Burger King 2009 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2009 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

prospective method, in which compensation expense was recognized for any unvested portion of the awards granted between the filing

of the Registration Statement and the adoption date of SFAS No. 123R over the remaining vesting period of the awards.

On July 1, 2006, the Company adopted SFAS No. 123R, which requires share−based compensation cost to be recognized based on

the grant date estimated fair value of each award, net of estimated cancellations, over the employee’s requisite service period, which is

generally the vesting period of the equity grant.

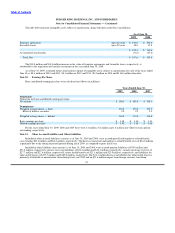

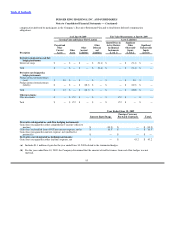

Non−qualified stock option awards (“stock options”) granted by the Company expire 10 years from the grant date and generally

vest ratably over a four to five−year service period commencing on the grant date. In August 2008, the Company granted stock options

covering approximately 1.2 million shares to eligible employees. Nonvested shares granted by the Company consist of restricted stock

and RSU, PBRS awards and deferred shares issued to non−employee members of the Company’s Board of Directors. RSU’s generally

vest ratably over a two to five year service period commencing on the grant date. In August 2008, the Company granted PBRS awards

covering approximately 0.4 million shares of common stock to eligible employees. The number of PBRS awards that actually vest are

determined based on achievement of a Company performance target for the year ended June 30, 2009. The PBRS primarily have a three

or four−year vesting period, which includes the one−year performance period.

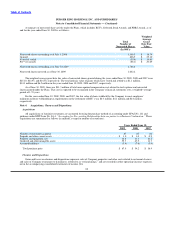

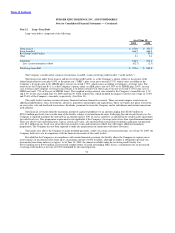

The Company recorded $16.2 million, $11.4 million and $4.9 million of stock−based compensation expense in the years ended

June 30, 2009, 2008 and 2007, respectively. In accordance with SFAS No. 123R, tax benefits realized for tax deduction from stock

options exercised of $3.3 million, $9.3 million and $13.5 million in the years ended June 30, 2009, 2008 and 2007, respectively, are

reported as financing cash flows.

Equity Incentive Plan and 2006 Omnibus Incentive Plan

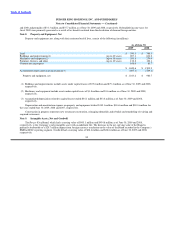

The Company’s Equity Incentive Plan and 2006 Omnibus Incentive Plan (collectively, “the Plans”) permit the grant of

stock−based compensation awards including stock options, RSU’s, deferred shares and PBRS to participants for up to 20.8 million

shares of the Company’s common stock. Awards are granted with an exercise price or market value equal to the closing price of the

Company’s common stock on the date of grant. The number of shares available to be granted under the Plans totaled approximately

5.1 million, as of June 30, 2009. The Company satisfies share−based exercises and vesting through the issuance of authorized but

previously unissued shares of the Company’s stock or treasury shares. Nonvested shares are generally net−settled with new Company

shares withheld, and not issued, to meet the employee’s minimum statutory withholding tax requirements.

Under the Company’s compensation program for the Board of Directors, non−employee directors receive an annual grant of

deferred shares of the Company’s common stock and may also elect to receive their quarterly retainer and Committee fees in deferred

shares in lieu of cash. The annual grant vests in quarterly installments over a one−year period on the first day of each calendar quarter

following the grant date, and the deferred shares granted in lieu of cash are fully vested on the grant date. The deferred shares will settle

and shares of common stock will be issued at the time the non−employee director no longer serves on the Board of Directors.

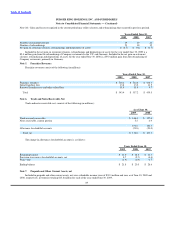

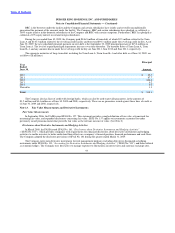

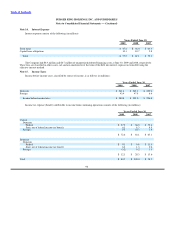

Stock−based compensation expense for stock options is estimated on the grant date using a Black−Scholes option pricing model.

The Company’s specific weighted−average assumptions for the risk−free interest rate, expected term, expected volatility and expected

dividend yield are discussed below. Additionally, under SFAS No. 123R the Company is required to estimate pre−vesting forfeitures

for purposes of determining compensation expense to be recognized. Future expense amounts for any quarterly or annual period could

be affected by changes in the Company’s assumptions or changes in market conditions.

In connection with the adoption of SFAS No. 123R, the Company has determined the expected term of stock options granted

using the simplified method as discussed in Section D, Certain Assumptions Used in Valuation Methods, of SEC Staff Accounting

Bulletin (“SAB”) No. 107. Based on the results of applying the simplified

86