BMW 2010 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2010 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.63 GROUP MANAGEMENT REPORT

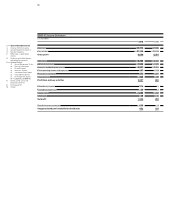

Risk management in the BMW Group

The BMW Group’s risk management system comprises

awide range of finely tuned organisational and meth-

odological

components. It is based on a decentralised

structure and supported by a network of risk managers.

The risk management system is aimed at encouraging

abalanced approach to risks at all organisational levels.

The risk management process is applied throughout

theGroup and comprises the early identification and

analysis of opportunities and risks, their measurement

and the use of suitable instruments to manage and

monitor risks. As part of the risk reporting system, deci-

sion makers are regularly informed about risks that could

have a significant impact on business performance.

Business decisions are reached after consideration of in-

depth project analyses which show both potential risks

and potential opportunities. In conjunction with the

Group’s monthly and medium- and long-term forecasting

systems, opportunities and risks attached to specific

business activities are evaluated and used as the basis for

implementing measures to mitigate risks and achieve

targets.

Important success factors are monitored

con-

tinuously to ensure that unfavourable developments are

identified at an early stage and appropriate counter-

measures implemented.

Changes in the legal, economic or regulatory environ-

ment or within the Company itself can only be assessed

in good time by means of ongoing processes. Standard-

ised rules and procedures consistently applied through-

out the BMW Group form the basis for an organisation

that is permanently learning. By regularly sharing expe-

riences with other companies, we ensure that innovative

ideas and approaches are incorporated in the risk manage-

ment

system and that risk management is subjected to

continual improvement. Regular basic and further train-

ing as well as information events are invaluable ways

ofpreparing staff for new or additional requirements with

regard to the processes in which they are involved.

Risk management is performed centrally and reviewed

regularly for appropriateness and effectiveness by inter-

nal auditors. Knowledge gained from these audits serves

as the basis for further improvements.

Consciously tak-

ing calculated risks and making full use of

theopportu-

nities relating to them has long been the basis

for our cor-

porate success.

As a globally operating organisation, the BMW Group is

exposed to a variety of risks, arising in part from the in-

creasing internationalisation of business activities and

ever-greater competition. Price fluctuations on the global

currency, money, capital and commodities markets as

well as shorter innovation cycles result in increasing com-

plexity, all of which place great demands on enterprises

with international operations.

In risk management terms, the financial year 2010 can be

sub-divided into two principal phases. During the first

half of the year, the knock-on effect of the international

economic and financial crisis was still highly evident and

the main focus was to manage related risks. The euro /US

dollar exchange rate stood at approximately 1.45 at the

beginning of the year, in retrospect its highest level for

the year. Some sales markets, particularly the USA,

did

not recover quickly from the consequences of the cri

sis.

More to the point, the worry of renewed recession

emerged. It was only over the course of the year that op-

portunities gained the upper hand as some of the world’s

economies picked up perceptibly. In this situation, pro-

active

management helped us make the most of the

op-

portunities that arose.

At present, no risks have been identified which could

threaten the going-concern status of the BMW Group or

which could have a materially adverse impact on the

netassets, financial position or results of operations of

the Group. However, risks can never be entirely ruled

out.

The main aspects of risk management activities are de-

scribed below. Additional comments on risks in conjunc-

tion with financial instruments are provided in the notes

to the Group Financial Statements.

Risks relating to the general economic environment

Global conditions were subject to a great deal of change

during the past year. Regional economic growth

differ-

ences and various measures designed to revive the

economy in the wake of the worldwide economic and

financial crisis were significant for Group revenues and

earnings.

The sale of vehicles outside the European Currency

Union gives rise to exchange risks, in particular in rela-

tion to the Chinese renminbi, the US dollar, the British

pound and the Japanese yen. These four currencies

accounted for over two-thirds of our total foreign cur-

rency exposure in 2010. Cash-flow-at-risk models and

scenario analyses are used to measure exchange rate

Risk Management