Burger King 2009 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2009 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

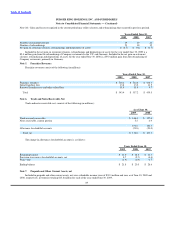

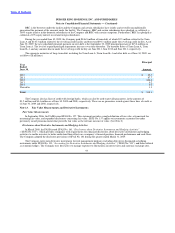

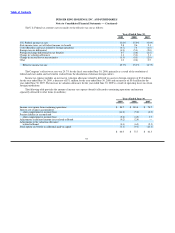

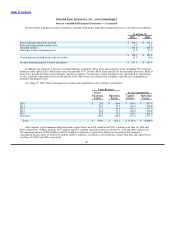

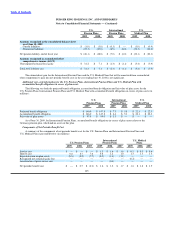

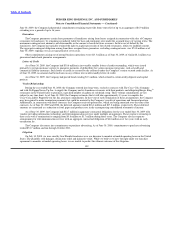

Changes in valuation allowance are as follows:

Years Ended June 30,

2009 2008 2007

Beginning balance $ 87.9 $ 97.8 $ 88.7

Change in estimates recorded to deferred income tax expense 3.0 (7.1) 5.0

Change in estimates in valuation allowance recorded to intangible assets (0.3) (6.5) (2.5)

Changes from foreign currency exchange rates (11.9) 4.6 6.6

Other — (0.9) —

Ending balance $ 78.7 $ 87.9 $ 97.8

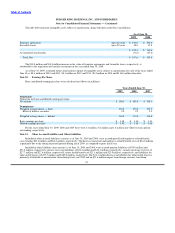

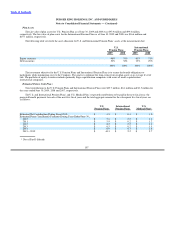

The Company has no Federal loss carryforwards in the United States and has State loss carryforwards of $1.8 million, expiring

between 2022 and 2023. In addition, the Company has foreign loss carryforwards of $261.3 million expiring between 2010 and 2029,

and foreign loss carryforwards of $151.9 million that do not expire. As of June 30, 2009, the Company has a foreign tax credit

carryforward balance of $43.5 million.

Deferred taxes have not been provided on basis differences related to investments in foreign subsidiaries. These differences

consist primarily of $117.5 million of undistributed earnings, which are considered to be permanently reinvested in the operations of

such subsidiaries outside the United States. Determination of the deferred income tax liability on these unremitted earnings is not

practicable. Such liability, if any, depends on circumstances existing if and when remittance occurs.

As discussed in Note 2, the Company adopted FIN 48 effective July 1, 2007. Upon adoption, the Company had no material

changes to its unrecognized tax benefits as of July 1, 2007. The amount of unrecognized tax benefits at July 1, 2007 was approximately

$22.0 million which, if recognized, would affect the effective income tax rate.

