Burger King 2009 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2009 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Extinguishments of Liabilities — a replacement of FASB Statement No. 125”, and eliminates the exception from applying FASB

Interpretation No. 46 (revised December 2003) (“FIN 46(R)”), Consolidation of Variable Interest Entities, to qualifying

special−purpose entities. Furthermore, SFAS No. 166 establishes specific conditions to account for a transfer of financial assets as a

sale, changes the requirements for derecognizing financial assets and requires additional disclosure. SFAS No. 166 will be effective as

of the beginning of the first annual reporting period that begins after November 15, 2009, which for us will be our fiscal year beginning

on July 1, 2010. We do not anticipate that the adoption of SFAS No. 166 will have a significant impact on the Company.

In June 2009, the FASB issued SFAS No. 167, “Amendments to FASB Interpretation No. 46(R)” (“SFAS No. 167”).

SFAS No. 167 amends FIN 46 (R) to require an enterprise to perform an analysis to identify the primary beneficiary of a Variable

Interest Entity (“VIE”), a qualitatively on−going re−assessment on whether the enterprise is the primary beneficiary of the VIE and

additional disclosures that will provide users of financial statements with more transparent information about an enterprise’s

involvement in a VIE. In addition, this statement revises the methods utilized for determining whether an entity is a VIE and the events

that trigger a reassessment of whether an entity is a VIE. SFAS No. 167 will be effective as of the beginning of the first annual

reporting period that begins after November 15, 2009, which for us will be our fiscal year beginning on July 1, 2010. We have not yet

determined the impact, if any, that SFAS No. 167 will have on our consolidated balance sheet and income statement.

In June 2009, the FASB issued SFAS No. 168, “The FASB Accounting Standards Codificationtm and the Hierarchy of Generally

Accepted Accounting Principles — a replacement of FASB Statement No. 162” (“SFAS No. 168”). SFAS No. 168 has revised the

GAAP hierarchy to include only two levels of GAAP: Authoritative and Non−Authoritative. All of the content included in the FASB

Accounting Standards Codificationtm (the “Codification”) will be considered authoritative. SFAS No. 168 is not intended to amend

GAAP but codifies previous accounting literature. SFAS No. 168 is effective for interim and annual reporting periods ending after

September 15, 2009, which for us will be our first quarter ending September 30, 2009. This statement will have no impact on our

consolidated balance sheet and income statement, but it will change the referencing of authoritative accounting literature to conform to

the Codification.

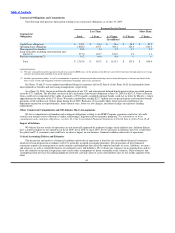

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

Market Risk

We are exposed to financial market risks associated with currency exchange rates, interest rates and commodity prices. In the

normal course of business and in accordance with our policies, we manage these risks through a variety of strategies, which may

include the use of derivative financial instruments to hedge our underlying exposures. Our policies prohibit the use of derivative

instruments for speculative purposes, and we have procedures in place to monitor and control their use.

Currency Exchange Risk

Movements in currency exchange rates may affect the translated value of our earnings and cash flow associated with our foreign

operations, as well as the translation of net asset or liability positions that are denominated in foreign currencies. In countries outside of

the United States where we operate Company restaurants, we generally generate revenues and incur operating expenses and selling,

general and administrative expenses denominated in local currencies. These revenues and expenses are translated using the average

rates during the period in which they are recognized and are impacted by changes in currency exchange rates. In many countries where

we do not have Company restaurants our franchisees pay royalties to us in currencies other than the local currency in which they

operate. However, as the royalties are calculated based on local currency sales, our revenues are still impacted by fluctuations in

exchange rates. In fiscal 2009, income from operations would have decreased or increased $12.3 million if all foreign currencies

uniformly weakened or strengthened 10% relative to the U.S. dollar.

We have entered into forward contracts intended to hedge our exposure to fluctuations in currency exchange rates associated with

our intercompany loans denominated in foreign currencies and certain foreign currency−denominated assets. These forward contracts

are primarily denominated in Euros but are also denominated in British Pounds and Canadian Dollars. Fluctuations in the value of these

forward contracts are recognized in our condensed consolidated statements of income as incurred. The fluctuations in the value of these

forward contracts

67