Burger King 2009 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2009 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

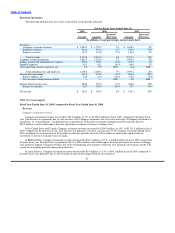

51%, of the increase in Company restaurant revenues was generated by the favorable impact from the movement of foreign currency

exchange rates, primarily in EMEA.

In the United States and Canada, Company restaurant revenues increased by $89.8 million, or 8%, to $1.2 billion in fiscal 2008,

primarily as a result of a net increase of 87 Company restaurants during fiscal 2008, including the acquisition of 56 franchise restaurants

in April 2008, and Company comparable sales growth of 2.6% (in constant currencies) for the period in this segment. Approximately

$16.4 million, or 18%, of the increase in Company restaurant revenues was generated by the favorable impact from the movement of

foreign currency exchange rates in Canada.

In EMEA/APAC, Company restaurant revenues increased by $39.7 million, or 8%, to $554.9 million in fiscal 2008, primarily as a

result of Company comparable sales growth of 3.8% (in constant currencies) for the period in this segment and a $52.6 million

favorable impact from the movement of foreign currency exchange rates. Partially offsetting these factors was a decrease in revenues

from a net decrease of 37 Company restaurants during fiscal 2008, which was primarily attributable to 15 closures and 16 refranchisings

in the U.K.

In Latin America, Company restaurant revenues increased by $8.4 million, or 14%, to $69.1 million in fiscal 2008, primarily as a

result of a net increase of seven Company restaurants during fiscal 2008, Company comparable sales growth of 1.8% (in constant

currencies) for the period in this segment and a $1.2 million favorable impact from the movement of foreign currency exchange rates.

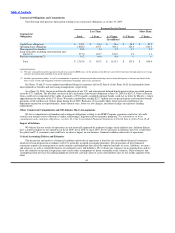

Franchise Revenues

Total franchise revenues increased by $77.7 million, or 17%, to $537.2 million in fiscal 2008, driven by a net increase of 225

franchise restaurants during fiscal 2008, worldwide franchise comparable sales growth of 5.7% (in constant currencies) for the period

and a $16.2 million favorable impact from the movement of foreign currency exchange rates.

In the United States and Canada, franchise revenues increased by $34.3 million, or 12%, to $317.9 million in fiscal 2008,

primarily as a result of franchise comparable sales growth of 5.8% (in constant currencies) for the period in this segment and higher

effective royalty rates, partially offset by the elimination of royalties from 63 fewer franchise restaurants driven by acquisitions by the

Company and closures during fiscal 2008, including the acquisition of 56 franchise restaurants in April 2008.

In EMEA/APAC, franchise revenues increased by $37.9 million, or 28%, to $173.0 million in fiscal 2008, driven by a net increase

of 196 franchise restaurants during fiscal 2008, franchise comparable sales growth of 5.6% (in constant currencies) for the period in this

segment and a $16.2 million favorable impact from the movement of foreign currency exchange rates.

Latin America franchise revenues increased by $5.5 million, or 13%, to $46.3 million in fiscal 2008, as a result of the net addition

of 92 franchise restaurants during fiscal 2008 and franchise comparable sales growth of 4.5% (in constant currencies) for the period in

this segment.

Property Revenues

Total property revenues increased by $5.4 million, or 5%, to $121.6 million in fiscal 2008, primarily as a result of worldwide

franchise comparable sales growth of 5.7% (in constant currencies) resulting in increased contingent rents and a $2.0 million favorable

impact from the movement of foreign currency exchange rates, partially offset by the net effect of changes to our property portfolio,

which includes the impact of the closure or acquisition of restaurants leased to franchisees.

In the United States and Canada, property revenues increased by $3.5 million, or 4%, to $88.7 million in fiscal 2008. This increase

was driven by increased contingent rent payments from increased franchise sales.

Our EMEA/APAC property revenues increased by $1.9 million, or 6%, to $32.9 million, primarily from increased contingent rents

as a result of an increase in franchise sales and a $1.6 million favorable impact from the movement of foreign currency exchange rates,

partially offset by the effect of a net reduction in the number of properties we lease or sublease to franchisees in EMEA.

56