Burger King 2009 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2009 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

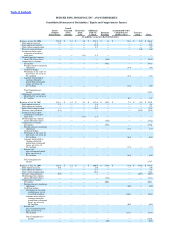

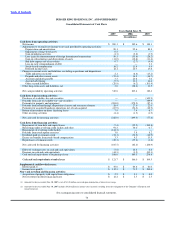

Table of Contents

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

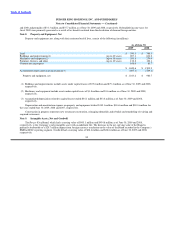

superseded Accounting Standards Board (“APB”) No. 25, “Accounting for Stock Issued to Employees,” and related interpretations and

amended SFAS No. 95. Prior to the adoption of SFAS No. 123R, all stock option grants were accounted for under the recognition and

measurement principles of APB No. 25. Accordingly, no stock−based compensation expense was recorded in the consolidated

statements of income for stock options, as all stock options granted had an exercise price equal to the market value of the Company’s

common stock on the date of grant. Under the pro−forma disclosure required by SFAS No. 123, compensation expense for stock

options was measured using the minimum value method, as permitted under SFAS No. 123.

Stock options granted by the Company typically contain only a service condition for vesting. For performance−based restricted

stock and restricted stock units (“PBRS”) and restricted stock units (“RSU”) awards, vesting is based both on a performance condition

and a service condition. For awards granted subsequent to the Company’s adoption of SFAS No. 123R that have a cliff−vesting

schedule, stock−based compensation cost is recognized ratably over the requisite service period. For awards with a graded vesting

schedule, where the award vests in increments during the requisite service period, the Company has elected to record stock−based

compensation cost over the requisite service period for the entire award, in accordance with the SFAS No. 123R.

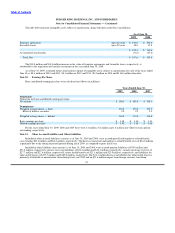

Retirement Plans

In September 2006, the FASB issued SFAS No. 158, “Employer’s Accounting for Defined Benefit Pension and Other

Postretirement Plans” — an amendment of FASB Statement No. 87, 88, 106, 132 ( R), (“SFAS No. 158”). In the fourth quarter of fiscal

year 2007, the Company adopted the recognition and disclosure provisions of SFAS No. 158. Additionally, SFAS No. 158 requires

measurement of the funded status of pension and postretirement plans as of the date of the Company’s fiscal year end effective for the

fiscal year ending June 30, 2009. The Company’s plans had measurement dates that did not coincide with its fiscal year end and thus

the Company was required to change their measurement dates in fiscal 2009.

SFAS No. 158 required the Company to recognize the funded status of its pension and postretirement plans in the June 30, 2007

consolidated balance sheet, with a corresponding adjustment to Accumulated other comprehensive income (loss), net of tax. The impact

of adopting these provisions of SFAS No. 158 was an after tax reduction of shareholders’ equity of $6.2 million in fiscal year 2007.

Subsequent to the adoption of SFAS No. 158, gains or losses and prior service costs or credits are being recognized as they arise as a

component of other comprehensive income (loss) to the extent they have not been recognized as a component of net periodic benefit

cost pursuant to SFAS No. 87, “Employers’ Accounting for Pensions,” or SFAS No. 106 “Employers’ Accounting for Post retirement

benefits Other than Pensions”. In the fourth quarter of fiscal year 2009, the Company adopted the measurement date provisions of

SFAS No. 158 and recorded a decrease to retained earnings of $0.4 million after tax related to its pension plans and postretirement

medical plan.

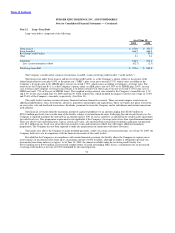

The Company sponsors the Burger King Savings Plan (the “Savings Plan”), a defined contribution plan under the provisions of

section 401(k) of the Internal Revenue Code. The Savings Plan is voluntary and is provided to all employees who meet the eligibility

requirements. A participant can elect to contribute up to 50% of their compensation subject to IRS limits and the Company matches

100% of the first 6% of employee compensation. Effective July 1, 2007, the Company added the Burger King Holdings, Inc. Stock

Fund (the “BK Stock Fund”) to the Savings Plan as an investment option. Participants in the Savings Plan may direct no more than 10%

of their investment elections to the BK Stock Fund and no more than 10% of their total account balance.

The Company also maintains an Executive Retirement Plan (“ERP”) for all officers and senior management. Officers and senior

management may elect to defer up to 50% of base pay once 401(k) limits are reached and up to 100% of incentive pay on a before−tax

basis under the ERP. BKC provides a dollar−for−dollar match up to the first 6% of base pay. Additionally, the Company may make a

discretionary contribution ranging from 0% to 6% based on the Company’s performance. The total deferred compensation liability

related to the ERP was $17.9 million and $20.2 million at June 30, 2009 and 2008, respectively.

84