Burger King 2009 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2009 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

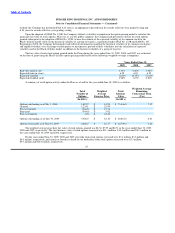

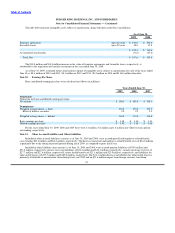

Effective July 1, 2007, the Company funded $21.7 million into a rabbi trust established to invest compensation deferred under the

ERP and fund future deferred compensation obligations. The rabbi trust is subject to creditor claims in the event of insolvency, but the

assets held in the rabbi trust are not available for general corporate purposes and are classified as restricted investments within other

assets, net in the Company’s consolidated balance sheets. The rabbi trust is required to be consolidated into the Company’s consolidated

financial statements in accordance with the provisions of Emerging Issues Task Force (“EITF”) Issue No. 97−14, “Accounting for

Deferred Compensation Arrangements Where Amounts Earned Are Held in a Rabbi Trust and Invested.” Prior to July 1, 2007,

participants received a fixed return from the Company on amounts they deferred under the deferred compensation plan. Subsequent to

July 1, 2007, participants receive returns on amounts they deferred under the deferred compensation plan based on investment elections

they make.

The investment securities in the rabbi trust have been designated by the Company as trading securities and are carried at fair value

as restricted investments within other assets, net in the Company’s consolidated balance sheets, with unrealized trading gains and losses

recorded in earnings. The fair value of the investment securities held in the rabbi trust was $17.9 million and $20.2 million as of

June 30, 2009 and 2008, respectively. Net unrealized trading gains and losses, which totaled $2.3 million and $1.3 million for the years

ended June 30, 2009 and 2008, respectively, are recorded in other operating (income) expense, net, in the Company’s consolidated

statements of income. The financial impact on the Company’s consolidated statements of income from unrealized trading gains and

losses on investments in the rabbi trust is completely offset by a corresponding change in compensation expense, which is reflected in

selling, general and administrative expenses in the Company’s consolidated statements of income.

Amounts recorded in the consolidated statements of income representing the Company’s matching contributions to the Savings

Plan and the ERP for the years ended June 30, 2009, 2008 and 2007 totaled $3.5 million, $4.3 million and $3.8 million, respectively.

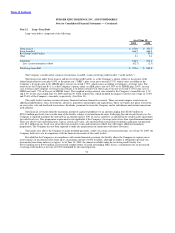

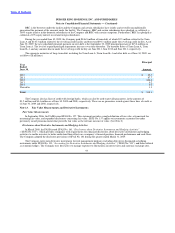

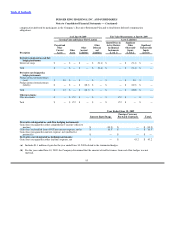

Note 3. Stock−based Compensation

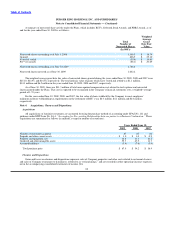

Prior to February 16, 2006, the date the Company filed a registration statement on Form S−1 with the Securities and Exchange

Commission, or SEC (for its initial public offering, which occurred on May 18, 2006) (the “Registration Statement”), the Company

accounted for stock−based compensation in accordance with the intrinsic−value method of APB No. 25. Under the intrinsic value

method of APB No. 25, stock options were granted at fair value, with no compensation cost being recognized in the financial statements

over the vesting period. In addition, the Company issued restricted stock units under APB No. 25 and recognized compensation cost

over the vesting period of the awards. Under the pro forma disclosure required by SFAS No. 123, compensation expense for stock

options was measured by the Company using the minimum value method, which assumed no volatility in the Black−Scholes model

used to calculate the option’s fair value.

As a result of filing the Registration Statement, the Company transitioned from a non−public entity to a public entity under

SFAS No. 123R. Since the Company applied SFAS No. 123 pro forma disclosure for stock options using the minimum value method

prior to becoming a public entity, SFAS No. 123R required that the Company adopt SFAS 123R using a combination of the prospective

and modified prospective methods. The Company was required to apply the prospective method for those stock options granted prior to

the Company filing the Registration Statement, as the Company used the minimum value method for these awards for disclosure under

SFAS No. 123. Under the prospective method, any unrecognized compensation cost relating to these stock options was required to be

recognized in the financial statements subsequent to the adoption of SFAS No. 123R, using the same method of recognition and

measurement originally applied to these options. Since no compensation cost was recognized by the Company in the financial

statements for these stock options under APB No. 25, no compensation cost has been or will be recognized for these stock options after

the Company’s adoption of SFAS No. 123R on July 1, 2006, unless such options are modified. For stock options granted subsequent to

the filing of the Registration Statement, but prior to the SFAS No. 123R adoption date, the Company was required to apply the modified

85