BMW 2010 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2010 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

128

74 GROUP FINANCIAL STATEMENTS

74 Income Statements

74 Statement of

Comprehensive Income

76 Balance Sheets

78 Cash Flow Statements

80 Group Statement of Changes

in Equity

81 Notes

81 Accounting Principles

and Policies

89 Notes to the Income

Statement

95 Notes to the Statement

of Comprehensive Income

96 Notes to the Balance Sheet

117 Other Disclosures

133 Segment Information

39

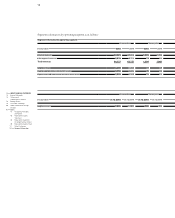

Explanatory notes to the cash flow statements

The cash flow statements show how the cash and cash

equivalents of the BMW Group and of the Automobiles

and Financial Services segments have changed in the

course of the year as a result of cash inflows and cash out-

flows. In accordance with IAS 7 (Statement of Cash Flows),

cash flows are classified into cash flows from operating,

investing and financing activities. The Group and segment

cash flow statements are presented on pages 78 et seq.

Cash and cash equivalents included in the cash flow

statement comprise cash in hand, cheques, and cash at

bank, to the extent that they are available within three

months from the end of the reporting period and are

subject to an insignificant risk of changes in value. The

positive impact of changes in cash and cash equivalents

due to the effect of exchange rate fluctuations in 2010

was euro 22 million (2009: euro 40 million).

The cash flows from investing and financial activities are

based on actual payments and receipts. By contrast, the

cash flow from operating activities is derived indirectly

from the net profit / loss for the year. Under this method,

changes in assets and liabilities relating to operating ac-

tivities are adjusted for currency translation effects and

changes in the composition of the Group. The changes in

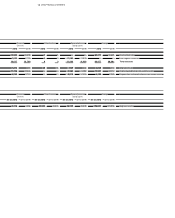

Related party relationships

In accordance with IAS 24 (Related Party Disclosures),

related individuals or entities which have the ability to

control the BMW Group or which are controlled by the

BMW Group, must be disclosed unless such parties are

not already included in the consolidated financial state-

ments

as consolidated companies. Control is defined as

ownership of more than one half of the voting power of

BMW AG or the power to direct, by statute or agreement,

the financial and operating policies of the management

of the Group.

In addition, the disclosure requirements of IAS 24 also

cover transactions with participations, joint ventures and

individuals that have the ability to exercise significant

influence over the financial and operating policies of the

BMW Group. This also includes close relatives and inter-

mediary entities. Significant influence over the financial

and operating policies of the BMW Group is presumed

when a party holds 20% or more of the voting power of

BMW AG. In addition, the requirements contained in

IAS 24 relating to key management personnel and close

members of their families or intermediary entities are

also applied. In the case of the BMW Group, this applies

balance sheet positions shown in the cash flow statement

do not therefore agree directly with the amounts shown

in the Group and segment balance sheets.

If the BMW Group acts as the lessor in a finance lease, the

relevant cash flows are reported in the cash flow state-

ments as part of the cash flow from investing activities. If

the BMW Group acts as the lessee in a finance lease, the

cash flows are reported as part of the cash flows from oper-

ating

and investing activities.

If the BMW Group acts as the lessor in an operating

lease, cash flows are reported as part of the cash flow

from investing activities. In the final case, where the

BMW Group acts as the lessee in an operating lease,

cash flows are reported as part of the cash flow from

operating activities.

Cash outflows for taxes on income and cash inflows for

interest are classified as cash flows from operating activi-

ties in accordance with IAS 7.31 and IAS 7.35. Cash out-

flows for interest are presented on a separate line within

cash flows from financing activities.

Cash flows from dividends received amounted to euro

5million (2009: euro 4 million).

to members of the Board of Management and Supervisory

Board.

For the financial year 2010, the disclosure requirements

contained in IAS 24 only affect the BMW Group with

regard to business relationships with affiliated, non-

consolidated entities, joint ventures and participations

aswell as members of BMW AG’s Board of Management

and Supervisory Board.

The BMW Group maintains normal business relation-

ships

with affiliated, non-consolidated entities. Trans-

actions with these entities are small in scale, arise in the

normal course of business and are conducted on the

basis of arm’s length principles.

Transactions of BMW Group companies with the joint

venture, BMW Brilliance Automotive Ltd., Shenyang, all

arise in the normal course of business and are conducted

on the basis of arm’s length principles. Group companies

sold goods and services to BMW Brilliance Automotive

Ltd., Shenyang, during 2010 for an amount of euro 1,046

million (2009: euro 532 million). At 31 December 2010,

receivables of Group companies from BMW Brilliance

40