates and currency exchange rates.

93