Burger King 2009 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2009 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

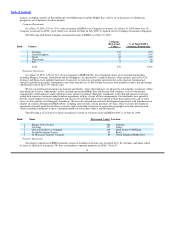

We believe the QSR segment is generally less vulnerable to economic downturns than the casual dining segment, due to the value

that QSRs deliver to consumers, as well as some “trading to value” by customers from other restaurant industry segments during

adverse economic conditions, as they seek to preserve the “away from home” dining experience on tighter budgets. During the current

recession, however, QSR traffic in the United States decreased 2% for the quarter ended in June 2009, while visits to casual dining

chains decreased 3% and family dining chains decreased 6% for the same period, according to The NPD Group, Inc. Overall

U.S. restaurant traffic decreased 3% for the quarter ended in May 2009, its steepest drop in 28 years, as diners with children ate out less,

according to The NPD Group, Inc.

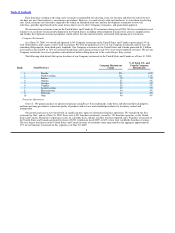

According to The NPD Group, Inc., the FFHR category is the largest category in the QSR segment, generating sales of over

$62.8 billion in the United States for the 12−month period ended June 30, 2009, representing 27% of total QSR sales. The FFHR

category grew at an annual rate of 3% in terms of sales during the same period and, according to The NPD Group, Inc., is expected to

increase at an average rate of 4% per year over the next five years. For the 12−month period ended June 30, 2009, Burger King

accounted for approximately 14% of total FFHR sales in the United States.

Our Competitive Strengths

We believe that we are well−positioned to capitalize on the following competitive strengths to achieve future growth:

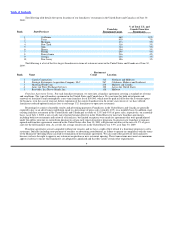

• Distinctive brand with global platform. We believe that our Burger King and Whopper brands are two of

the most widely−recognized consumer brands in the world. We have one of the largest restaurant

networks in the world, with 11,925 restaurants operating in 73 countries and U.S. territories, of which

4,692 are located in our international markets. During fiscal 2009, our franchisees opened restaurants in

two new international markets, the Czech Republic and Suriname, and re−entered Uruguay, a market in

which we had no presence since August 2007. We believe that the demand for new international franchise

restaurants is growing and that our global platform will allow us to leverage our established infrastructure

to significantly increase our international restaurant count with limited incremental investment or expense.

• Attractive business model. Approximately 90% of our restaurants are franchised, which is a higher

percentage than that of our major competitors in the FFHR category. We believe that our franchise

restaurants will generate a consistent, profitable royalty stream to us, with minimal ongoing capital

expenditures or incremental expense by us. We also believe this will provide us with significant cash flow

to reinvest in growing our brand and enhancing shareholder value. Although we believe that this

restaurant ownership mix is beneficial to us, it also presents a number of drawbacks, such as our limited

influence over franchisees and limited ability to facilitate changes in restaurant ownership.

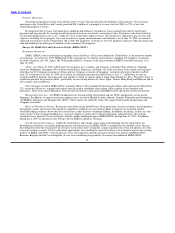

• Innovative marketing campaigns, creative advertising and strategic sponsorships. We utilize our

successful marketing, advertising and sponsorships to drive sales and generate restaurant traffic. We were

named “Advertiser of the Decade” by AdWeek in late 2008. During fiscal 2009, we launched innovative,

creative and edgy advertising campaigns, such as our Whopper Sacrifice campaign in which we built an

application in the social network Facebook to test if people love the Whopper sandwich more than their

friends by offering a free Whopper sandwich to anyone who deleted ten of their Facebook friends. The

campaign commanded the attention of consumers and media with 85 million media impressions and

continues to be referenced as an example of a successful Facebook application from a brand perspective.

We are also reaching out to a broad spectrum of restaurant guests with entertainment events, such as Star

Trektm and SpongeBob SquarePantstm and sports initiatives, such as our partnership with Tony Stewart

and NASCAR. Additionally, we reinforced our commitment to the nutrition portion of our BKtm Positive

Steps program by launching BK® Fresh Apple Fries, which was named one of 2008’s Most Memorable

New Product Launches by Launch PR.

• Experienced management team. We have a seasoned management team with significant experience.

John Chidsey, our Chairman and Chief Executive Officer, has extensive experience in managing

franchised and branded businesses, including the Avis Rent−A−Car and Budget Rent−A−Car systems,

Jackson Hewitt Tax Services and PepsiCo. Russell Klein, our President, Global Marketing, Strategy and

Innovation, has

4