Burger King 2009 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2009 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225

|

|

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

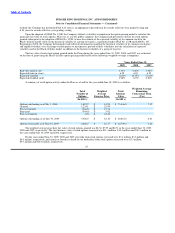

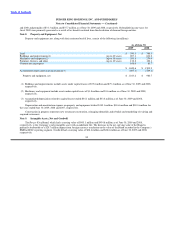

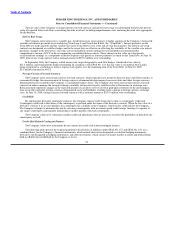

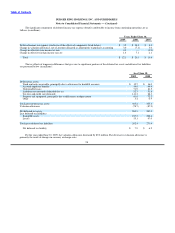

A summary of nonvested share activity under the Plans, which includes RSU’s, Deferred Stock Awards, and PBRS awards, as of

and for the year ended June 30, 2009 is as follows:

Weighted

Average

Total Grant

Number of Date Fair

Nonvested Shares Value

(In 000’s)

Nonvested shares outstanding as of July 1, 2008 1,305.5 $ 18.74

Granted 606.9 $ 25.10

Vested & settled (55.9) $ 19.61

Pre−vest cancels (88.1) $ 20.69

Nonvested shares outstanding as of June 30, 2009 1,768.4

Nonvested shares unvested as of June 30, 2009 1,642.2

The weighted average grant date fair value of nonvested shares granted during the years ended June 30, 2009, 2008 and 2007 were

$25.10, $23.95, and $14.36, respectively. The total intrinsic value of grants which have vested and settled was $1.1 million,

$14.3 million and $6.5 million in the years ended June 30, 2009, 2008,and 2007, respectively.

As of June 30, 2009, there was $31.3 million of total unrecognized compensation cost related to stock options and nonvested

shares granted under the Plans. That cost is expected to be recognized in the Company’s financial statements over a weighted−average

period of 1.74 years.

For the years ended June 30, 2009, 2008, and 2007, the fair value of shares withheld by the Company to meet employees’

minimum statutory withholding tax requirements on the settlement of RSU’s was $0.3 million, $4.1 million and $2.0 million,

respectively.

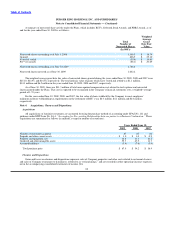

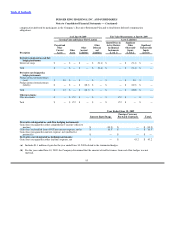

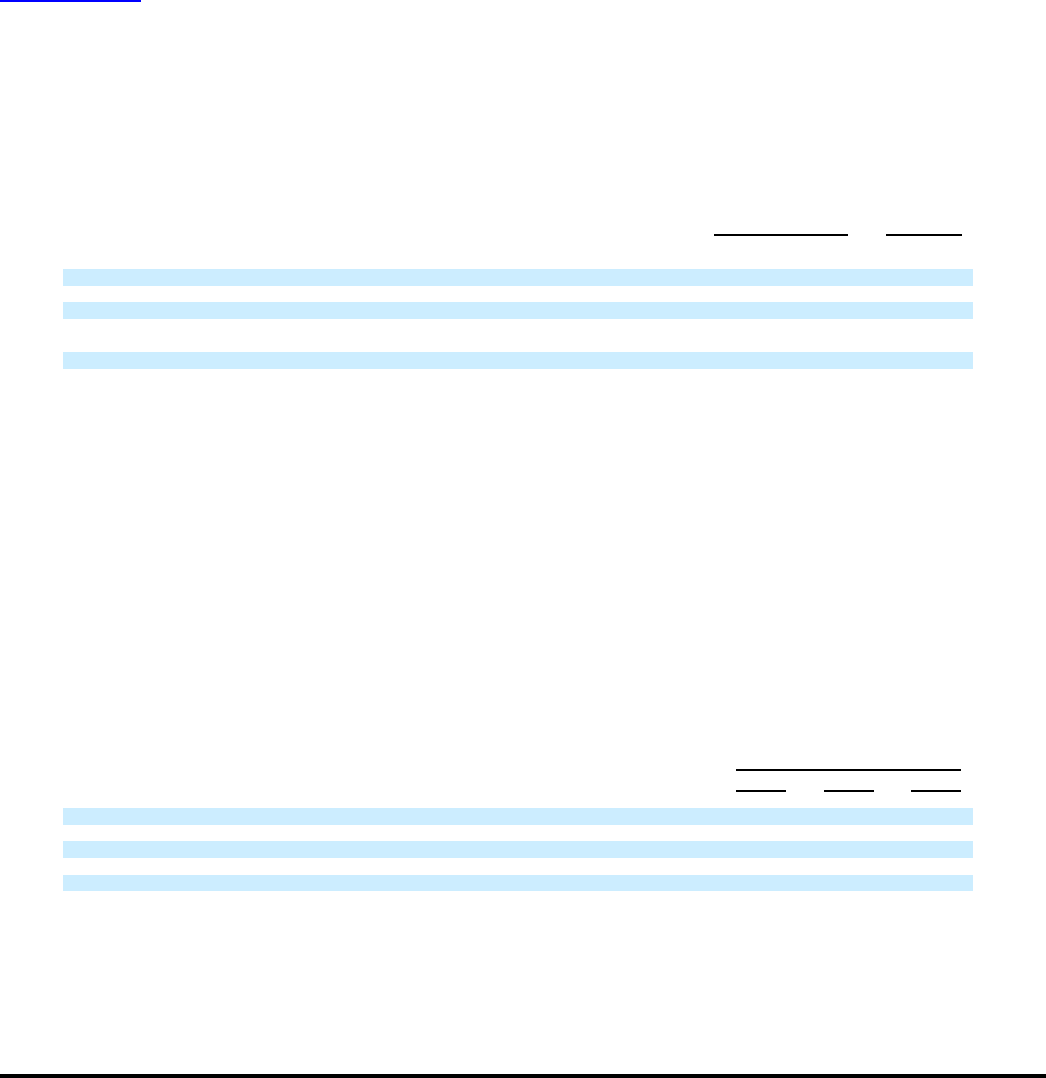

Note 4. Acquisitions, Closures and Dispositions

Acquisitions

All acquisitions of franchise restaurants are accounted for using the purchase method of accounting under SFAS No. 141 and

guidance under EITF Issue No. 04−1, “Accounting for Pre−existing Relationships between parties to a Business Combination.” These

acquisitions are summarized as follows (in millions, except for number of restaurants):

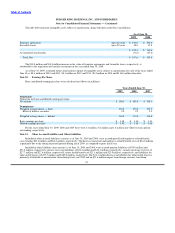

Years Ended June 30,

2009 2008 2007

Number of restaurants acquired 87 83 64

Prepaids and other current assets $ 1.0 $ 1.0 $ 0.9

Property and equipment, net 14.6 13.3 10.2

Goodwill and other intangible assets 55.7 47.5 11.7

Assumed liabilities (3.4) (7.6) (5.9)

Total purchase price $ 67.9 $ 54.2 $ 16.9

Closures and Dispositions

Gains and losses on closures and dispositions represent sales of Company properties and other costs related to restaurant closures

and sales of Company restaurants to franchisees, referred to as “refranchisings,” and are recorded in other operating (income) expenses,

net in the accompanying consolidated statements of income (See

88