Burger King 2009 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2009 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

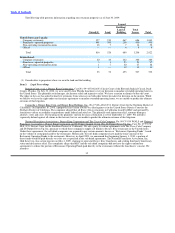

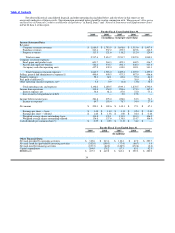

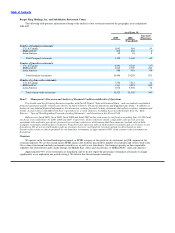

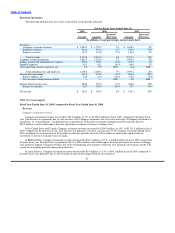

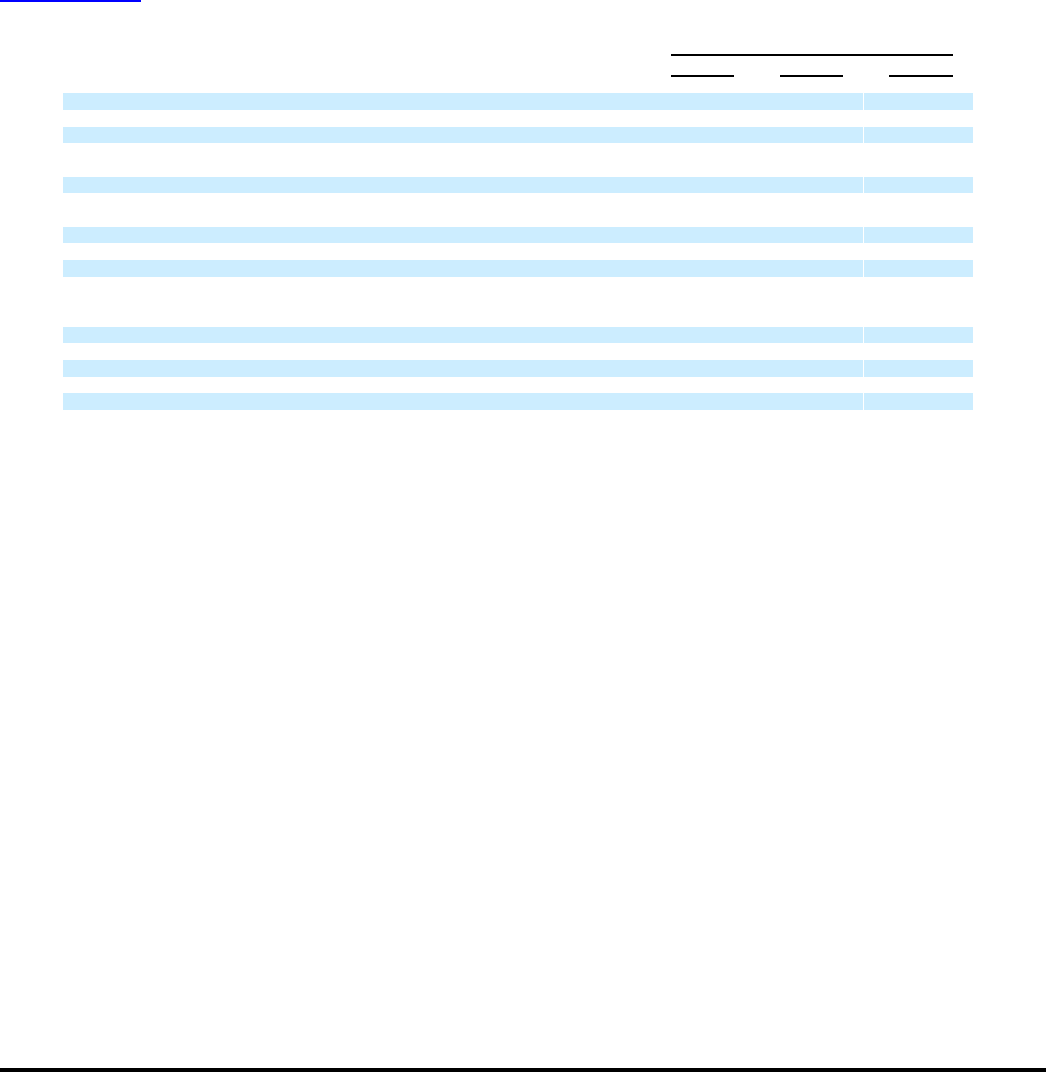

For the Fiscal Years Ended June 30,

2009 2008 2007

Worldwide

Food, paper and products costs 32.1% 31.4% 30.1%

Payroll and employee benefits 31.0% 29.8% 29.7%

Occupancy and other operating costs 24.3% 24.5% 25.2%

Total Company restaurant expenses 87.4% 85.7% 85.0%

Franchise revenues (in millions) (10):

