Burger King 2009 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2009 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

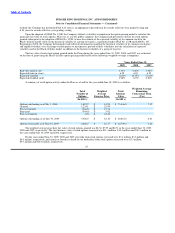

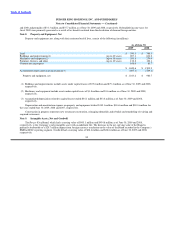

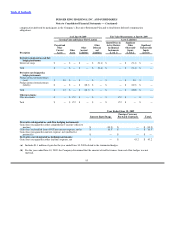

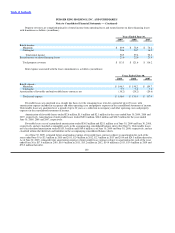

Note 12. Long−Term Debt

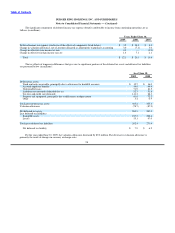

Long−term debt is comprised of the following:

As of June 30,

2009 2008

Term Loan A $ 150.0 $ 152.5

Term Loan B−1 666.2 666.2

Revolving Credit Facility — 50.0

Other 2.1 2.4

Total debt 818.3 871.1

Less: current maturities of debt (62.7) (2.3)

Total long−term debt $ 755.6 $ 868.8

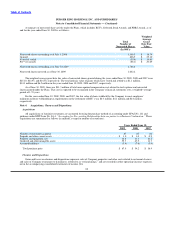

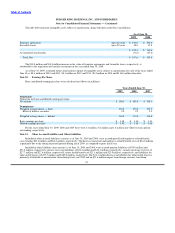

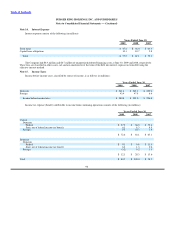

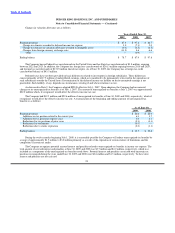

The Company’s credit facility consists of term loans A and B−1 and a revolving credit facility (“credit facility”).

The interest rate under Term Loan A and the revolving credit facility is, at the Company’s option, either (a) the greater of the

federal funds effective rate plus 0.50% or the prime rate (“ABR”), plus a rate not to exceed 0.75%, which varies according to the

Company’s leverage ratio or (b) LIBOR plus a rate not to exceed 1.75%, which varies according to Company’s leverage ratio. The

interest rate for Term Loan B−1 is, at the Company’s option, either (a) ABR, plus a rate of 0.50% or (b) LIBOR plus 1.50%, in each

case so long as the Company’s leverage ratio remains at or below certain levels (but in any event not to exceed 0.75% in the case of

ABR loans and 1.75% in the case of LIBOR loans). The weighted average interest rates related to the Company’s term debt was 5.1%

and 6.3% for the years ended June 30, 2009 and June 30, 2008, respectively, which included the impact of interest rate swaps on 70.6%

and 55.6% of the Company’s term debt, respectively, (See Note 13).

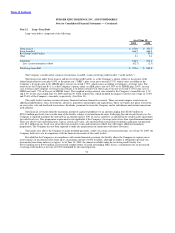

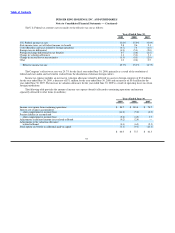

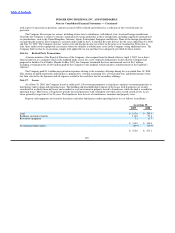

The credit facility contains certain customary financial and non−financial covenants. These covenants impose restrictions on

additional indebtedness, liens, investments, advances, guarantees and mergers and acquisitions. These covenants also place restrictions

on asset sales, sale and leaseback transactions, dividends, payments between the Company and its subsidiaries and certain transactions

with affiliates.

The financial covenants limit the maximum amount of capital expenditures to an amount ranging from $180.0 million to

$250.0 million per fiscal year over the term of the facility, subject to certain financial ratios. Following the end of each fiscal year, the

Company is required to prepay the term debt in an amount equal to 50% of excess cash flow (as defined in the credit facility agreement)

for such fiscal year. This prepayment requirement is not applicable if the Company’s leverage ratio is less than a predetermined amount.

There are other events and transactions, such as certain asset sales, sale and leaseback transactions resulting in aggregate net proceeds

over $2.5 million in any fiscal year, proceeds from casualty events and incurrence of debt that will trigger additional mandatory

prepayment. The Company has not been required to make any prepayments in connection with these covenants.

The facility also allows the Company to make dividend payments, subject to certain covenant restrictions. As of June 30, 2009, the

Company believes it was in compliance with the financial covenants of the credit facility.

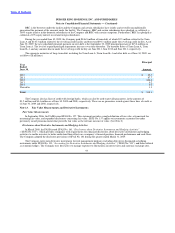

Provided that the Company is in compliance with certain financial covenants, the facility allows the Company to request one or

more tranches of incremental term loans up to a maximum amount of $150.0 million, although no lender is obligated to provide any

incremental term loans unless it so agrees. As of June 30, 2009, the amount available under the revolving credit facility was

$119.4 million net of $30.6 million of irrevocable standby letters of credit outstanding. BKC incurs a commitment fee on the unused

revolving credit facility at the rate of 0.50% multiplied by the unused portion.

92