BMW 2010 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2010 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282

|

|

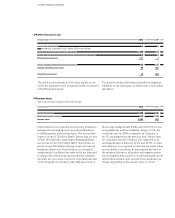

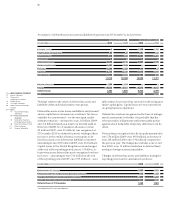

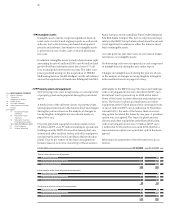

93 GROUP FINANCIAL STATEMENTS

in euro million 2010 2009

Expected tax expense 1,460 124

Variances due to different tax rates – 50 38

Tax increases (+) / tax reductions (–) as a result of non-taxable income and non-deductible expenses 105 68

Tax expense (+) / benefits (–) for prior periods 141 – 26

Other variances – 54 –1

Actual tax expense 1,602 203

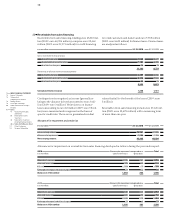

2010 2009

Net profit for the year after minority interest euro million 3,218.1 203.6

Profit attributable to common stock euro million 2,958.3 186.5

Profit attributable to preferred stock euro million 259.8 17.1

Average number of common stock shares in circulation number 601,995,196 601,995,196

Average number of preferred stock shares in circulation number 52,663,822 51,833,937

Earnings per share of common stock euro 4.91 0.31

Earnings per share of preferred stock euro 4.93 0.33

Dividend per share of common stock euro 1.30 0.30

Dividend per share of preferred stock euro 1.32 0.32

Earnings per share

Tax increases as a result of non-deductible expenses relate

mainly to the impact of non-recoverable withholding

taxes on intra-group dividends. This line also includes

write-downs recorded in the current year on investments.

The line “Tax expense (+) / benefits (–) for prior years”

mainly reflects the impact of tax field audits in Germany

and abroad.

The item “Other variances” includes the impact of the

reduction in tax expense as a result of utilising tax losses

brought forward for which deferred assets had not pre-

viously been recognised and tax credits, also not pre-

viously recognised, amounting to euro 7 million (2009:

euro 3 million). The tax income for the valuation allow-

ance on deferred tax assets relating to tax losses available

for carryforward and temporary differences and their

reversal amounted to euro 18 million (2009: euro 10 mil-

lion).

Deferred taxes are not recognised on retained profits of

euro 16.2 billion (2009: euro 15.9 billion) of foreign sub-

sidiaries, as it is intended to invest these profits to main-

tain and expand the business volume of the relevant

companies. A computation was not made of the potential

impact of income taxes on the grounds of dispropor-

tionate

expense.

The tax returns of BMW Group entities are checked

re-

gularly by German and foreign tax authorities. Taking

account of a variety of factors – including existing inter-

pretations,

commentaries and legal decisions taken

relating to the various tax jurisdictions and the BMW

Group’s past experience – adequate provision has, as

faras identifiable, been made for potential future tax ob-

ligations.

The actual tax expense for the financial year 2010 of euro

1,602 million (2009: euro 203 million) is euro 142 million

(2009: euro 79 million higher) higher than the expected

tax expense of euro 1,460 million (2009: euro 124 mil-

lion)

which would theoretically arise if the tax rate of

30.2% applicable for German companies, and unchanged

from the previous year, was applied across the Group.

The difference between the expected and actual tax ex-

pense is attributable to the following:

15