United States and Canada $ 323.1 $ 317.9 $ 283.6

EMEA/APAC(8) 173.4 173.0 135.1

Latin America(9) 46.9 46.3 40.8

Total franchise revenues $ 543.4 $ 537.2 $ 459.5

Income from operations (in millions):

United States and Canada $ 341.8 $ 348.2 $ 339.4

EMEA/APAC(8) 83.6 91.8 53.9

Latin America(9) 37.8 41.4 35.2

Unallocated(11) (123.8) (127.2) (133.9)

Total income from operations $ 339.4 $ 354.2 $ 294.6

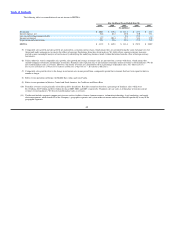

* See Note 2 to the Consolidated Financial Statements in Part II, Item 8 of this Form 10−K for information about income tax expense and other operating

(income) expenses, net related to the reclassification of transaction gains and losses resulting from the remeasurement of foreign denominated tax assets for

the fiscal years ended June 30, 2009, 2008 and 2007. For the fiscal years ended June 30, 2006 and 2005, we reclassified $1.5 million of income and

$3.8 million of expense, respectively from income tax expense to other operating (income) expense, net related to the reclassification.

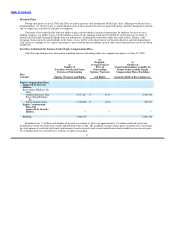

(1) Selling, general and administrative expenses for fiscal 2006 include compensation expense and taxes related to a $34.4 million compensatory make−whole

payment made on February 21, 2006 to holders of options and restricted stock unit awards, primarily members of senior management.

(2) Fees paid to affiliates consist of management fees we paid to the Sponsors under a management agreement. Fees paid to affiliates in fiscal 2006 also include a

$30.0 million fee that we paid to terminate the management agreement with the Sponsors.

(3) The cash dividend paid in fiscal 2006 represents a special dividend paid prior to our initial public offering.

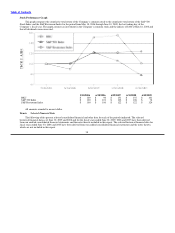

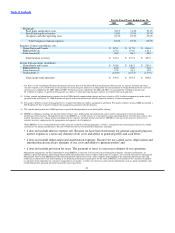

(4) EBITDA is defined as earnings (net income) before interest, taxes, depreciation and amortization, and is used by management to measure operating

performance of the business. Management believes that EBITDA is a useful measure as it incorporates certain operating drivers of our business such as sales

growth, operating costs, selling, general and administrative expenses and other income and expense. EBITDA is also one of the measures used by us to

calculate incentive compensation for management and corporate−level employees.

While EBITDA is not a recognized measure under generally accepted accounting principles (“GAAP”), management uses this financial measure to evaluate

and forecast our business performance. The non−GAAP measure has certain material limitations, including:

• it does not include interest expense, net. Because we have borrowed money for general corporate purposes,

interest expense is a necessary element of our costs and ability to generate profits and cash flows;

• it does not include depreciation and amortization expenses. Because we use capital assets, depreciation and

amortization are necessary elements of our costs and ability to generate profits; and

• it does not include provision for taxes. The payment of taxes is a necessary element of our operations.

Management compensates for these limitations by using EBITDA as only one of its measures for evaluating the Company’s business performance. In

addition, capital expenditures, which impact depreciation and amortization, interest expense and income tax expense, are reviewed separately by management.

Management believes that EBITDA provides both management and investors with a more complete understanding of the underlying operating results and

trends and an enhanced overall understanding of our financial performance and prospects for the future. EBITDA is not intended to be a measure of liquidity

or cash flows from operations nor a measure comparable to net income, as it does not take into account certain requirements such as capital expenditures and

related depreciation, principal and interest payments and tax payments.

41