Burger King 2009 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2009 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

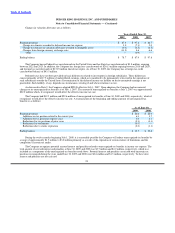

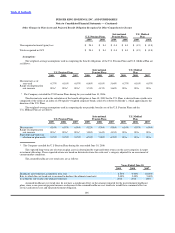

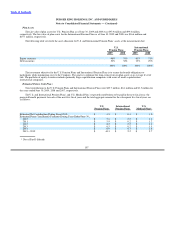

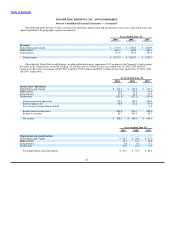

June 30, 2009, the Company had potential commitments remaining to provide future rent relief of up to an aggregate of $4.9 million

extending over a period of up to 16 years.

Guarantees

The Company guarantees certain lease payments of franchisees arising from leases assigned in connection with sales of Company

restaurants to franchisees, by remaining secondarily liable for base and contingent rents under the assigned leases of varying terms. The

maximum contingent rent amount is not determinable as the amount is based on future revenues. In the event of default by the

franchisees, the Company has typically retained the right to acquire possession of the related restaurants, subject to landlord consent.

The aggregate contingent obligation arising from these assigned lease guarantees, excluding contingent rents, was $74.0 million as of

June 30, 2009, expiring over an average period of seven years.

Other commitments arising out of normal business operations were $13.3 million as of June 30, 2009, of which $8.1 million was

guaranteed under bank guarantee arrangements.

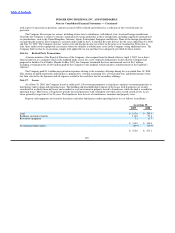

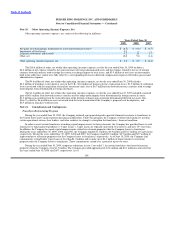

Letters of Credit

As of June 30, 2009, the Company had $30.6 million in irrevocable standby letters of credit outstanding, which were issued

primarily to certain insurance carriers to guarantee payments of deductibles for various insurance programs, such as health and

commercial liability insurance. Such letters of credit are secured by the collateral under the Company’s senior secured credit facility. As

of June 30, 2009, no amounts had been drawn on any of these irrevocable standby letters of credit.

As of June 30, 2009, the Company had posted bonds totaling $3.3 million, which related to certain utility deposits and capital

projects.

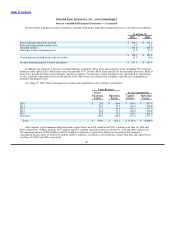

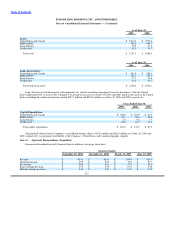

Vendor Relationships

During the year ended June 30, 2000, the Company entered into long−term, exclusive contracts with The Coca−Cola Company

and with Dr Pepper/Seven Up, Inc. to supply the Company and its franchise restaurants with their products and obligating Burger King ®

restaurants in the United States to purchase a specified number of gallons of soft drink syrup. These volume commitments are not

subject to any time limit. As of June 30, 2009, the Company estimates that it will take approximately 13 years to complete the

Coca−Cola and Dr Pepper/Seven Up, Inc. purchase commitments. In the event of early termination of these arrangements, the Company

may be required to make termination payments that could be material to the Company’s results of operations and financial position.

Additionally, in connection with these contracts, the Company received upfront fees, which are being amortized over the term of the

contracts. As of June 30, 2009 and 2008, the deferred amounts totaled $16.1 million and $17.2 million, respectively. These deferred

amounts are amortized as a reduction to food, paper and product costs in the accompanying consolidated statements of income.

As of June 30, 2009, the Company had $12.7 million in aggregate contractual obligations for the year ended June 30, 2009 with

vendors providing information technology and telecommunication services under multiple arrangements. These contracts extend up to

three years with a termination fee ranging from $0.8 million to $1.7 million during those years. The Company also has separate

arrangements for telecommunication services with an aggregate contractual obligation of $4.6 million over two years with no early

termination fee.

The Company also enters into commitments to purchase advertising. As of June 30, 2009, commitments to purchase advertising

totaled $51.7 million and run through October 2011.

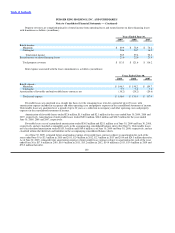

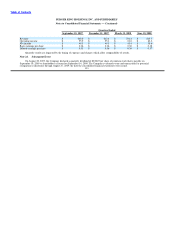

Litigation

On July 30, 2008, we were sued by four Florida franchisees over our decision to mandate extended operating hours in the United

States. The plaintiffs seek damages, declaratory relief and injunctive relief. While we believe we have the right under our franchise

agreement to mandate extended operating hours, we are unable to predict the ultimate outcome of this litigation.

109