Burger King 2009 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2009 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

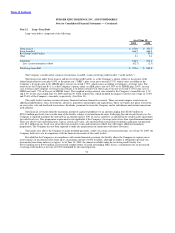

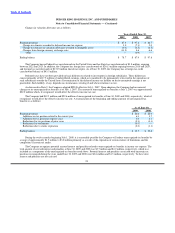

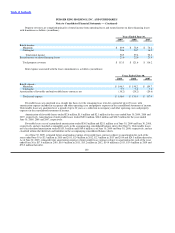

with respect to uncertain tax positions, amounts accrued will be reduced and reflected as a reduction of the overall income tax

provision.

The Company files income tax returns, including returns for its subsidiaries, with federal, state, local and foreign jurisdictions.

Generally the Company is subject to routine examination by taxing authorities in these jurisdictions, including significant international

tax jurisdictions, such as the United Kingdom, Germany, Spain, Switzerland, Singapore and Mexico. None of the foreign jurisdictions

are individually material. The Company is currently under audit by the U.S. Internal Revenue Service for the years ended June 30, 2008

and June 30, 2007. The Company also has various state and foreign income tax returns in the process of examination. From time to

time, these audits result in proposed assessments where the ultimate resolution may result in the Company owing additional taxes. The

Company believes that its tax positions comply with applicable tax law and that it has adequately provided for these matters.

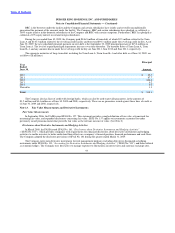

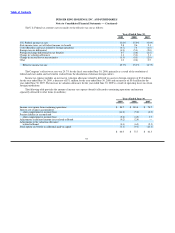

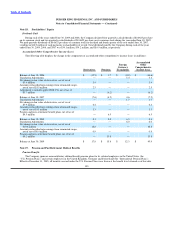

Note 16. Related Party Transactions

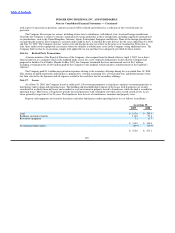

A former member of the Board of Directors of the Company, who resigned from the Board effective April 1, 2007, has a direct

financial interest in a company which is the landlord under a lease for a new corporate headquarters facility that the Company had

proposed to build in Coral Gables, Florida. In May 2007, the Company terminated the lease and incurred costs of $6.7 million,

including a termination fee of $5.0 million paid by the Company to the landlord, which includes a reimbursement of the landlord’s

expenses.

The Company paid $1.1 million in registration expenses relating to the secondary offerings during the year ended June 30, 2008.

This amount included registration and filing fees, printing fees, external accounting fees, all reasonable fees and disbursements of one

law firm selected by the Sponsors and all expenses related to the road show for the secondary offerings.

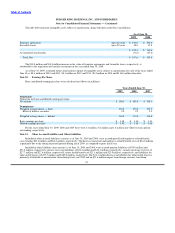

Note 17. Leases

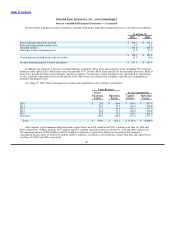

As of June 30, 2009, the Company leased or subleased 1,108 restaurant properties to franchisees and non−restaurant properties to

third parties under capital and operating leases. The building and leasehold improvements of the leases with franchisees are usually

accounted for as direct financing leases and recorded as a net investment in property leased to franchisees, while the land is recorded as

operating leases. Most leases to franchisees provide for fixed payments with contingent rent when sales exceed certain levels. Lease

terms generally range from 10 to 20 years. The franchisees bear the cost of maintenance, insurance and property taxes.

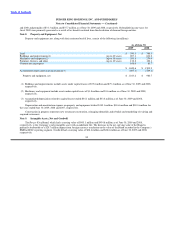

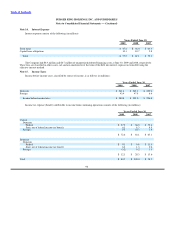

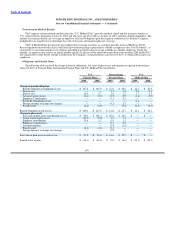

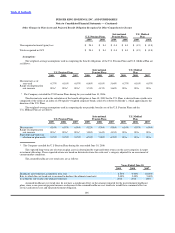

Property and equipment, net leased to franchisees and other third parties under operating leases was as follows (in millions):

As of June 30,

2009 2008

Land $ 195.8 $ 200.9

Buildings and improvements 114.0 95.4

Restaurant equipment 5.1 11.7

$ 314.9 $ 308.0

Accumulated depreciation (40.9) (34.9)

$ 274.0 $ 273.1

100