Burger King 2009 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2009 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

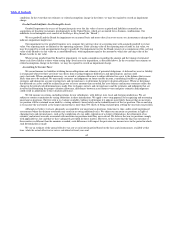

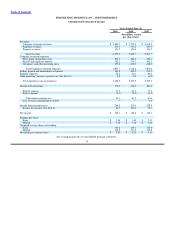

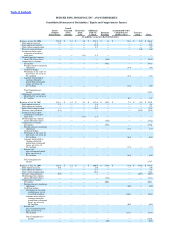

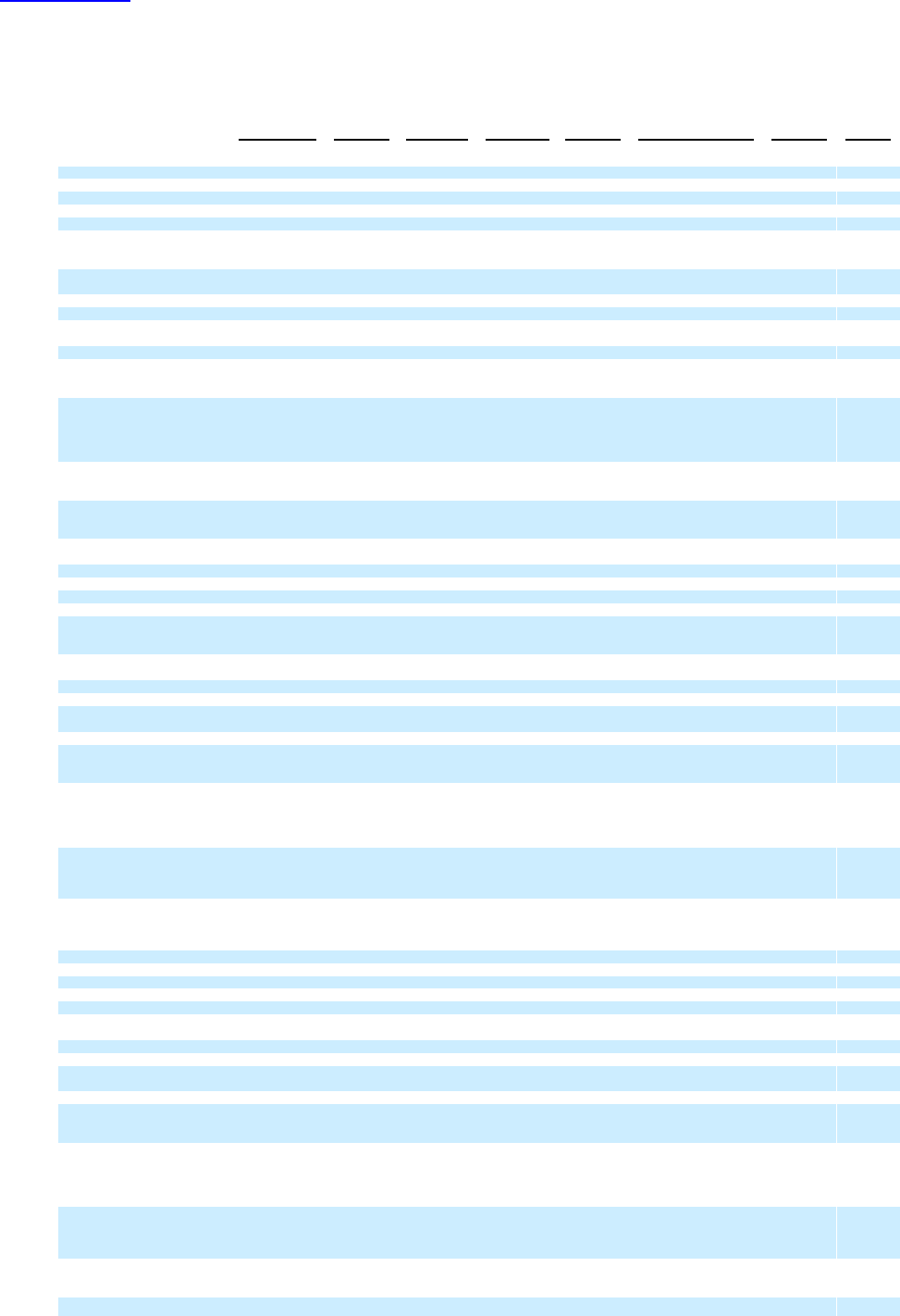

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES

Consolidated Statements of Stockholders’ Equity and Comprehensive Income

Issued

Issued Common Restricted Additional Accumulated Other

Common Stock Stock Paid−In Retained Comprehensive Treasury

Stock Shares Amount Units Capital Earnings Income (Loss) Stock Total

(In millions, except per share information)

