Burger King 2009 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2009 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

properties in EMEA that we lease or sublease to franchisees, we own three properties and lease the land and building from third party

landlords on the remaining 94 properties. Our EMEA property operations generated $25.4 million of our revenues in fiscal 2009, or

22% of our total worldwide property revenues.

Lease terms on properties that we lease or sublease to our EMEA franchisees vary from country to country. These leases generally

provide for 25−year terms, depending on the term of the related franchise agreement. We lease most of our properties from third party

landlords and sublease them to franchisees. These leases generally provide for fixed rental payments based on our underlying rent plus a

small markup. In general, franchisees are obligated to pay for all costs and expenses associated with the restaurant property, including

property taxes, repairs and maintenance and insurance. In the U.K., many of our leases for our restaurant properties are subject to rent

reviews every five years, which may result in rent adjustments to reflect current market rents.

Latin America

As of June 30, 2009, we had 1,078 restaurants in 27 countries and territories in Latin America. There were 92 Company

restaurants in Latin America, all located in Mexico, and 986 franchise restaurants in the segment as of June 30, 2009. We are the leader

in 14 of the 27 countries and territories in which the Burger King system operates in Latin America, including Mexico and Puerto Rico,

in terms of number of restaurants. Mexico is the largest market in this segment, with a total of 413 restaurants as of June 30, 2009, or

38% of the region. Our restaurants in Mexico have consistently been among the Company restaurants with the highest margins

worldwide due to a favorable real estate and labor environment. In fiscal 2009, we opened 28 new restaurants in Mexico, of which nine

were Company restaurants and 19 were franchise restaurants. Additionally, we entered the country of Suriname and re−opened

restaurants in Uruguay during the same period.

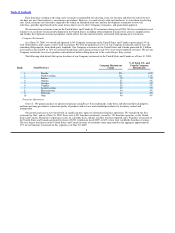

The following is a list of the five largest franchisees in terms of restaurant count in Latin America as of June 30, 2009:

Rank Name Restaurant Count Location

1 Alsea and Affiliates 188 Mexico/Argentina/Chile/Colombia

2 Caribbean Restaurants, Inc. 175 Puerto Rico

3 Geboy de Tijuana, S.A. de C.V. 64 Mexico

4 Operadora Exe S.A. de C.V. 47 Mexico

5 B & A S.A. 41 Guatemala

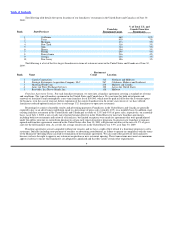

Advertising and Promotion

We believe sales in the QSR segment can be significantly affected by the frequency and quality of advertising and promotional

programs. We believe that three of our major competitive advantages are our strong brand equity, market position and our global

franchise network which allow us to drive sales through extensive advertising and promotional programs.

Franchisees must make monthly contributions, generally 4% to 5% of gross sales, to our advertising funds, and we contribute on

the same basis for Company restaurants. Advertising contributions are used to pay for all expenses relating to marketing, advertising

and promotion, including market research, production, advertising costs, sales promotions and other support functions. In international

markets where there is no Company restaurant presence, franchisees typically manage their own advertising expenditures, and these

amounts are not included in the advertising fund. However, as part of our global marketing strategy, we provide these franchisees with

support and guidance in order to deliver a consistent global brand message.

In the United States and in those other countries where we have Company restaurants, we coordinate the development, budgeting

and expenditures for all marketing programs, as well as the allocation of advertising and media contributions, among national, regional

and local markets, subject in the United States to minimum expenditure requirements for media costs and certain restrictions as to new

media channels. We are required, however, under our U.S. franchise agreements to discuss the types of media in our advertising

campaigns and the percentage of the advertising fund to be spent on media with the recognized franchisee association, currently the

National Franchisee Association, Inc. In addition, U.S. franchisees may elect to participate in certain local

12