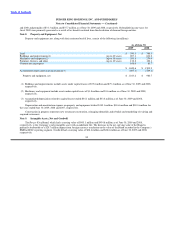

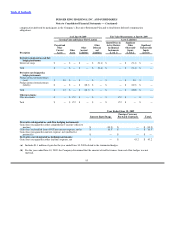

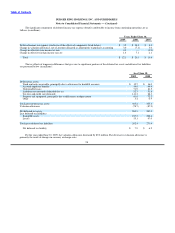

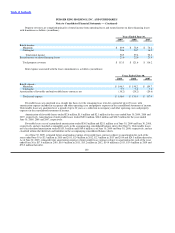

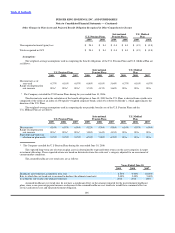

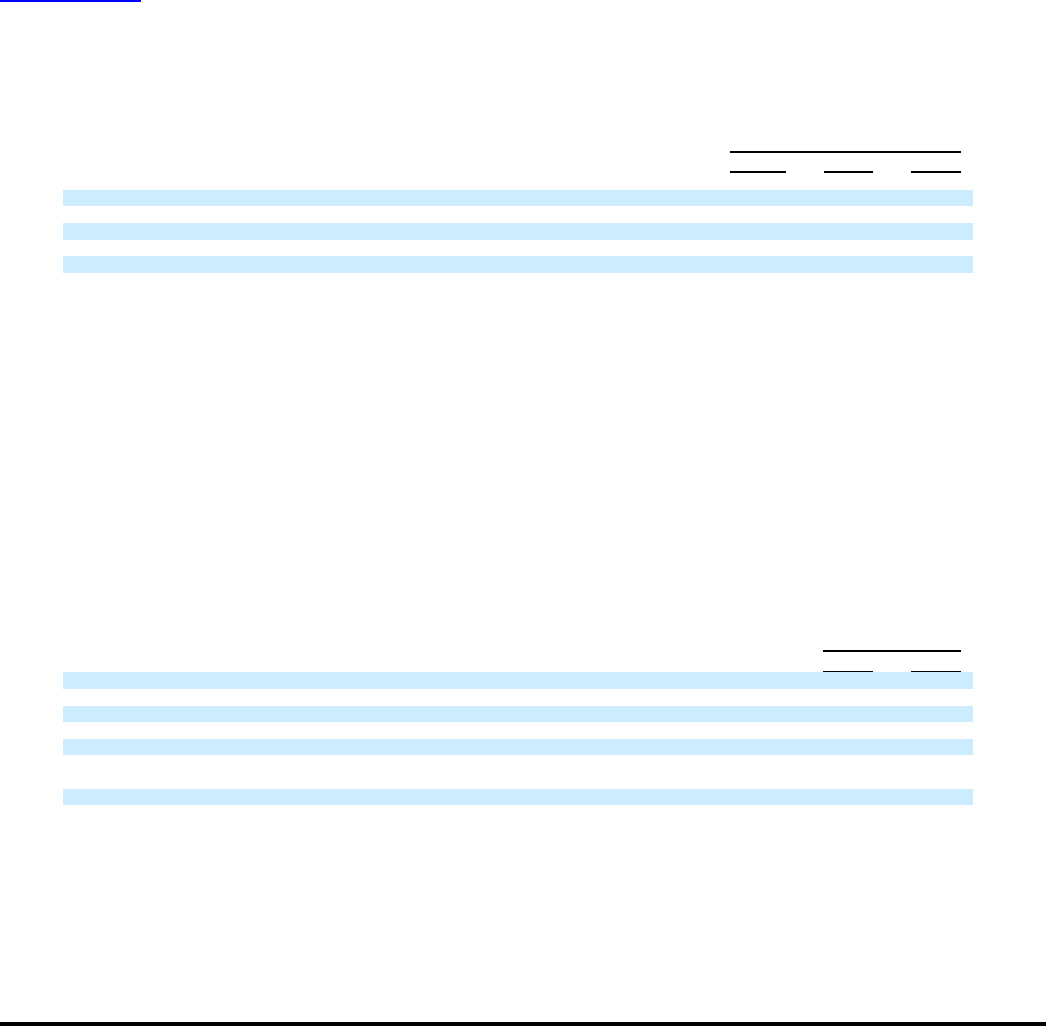

The Company had $19.5 million and $22.6 million of unrecognized tax benefits at June 30, 2009 and 2008, respectively, which if

recognized, would affect the effective income tax rate. A reconciliation of the beginning and ending amounts of unrecognized tax

benefits is as follows:

As of June 30,

2009 2008

Beginning balance $ 22.6 $ 22.0

Additions on tax position related to the current year 6.3 3.7

Additions for tax positions of prior years 2.0 2.1

Reductions for tax positions of prior years (9.1) (4.1)

Reductions for settlements (0.3) —

Reductions due to statute expiration (2.0) (1.1)

Ending balance $ 19.5 $ 22.6

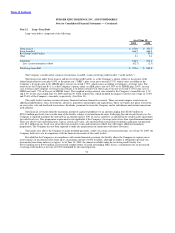

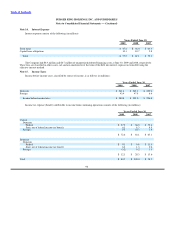

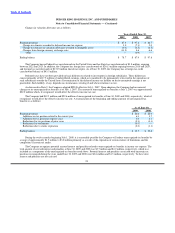

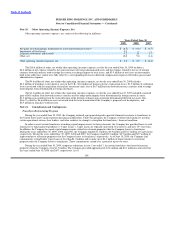

During the twelve months beginning July 1, 2009, it is reasonably possible the Company will reduce unrecognized tax benefits by

a range of approximately $1.5 million to $3.0 million primarily as a result of the expiration of certain statutes of limitations and the

completion of certain tax audits.

The Company recognizes potential accrued interest and penalties related to unrecognized tax benefits in income tax expense. The

total amount of accrued interest and penalties at June 30, 2009 and 2008 was $3.7 million and $4.2 million, respectively, which was

included as a component of the unrecognized tax benefits noted above. Potential interest and penalties associated with uncertain tax

positions recognized during the years ended June 30, 2009 and 2008 were $0.6 million and $1.5 million, respectively. To the extent

interest and penalties are not assessed

99