BMW 2010 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2010 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282

|

|

48

12 GROUP MANAGEMENT REPORT

12 A Review of the Financial Year

14 General Economic Environment

18 Review of Operations

41 BMW Group – Capital Market

Activities

44 Disclosures relevant for takeovers

and explanatory comments

47 Financial Analysis

47 Internal Management System

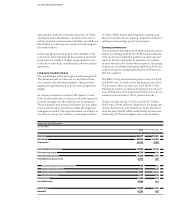

49 Earnings Performance

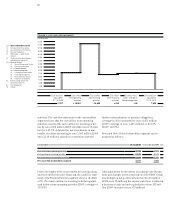

51 Financial Position

53 Net Assets Position

55 Subsequent Events Report

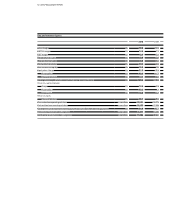

55 Value Added Statement

57 Key Performance Figures

58 Comments on BMW AG

62 Internal Control System and

explanatory comments

63 Risk Management

70 Outlook

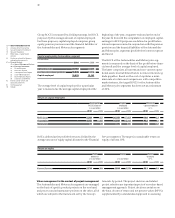

Group ROCE is measured by dividing earnings for ROCE

purposes by the average amount of capital employed.

For

these purposes, capital employed comprises group

equity, pension provisions and the financial liabilities of

the

Automobiles and Motorcycles segments.

The average level of capital employed for a particular

year is measured as the average capital employed at the

ROE is defined as the profit before taxes divided by the

average amount of equity capital allocated to the Financial

Value management in the context of project management

The Automobiles and Motorcycles segments are managed

on the basis of specific product projects on the one hand

and process and infrastructure projects on the other, all of

which are subject to the framework set by the Group’s

Services segment. The target is a sustainable return on

equity of at least 18%.

forecasts by period. The project decision and related

project selection are important aspects of our value-based

management approach. Project decisions are taken on

the basis of rates of return and net present values (NPVs),

supplemented by a standardised approach to assessing

beginning of the year, at quarter-ends and at the end of

the year. In line with the computation of employed capital,

earnings for ROCE purposes are defined as profit before

interest expense incurred in conjunction with the pension

provision and the financial liabilities of the Automobiles

and Motorcycles segments (profit before interest expense

and taxes).

The ROCE of the Automobiles and Motorcycles seg-

ments

is measured on the basis of the profit before finan-

cial

result and the average level of capital employed.

The latter comprises all current and non-current opera-

tional assets less liabilities that do not incur interest e.g.

trade payables. Based on the cost of capital as a mini-

mum rate of return and comparisons with competitive

market returns, the target ROCE for the Automobiles

and Motorcycles segments has been set at a minimum

of 26%.

Capital employed by Automobiles segment

in euro million

2010 2009

Operational assets 27,787 27,659

less: Non-interest-bearing liabilities 16,948 14,516

Capital employed 10,839 13,143

Return on equity

Profit Equity Return

before tax on equity

in euro million in euro million in %

2010 2009 2010 2009 2010 2009

Financial Services 1,214 365 4,654 3,978 26.1 9.2

Return on capital employed

Earnings for Capital Return on

ROCE purposes employed capital employed

in euro million in euro million in %

2010 2009 2010 2009 2010 2009

BMW Group 5,203 922 26,555 27,923 19.6 3.3

Automobiles 4,355 – 265 10,839 13,143 40.2 –

Motorcycles 71 19 394 405 18.0 4.7