Burger King 2009 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2009 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

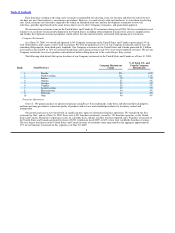

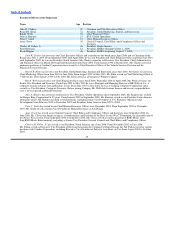

The following table details the top ten locations of our franchisees’ restaurants in the United States and Canada as of June 30,

2009:

% of Total U.S. and

Franchise Canada Franchise

Rank State/Province Restaurant Count Restaurants

1 California 669 10%

2 Texas 430 7%

3 Michigan 333 5%

4 New York 316 5%

5 Ohio 310 5%

6 Illinois 304 5%

7 Florida 295 5%

8 Pennsylvania 236 4%

9 Georgia 204 3%

10 New Jersey 186 3%

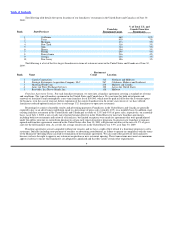

The following is a list of the five largest franchisees in terms of restaurant count in the United States and Canada as of June 30,

2009:

Restaurant

Rank Name Count Location

1 Carrols Corporation 314 Northeast and Midwest

2 Strategic Restaurants Acquisition Company, LLC 267 California, Midwest and Southeast

3 Heartland Food Corp. 258 Midwest and Canada

4 Army Air Force Exchange Services 128 Across the United States

5 Bravokilo, Inc./Bravo Grande, Inc. 118 Midwest

Franchise Agreement Terms. For each franchise restaurant, we enter into a franchise agreement covering a standard set of terms

and conditions. The typical franchise agreement in the United States and Canada has a 20−year term (for both initial grants and

renewals of franchises) and contemplates a one−time franchise fee of $50,000, which must be paid in full before the restaurant opens

for business, or in the case of renewal, before expiration of the current franchise term. In recent years, however, we have offered

franchisees reduced upfront franchise fees to encourage U.S. franchisees to open new restaurants.

Recurring fees consist of monthly royalty and advertising payments. Franchisees in the United States and Canada are generally

required to pay us an advertising contribution equal to a percentage of gross sales, typically 4.0%, on a monthly basis. In addition, most

existing franchise restaurants in the United States and Canada pay a royalty of 3.5% and 4.0% of gross sales, respectively, on a monthly

basis. As of July 1, 2000, a new royalty rate structure became effective in the United States for most new franchise agreements,

including both new restaurants and renewals of franchises, but limited exceptions were made for agreements that were grandfathered

under the old fee structure or entered into pursuant to certain early renewal incentive programs. In general, new franchise restaurants

opened and franchise agreements renewed in the United States after June 30, 2003 will generate royalties at the rate of 4.5% of gross

sales for the full franchise term. As a result, the average royalty rate in the United States was 3.9% as of June 30, 2009.

Franchise agreements are not assignable without our consent, and we have a right of first refusal if a franchisee proposes to sell a

restaurant. Defaults (including non−payment of royalties or advertising contributions, or failure to operate in compliance with the terms

of the Manual of Operating Data) can lead to termination of the franchise agreement. We can control the growth of our franchisees

because we have the right to approve any restaurant acquisition or new restaurant opening. These transactions must meet our minimum

approval criteria to ensure that franchisees are adequately capitalized and that they satisfy certain other requirements.

9