Balances at June 30, 2006 133.0 $ 1.4 $ 4.6 $ 545.2 $ 3.2 $ 14.6 $ (2.2) $ 566.8

Stock option exercises 2.2 — — 8.2 — — — 8.2

Stock option tax benefits — — — 13.5 — — — 13.5

Stock−based compensation — — — 4.9 — — — 4.9

Treasury stock purchases — — — — — — (1.6) (1.6)

Issuance of shares upon

settlement of restricted

stock units — — (1.8) 1.8 — — — —

Dividend paid on common

shares ($0.13 per share) — — — — (16.9) — — (16.9)

Comprehensive income:

Net income — — — — 148.1 — — 148.1

Foreign currency translation

adjustment — — — — — (5.4) — (5.4)

Cash flow hedges:

Net change in fair value of

derivatives, net of tax of

$3.4 million — — — — — (5.4) — (5.4)

Amounts reclassified to

earnings during the

period from terminated

swaps, net of tax of

$1.5 million — — — — — (2.5) — (2.5)

Total Comprehensive

income 134.8

Adjustment to initially apply

SFAS No 158, net of tax of

$3.7 million — — — — — 6.2 — 6.2

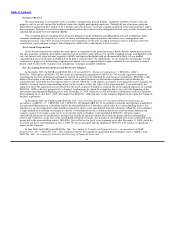

Balances at June 30, 2007 135.2 $ 1.4 $ 2.8 $ 573.6 $ 134.4 $ 7.5 $ (3.8) $ 715.9

Stock option exercises 1.2 — — 3.8 — — — 3.8

Stock option tax benefits — — — 9.3 — — — 9.3

Stock−based compensation — — — 11.4 — — — 11.4

Treasury stock purchases (1.4) — — — — — (35.4) (35.4)

Issuance of shares upon

settlement of restricted

stock units — — (2.8) 2.8 — — — —

Dividend paid on common

shares ($0.25 per share) — — — — (34.2) — — (34.2)

Comprehensive income:

Net income — — — — 189.6 — — 189.6

Foreign currency translation

adjustment — — — — — (1.7) — (1.7)

Cash flow hedges:

Net change in fair value of

derivatives, net of tax of

$3.9 million — — — — — (6.4) — (6.4)

Amounts reclassified to

earnings during the

period from terminated

swaps, net of tax of

$1.1 million — — — — — (1.3) — (1.3)

Pension and

post−retirement benefit

plans, net of tax of

$4.5 million — — — — — (6.5) — (6.5)

Total Comprehensive

income 173.7

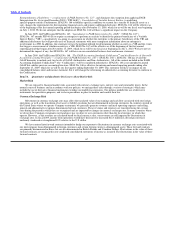

Balances at June 30, 2008 135.0 $ 1.4 $ — $ 600.9 $ 289.8 $ (8.4) $ (39.2) $ 844.5

Stock option exercises 0.6 — — 3.0 — — — 3.0

Stock option tax benefits — — — 3.3 — — — 3.3

Stock−based compensation — — — 16.2 — — — 16.2

Treasury stock purchases (0.8) — — — — — (20.3) (20.3)

Dividend paid on common

shares ($0.25 per share) — — — — (34.1) — — (34.1)

Comprehensive income:

Net income — — — — 200.1 — — 200.1

Foreign currency translation

adjustment — — — — — (6.0) — (6.0)

Cash flow hedges:

Net change in fair value

of derivatives, net of

tax of $10.6 million — — — — — (16.8) — (16.8)

Amounts reclassified to

earnings during the

period from terminated

swaps, net of tax of

$0.4 million — — — — — (0.9) — (0.9)

Pension and

post−retirement benefit

plans, net of tax of

$9.2 million — — — — — (13.8) — (13.8)

Total Comprehensive

income — — — — — — — 162.6

— — — — (0.4) — — (0.4)