BMW 2010 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2010 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

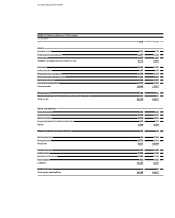

51 GROUP MANAGEMENT REPORT

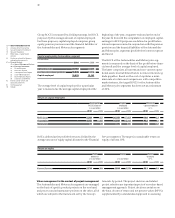

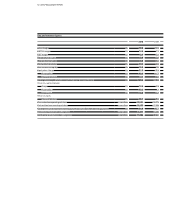

Revenues by segment

in euro million

2010 2009

Automobiles 54,137 43,737

Motorcycles 1,304 1,069

Financial Services 16,617 15,798

Other Entities 4 3

Eliminations –11,585 – 9,926

Group 60,477 50,681

Profit / loss before tax by segment

in euro million

2010 2009

Automobiles 3,887 – 588

Motorcycles 65 11

Financial Services 1,214 365

Other Entities 45 51

Eliminations – 375 574

Group 4,836 413

In the Motorcycles segment, the number of BMW motor-

cycles handed over to customers increased by 12.3%,

compared with a 22.0% increase in segment revenues.

The pre-tax segment result increased by euro 54 million

to euro 65 million.

Financial Services segment revenues grew by 5.2% to

euro 16,617 million. The pre-tax segment result climbed

to euro 1,214 million (2009: euro 365 million). The im-

provement mainly reflected lower expense for risk pro-

vision in the areas of credit financing and residual values

on the one hand and lower refinancing costs on the

other.

The Other Entities segment recorded a pre-tax profit of

euro 45 million (2009: euro 51 million).

The result from inter-segment eliminations was a net

expense of euro 375 million (2009: net income of euro

574 million), mainly reflecting the higher volume of new

leasing business and lower Group production costs.

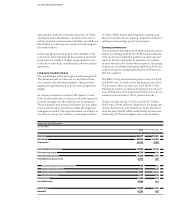

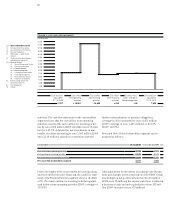

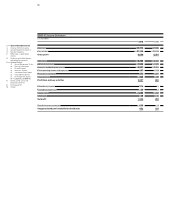

Financial position

The cash flow statements of the BMW Group and the

Automobiles and Financial Services segments show the

sources and applications of cash flows for the financial

years 2009 and 2010, classified into cash flows from oper-

ating, investing and financing activities. Cash and cash

equivalents in the cash flow statements correspond to the

amount disclosed in the balance sheet.

Cash flows from operating activities are determined indi-

rectly,

starting with Group and segment net profit. By

contrast, cash flows from investing and financing activities

are based on actual payments and receipts.

Operating activities of the BMW Group generated a

posi-

tive cash flow of euro 13,651 million in 2010, an increase

of euro 3,380 million or 32.9% compared to the previous

year. The higher net profit in 2010 accounted for euro

3,024 million of the increased cash inflow. Changes in

working capital reduced cash flows from operating activi-

ties by euro 2,205 million. This compared with changes

in other operating assets and liabilities (up by euro

1,466 million) and provisions (up by euro 910 million),

which resulted in an increase in the cash flow from oper-

ating activities.

The cash outflow for investing activities amounted to

euro 14,522 million and was therefore euro 3,194 million

higher than in 2009. Capital expenditure for intangible

assets and property, plant and equipment resulted in the

cash outflow for investing activities decreasing by euro

208 million compared to the corresponding period last

year. The cash outflow for the net investment in leased

products and receivables from sales financing increased

by euro 3,632 million to euro 9,332 million, primarily re-

flecting the higher level of new business recorded in the

Financial Services segment. The change in marketable

securities resulted in a euro 363 million decrease in cash

outflow.

Financing activities generated a cash inflow of euro

510million

in 2010, euro 842 million lower than in the

previous year (2009: cash inflow of euro 1,352 million).

Cash inflows from the issue of bonds totalled euro

4,578million (2009: euro 9,762 million), while euro

3,406 million (2009: euro 6,440 million) was used to

repay bonds. The dividend payment for the financial

year2010 amounted to euro 197 million. The cash out-

flow for other financial liabilities and commercial paper

was euro 260 million (2009: cash outflow of euro

1,562million).

94.0% (2009: 90.7%) of the cash outflow for investing

activities was covered by the cash inflow from operating