Burger King 2009 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2009 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

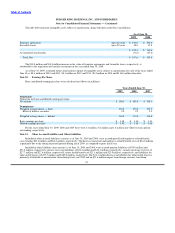

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

Derivative Financial Instruments

SFAS No. 133, “Accounting for Derivative Instruments and Hedging Activities,” as amended, establishes accounting and

reporting standards for derivative instruments and for hedging activities by requiring that all derivatives be recognized in the balance

sheet and measured at fair value. Gains or losses resulting from changes in the fair value of derivatives are recognized in earnings or

recorded in other comprehensive income (loss) and recognized in the statement of income when the hedged item affects earnings,

depending on the purpose of the derivatives and whether they qualify for, and the Company has applied hedge accounting treatment.

When applying hedge accounting, the Company’s policy is to designate, at a derivative’s inception, the specific assets, liabilities

or future commitments being hedged, and to assess the hedge’s effectiveness at inception and on an ongoing basis. The Company may

elect not to designate the derivative as a hedging instrument where the same financial impact is achieved in the financial statements.

The Company does not enter into or hold derivatives for trading or speculative purposes.

Disclosures About Fair Value of Financial Instruments

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements” (“SFAS No. 157”), which defines fair value,

establishes a framework for measuring fair value and enhances disclosures about fair value measurements required under other

accounting pronouncements, but does not change existing guidance as to whether or not an instrument is carried at fair value. On July 1,

2008, the Company adopted the provisions of SFAS No. 157 related to its financial assets and financial liabilities. Also, in October

2008, the FASB issued Financial Statement of Position (“FSP”) FAS 157−3, as amended, “Determining the Fair Value of a Financial

Asset When the Market for That Asset Is Not Active” (“FSP FAS 157−3”), which clarified the application of SFAS No. 157 in a market

that is not active and also provided an example to illustrate key considerations in determining the fair value of a financial asset when the

market for the financial asset is not active. FSP FAS 157−3 did not have an effect upon the Company’s adoption of SFAS No. 157.

In February 2008, the FASB issued FSP FAS 157−2, “Effective Date of FASB No. 157”, which permits a one−year deferral for

the implementation of SFAS No. 157 with regard to non−financial assets and liabilities that are not recognized or disclosed at fair value

in the financial statements on a recurring basis (at least annually). The Company elected to defer the adoption of SFAS No. 157 for such

items under this provision until its quarter ending September 30, 2009. For the Company these items primarily include long−lived

assets, goodwill and intangibles for which fair value would be determined as part of the related impairment tests, intangible assets

measured at fair value in conjunction with the Company’s acquisition of BKC on December 12, 2002, but not measured at fair value in

subsequent periods, and asset retirement obligations initially measured at fair value under SFAS No. 143, “Asset Retirement

Obligations.” The Company does not currently anticipate that full adoption of SFAS No. 157 in fiscal 2010 will materially impact the

Company’s results of operations or financial condition.

SFAS No. 157 defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly

transaction between market participants in the principal market, or if none exists, the most advantageous market, for the specific asset or

liability at the measurement date (the exit price). The fair value should be based on assumptions that market participants would use

when pricing the asset or liability. SFAS No. 157 establishes a fair value hierarchy that prioritizes the information used in measuring

fair value as follows:

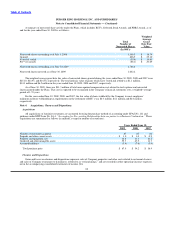

Level 1 Observable inputs that reflect quoted prices (unadjusted) for identical assets or liabilities in

active markets

Level 2 Inputs other than quoted prices included in Level 1 that are observable for the asset or liability

either directly or indirectly

Level 3 Unobservable inputs reflecting management’s own assumptions about the inputs used in pricing

the asset or liability

81