Burger King 2009 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2009 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

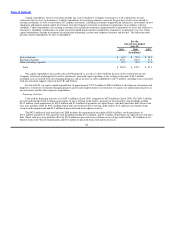

record. We paid quarterly dividends of $0.0625 per share of common stock for the third and fourth quarter of the year ended June 30,

2007, resulting in $16.9 million of cash payments to shareholders of record. During the first quarter of fiscal 2010, we declared a

quarterly dividend of $0.0625 per share of common stock that is payable on September 30, 2009 to shareholders of record on

September 14, 2009.

During fiscal 2009, we repurchased 834,882 shares of common stock under our previously announced share repurchase program at

an aggregate cost of $20.0 million, which we will retain in treasury for future use. All of the shares were purchased under the former

share repurchase program, which expired on December 31, 2008. During the third quarter of fiscal 2009, our board of directors

approved, and we adopted a new share repurchase program to repurchase up to $200 million of our common stock in the open market

from time to time prior to December 31, 2010. We intend to use a portion of our excess cash to repurchase shares under our share

repurchase program depending on market conditions. No shares have been purchased under the new share repurchase program to date.

We had cash and cash equivalents of $121.7 million and $166.0 million as of June 30, 2009 and 2008, respectively. In addition, as

of June 30, 2009, we had a borrowing capacity of $119.4 million under our $150.0 million revolving credit facility.

We expect that cash on hand, cash flow from operations and our borrowing capacity under our revolving credit facility will allow

us to meet cash requirements, including capital expenditures, tax payments, dividends, debt service payments and share repurchases, if

any, over the next twelve months and for the foreseeable future. If additional funds are needed for strategic initiatives or other corporate

purposes, we believe we could incur additional debt or raise funds through the issuance of our equity securities.

Comparative Cash Flows

Operating Activities

Cash provided by operating activities was $310.8 million in fiscal 2009, compared to $243.4 million in fiscal 2008. The

$310.8 million provided in fiscal 2009 includes net income of $200.1 million, non−cash items of $165.4 million, which include

depreciation and amortization of $98.1 million and a $50.1 million loss on the remeasurement of foreign denominated assets and a

$3.8 million change in other long term assets and liabilities, partially offset by a $58.5 million change in working capital. The

$58.5 million of cash used from the change in working capital is primarily due to the timing of tax payments, including benefits derived

from the dissolution of dormant foreign entities.

The $243.4 million provided in fiscal 2008 includes net income of $189.6 million, non−cash items of $50.2 million, which include

depreciation and amortization of $95.6 million, a $55.6 million gain on the remeasurement of foreign denominated assets, and

$32.0 million from a change in working capital, partially offset by a change in other long term assets and liabilities of $28.4 million.

The $32.0 million of cash generated from the change in working capital is primarily driven by a $20.8 million increase in accounts

payable and capital accruals, a decrease of $11.7 million in prepaid advertising and insurance expense and an $11.1 million increase in

accrued advertising, partially offset by an increase in accounts receivable of $8.6 million, which is primarily driven by higher sales

recognized in fiscal 2008, as compared to the prior fiscal year.

Investing Activities

Cash used for investing activities was $242.0 million in fiscal 2009, compared to $199.3 million in fiscal 2008. The $242.0 million

of cash used in fiscal 2009 includes $204.0 million of payments for property and equipment, $67.9 million used for the acquisition of

franchised restaurants and $4.4 million used for other investing activities, partially offset by proceeds received from refranchisings,

dispositions of assets and restaurant closures of $26.4 million and $7.9 million of principal payments received on direct financing

leases.

The $199.3 million of cash used in fiscal 2008 includes $178.2 million of payments for property and equipment, $54.2 million

used for the acquisition of franchised restaurants and $1.3 million used for other investing activities, partially offset by proceeds

received from refranchisings, dispositions of assets and restaurant closures of $27.0 million and $7.4 million of principal payments

received on direct financing leases.

61