Burger King 2009 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2009 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

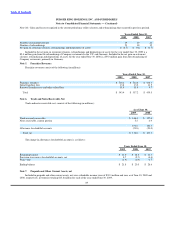

Income Taxes

Amounts in the financial statements related to income taxes are calculated using the principles of SFAS No. 109, “Accounting for

Income Taxes.” Under SFAS No. 109, deferred tax assets and liabilities reflect the impact of temporary differences between the

amounts of assets and liabilities recognized for financial reporting purposes and the amounts recognized for tax purposes, as well as tax

credit carryforwards and loss carryforwards. These deferred taxes are measured by applying currently enacted tax rates. A deferred tax

asset is recognized when it is considered more likely than not to be realized. The effects of changes in tax rates on deferred tax assets

and liabilities are recognized in income in the year in which the law is enacted. A valuation allowance reduces deferred tax assets when

it is “more likely than not” that some portion or all of the deferred tax assets will not be recognized.

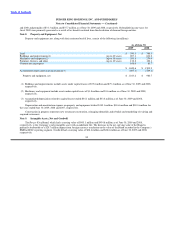

Income tax benefits credited to stockholders’ equity relate to tax benefits associated with amounts that are deductible for income

tax purposes but do not affect earnings. These benefits are principally generated from employee exercises of nonqualified stock options

and settlement of restricted stock awards.

Effective July 1, 2007, the Company adopted FASB Interpretation No. 48, “Accounting for Uncertainty in Income Taxes, an

interpretation of FASB Statement No. 109” (“FIN 48”). FIN 48 requires that a position taken or expected to be taken in a tax return be

recognized in the financial statements when it is more likely than not (i.e., a likelihood of more than fifty percent) that the position

would be sustained upon examination by tax authorities. A recognized tax position is then measured at the largest amount of benefit that

is greater than fifty percent likely of being realized upon ultimate settlement. Upon adoption, the Company had no material change to its

unrecognized tax benefits.

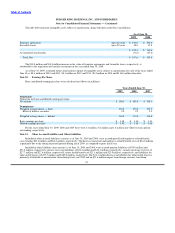

During fiscal year 2009, the Company changed its classification of transaction gains and losses resulting from the remeasurement

of foreign deferred tax assets, reflected in its consolidated statements of income. In accordance with SFAS No. 109, “Accounting for

Income Taxes” (“SFAS No. 109”), transaction gains and losses resulting from the remeasurement of foreign deferred tax assets or

liabilities may be reported separately or included in deferred tax expense or benefit, if that presentation is considered more useful. In

that regard, in order to (i) reduce complexity in financial reporting by mitigating the impact that fluctuations in exchange rates have on

the calculation of the Company’s effective tax rate, (ii) provide clarity by reducing the impact attributable to fluctuations in exchange

rates on the Company’s effective tax rate, leaving remaining differences between expected and actual tax expense primarily related to

trends in earnings, and (iii) provide transparency to its financial statements by isolating foreign exchange transaction gains and losses

within the same line in the consolidated statements of income, the Company believes it to be preferable to reclassify the foreign

exchange transaction gains and losses attributable to the remeasurement of foreign deferred tax assets, previously included within

income tax expense, to other operating (income) expense, net. For the year ended June 30, 2007, this change in accounting policy

resulted in an increase to income tax expense of $3.4 million, with a corresponding increase in net gains from foreign exchange

transactions, included in other operating (income) expense, net. For the year ended June 30, 2008, the impact of this change in

accounting policy was not significant. This accounting policy change had no effect on net income for the periods presented.

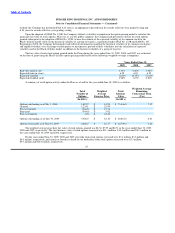

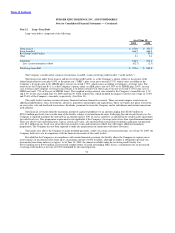

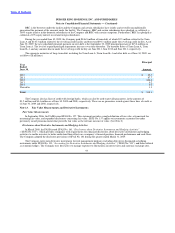

Earnings per Share

Basic earnings per share is computed by dividing net income by the weighted average number of common shares outstanding for

the period. The computation of diluted earnings per share is consistent with that of basic earnings per share, while giving effect to all

dilutive potential common shares that were outstanding during the period.

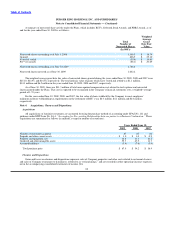

Stock−based Compensation

On July 1, 2006, the Company adopted SFAS No. 123 (Revised 2004) “Share−Based Payment” (“SFAS No. 123R”), which

replaced SFAS No. 123, “Accounting for Stock−Based Compensation,” (“SFAS No. 123”)

83