Burger King 2009 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2009 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

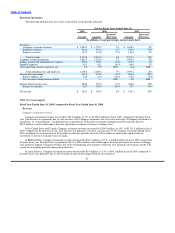

In the United States and Canada, income from operations increased by $8.8 million, or 3%, to $348.2 million in fiscal 2008,

primarily as a result of a $34.3 million increase in franchise revenues, reflecting franchise comparable sales growth of 5.8% (in constant

currencies) for the period in this segment and an increase in the effective royalty rate. This increase was partially offset by higher

selling, general and administrative expenses of $316.3 million, driven primarily by increased salaries and wages, fringe benefit costs

and increased stock−based compensation expense.

Income from operations in EMEA/APAC increased by $37.9 million, or 70%, to $91.8 million in fiscal 2008, primarily as a result

of a $37.9 million increase in franchise revenues, reflecting franchise comparable sales growth of 5.6% (in constant currencies) for the

period in this segment and the net increase of 196 franchise restaurants during fiscal 2008. The favorable impact that the movement in

foreign currency exchange rates had on revenues was partially offset by the unfavorable impact on operating costs and expenses,

resulting in a $7.7 million net favorable impact on income from operations.

Income from operations in Latin America increased by $6.2 million, or 18%, to $41.4 million in fiscal 2008, primarily as a result

of an increase in franchise revenues, reflecting comparable sales growth of 4.5% (in constant currencies) for the period in this segment,

and a net increase of 92 franchise restaurants during fiscal 2008.

Our unallocated corporate expenses decreased by $6.7 million during fiscal 2008, primarily as a result of non−recurring

professional services fees incurred associated with the realignment of our European and Asian businesses during fiscal 2007.

Interest Expense, Net

Interest expense, net decreased by $5.8 million during fiscal 2008, reflecting a reduction in the amount of borrowings outstanding

due to early prepayments of our debt and a decrease in rates paid on borrowings during the period. The weighted average interest rates

for fiscal 2008 and fiscal 2007 were 6.02% and 6.91%, respectively, which included the impact of interest rate swaps on 56.0% and

57.0% of our term debt, respectively.

Income Tax Expense

Income tax expense was $103.4 million in fiscal 2008. Compared to the same period in the prior fiscal year, our effective tax rate

increased slightly by 0.6 percentage points to 35.3%.

See Note 15 to our consolidated financial statements for further information regarding our effective tax rate. See Item 1A “Risk

Factors” in Part I of this report for a discussion regarding our ability to utilize foreign tax credits and estimate deferred tax assets.

Net Income

Net income increased by $41.5 million, or 28%, to $189.6 million in fiscal 2008, primarily as a result of a net increase in

restaurants and strong comparable sales growth, which increased franchise revenues by $77.7 million, Company restaurant margin by

$9.3 million and net property revenues by $5.4 million. We also benefited from a $5.8 million decrease in interest expense. These

improvements were partially offset by a $26.0 million increase in selling, general and administrative expenses and a $28.1 million

increase in income tax expense.

Liquidity and Capital Resources

Overview

Cash provided by operations was $310.8 million in fiscal 2009, compared to $243.4 million in fiscal 2008.

Our leverage ratio, as defined by our credit agreement, was 1.8x as of June 30, 2009 and 2008. The weighted average interest rate

on our term debt for fiscal 2009 was 5.1%, which included the benefit of interest rates swaps on 70.6% of our debt.

For each of the years ended June 30, 2009 and 2008, we paid four quarterly dividends of $0.0625 per share of common stock,

resulting in $34.1 million and $34.2 million, respectively, of cash payments to shareholders of

60