Burger King 2009 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2009 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

vigorously defend against all claims in this lawsuit, but we are unable to predict the ultimate outcome of this litigation.

From time to time, we are involved in other legal proceedings arising in the ordinary course of business relating to matters

including, but not limited to, disputes with franchisees, suppliers, employees and customers, as well as disputes over our intellectual

property.

Item 4. Submission of Matters to a Vote of Security Holders

None.

Part II

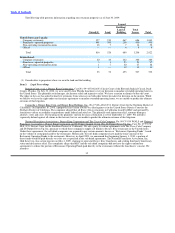

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market for Our Common Stock

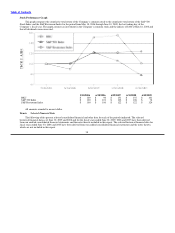

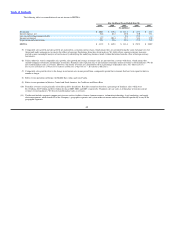

Our common stock trades on the New York Stock Exchange under the symbol “BKC.” Trading of our common stock commenced

on May 18, 2006, following the completion of our initial public offering. Prior to that date, no public market existed for our common

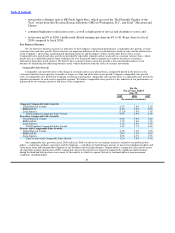

stock. As of August 20, 2009, there were approximately 387 holders of record of our common stock. The following table sets forth the

high and low sales prices of our common stock as reported on the New York Stock Exchange and dividends declared per share of

common stock for each of the quarters in fiscal 2009 and fiscal 2008:

2009 2008

Dollars

per

Share: High Low Dividend High Low Dividend

First Quarter $ 30.95 $ 22.77 $ 0.0625 $ 27.00 $ 22.21 $ 0.0625

Second Quarter $ 24.93 $ 16.56 $ 0.0625 $ 29.19 $ 24.41 $ 0.0625

Third Quarter $ 24.48 $ 19.21 $ 0.0625 $ 28.90 $ 21.60 $ 0.0625

Fourth Quarter $ 24.10 $ 15.85 $ 0.0625 $ 30.75 $ 26.41 $ 0.0625

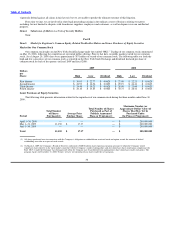

Issuer Purchases of Equity Securities

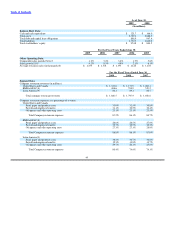

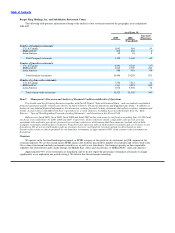

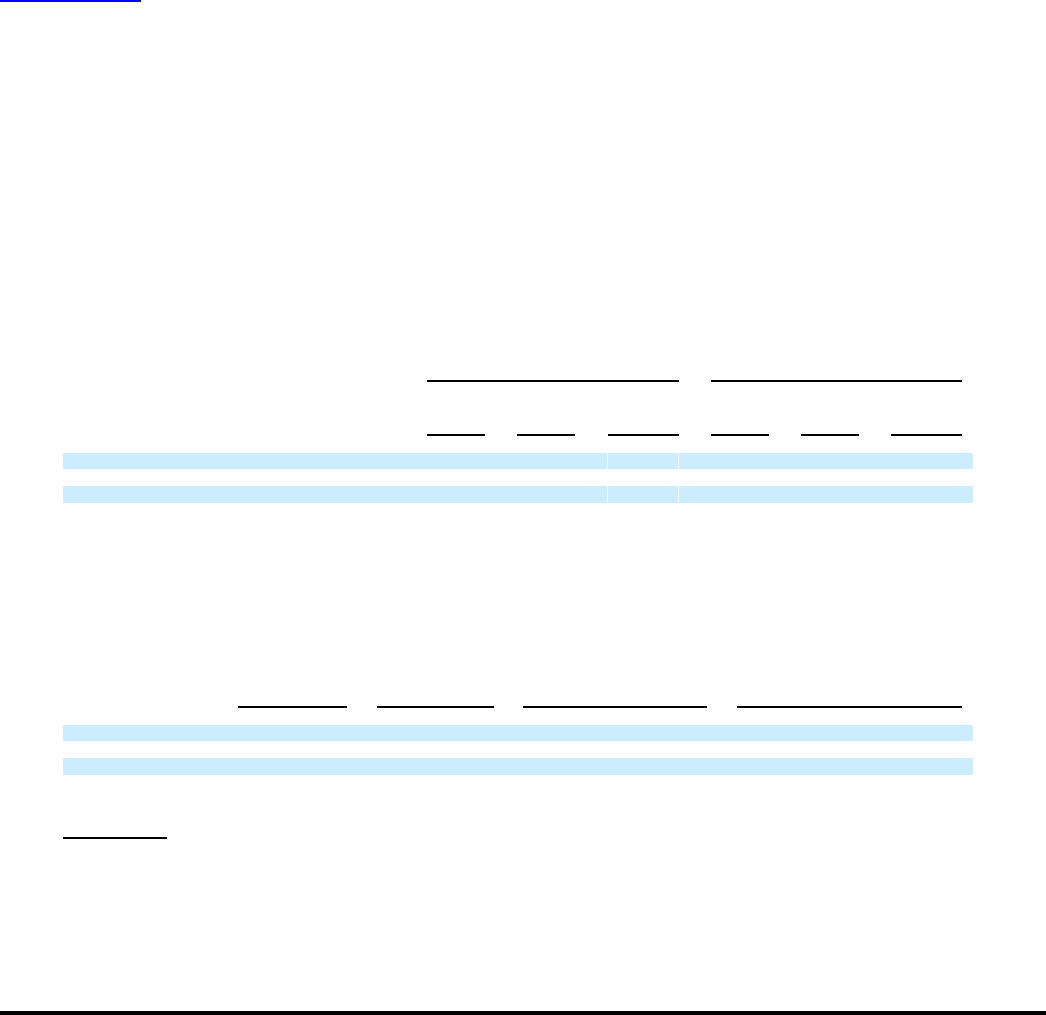

The following table presents information related to the repurchase of our common stock during the three months ended June 30,

2009:

Maximum Number (or

Total Number of Shares Approximate Dollar Value) of

Total Number Purchased as Part of Shares That May Yet be

of Shares Average Price Publicly Announced Purchased Under

Period Purchased(1) Paid per Share Plans or Programs(2) the Plans or Programs(2)

April 1−30, 2009 — — — $ 200,000,000

May 1−31, 2009 11,150 $ 17.37 — $ 200,000,000

June 1−30, 2009 — — — $ 200,000,000

Total 11,150 $ 17.37 — $ 200,000,000

(1) All shares purchased were in connection with the Company’s obligation to withhold from restricted stock and option awards the amount of federal

withholding taxes due in respect of such awards.

(2) On March 4, 2009, the Company’s Board of Directors authorized a $200.0 million share repurchase program pursuant to which the Company would

repurchase shares directly in the open market consistent with the Company’s insider trading policy and also repurchase shares under plans complying with

Rule 10b5−1 under the Exchange Act during periods when the Company may be prohibited from making direct share repurchases under such policy. The

program expires on December 31, 2010. To date, we have not repurchased any shares under the new program.

36