Burger King 2009 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2009 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Sponsors. Although each Sponsor has currently elected to nominate only one director, each Sponsor retains the right to nominate two

directors, subject to reduction and elimination as the stock ownership percentage of the private equity funds controlled by the applicable

Sponsor declines. In addition, with respect to each committee of our board other than the audit committee, each Sponsor has the right to

appoint at least one director to each committee, for Sponsor directors to constitute a majority of the membership of each committee

(subject to NYSE requirements) and for the chairman of each committee to be a Sponsor director until the private equity funds

controlled by the Sponsors collectively own less than 30% of our outstanding common stock. As a result of these contractual rights, the

Sponsors will continue to have significant influence over our decision to enter into any corporate transaction and may have the ability to

prevent any transaction that requires the approval of stockholders, regardless of whether or not other stockholders believe that such

transaction is in their own best interests. Such concentration of voting power could have the effect of delaying, deterring or preventing a

change of control or other business combination that might otherwise be beneficial to our stockholders.

Your percentage ownership in us may be diluted by future issuances of capital stock, which could reduce your influence over

matters on which stockholders vote.

Our board of directors has the authority, without action or vote of our stockholders, to issue all or any part of our authorized but

unissued shares of common stock, including shares issuable upon the exercise of options, or shares of our authorized but unissued

preferred stock. Our board also has the authority to issue debt convertible into shares of common stock. Issuances of common stock,

voting preferred stock or convertible debt could reduce your influence over matters on which our stockholders vote, and, in the case of

issuances of preferred stock, would likely result in your interest in us being subject to the prior rights of holders of that preferred stock.

The sale of a substantial number of shares of our common stock may cause the market price of shares of our common stock to

decline.

Future sales of a substantial number of shares of our common stock, or the perception that such sales might occur, could cause the

market price of our common stock to decline. The private equity funds controlled by the Sponsors have approximately 42.6 million

shares, which represents approximately 32% of our common stock issued and outstanding at June 30, 2009 and all of which are subject

to registration rights.

Provisions in our certificate of incorporation could make it more difficult for a third party to acquire us and could discourage a

takeover and adversely affect existing stockholders.

Our certificate of incorporation authorizes our board of directors to issue up to 10,000,000 preferred shares and to determine the

powers, preferences, privileges, rights, including voting rights, qualifications, limitations and restrictions on those shares, without any

further vote or action by our stockholders. The rights of the holders of our common stock will be subject to, and may be adversely

affected by, the rights of the holders of any preferred shares that may be issued in the future. The issuance of preferred shares could

have the effect of delaying, deterring or preventing a change in control and could adversely affect the voting power or economic value

of your shares.

Item 1B. Unresolved Staff Comments

None.

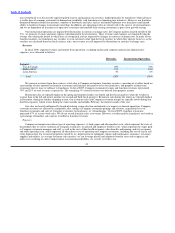

Item 2. Properties

Our global restaurant support center and U.S. headquarters is located in Miami, Florida and consists of approximately

213,000 square feet which we lease. We extended the Miami lease for our global restaurant support center in May 2008 through

September 2018 with an option to renew for one five−year period. We lease properties for our EMEA headquarters in Zug, Switzerland

and our APAC headquarters in Singapore. We believe that our existing headquarters and other leased and owned facilities are adequate

to meet our current requirements.

34