BMW 2010 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2010 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86

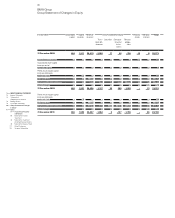

74 GROUP FINANCIAL STATEMENTS

74 Income Statements

74 Statement of

Comprehensive Income

76 Balance Sheets

78 Cash Flow Statements

80 Group Statement of Changes

in Equity

81 Notes

81 Accounting Principles

and Policies

89 Notes to the Income

Statement

95 Notes to the Statement

of Comprehensive Income

96 Notes to the Balance Sheet

117 Other Disclosures

133 Segment Information

equity instrument of another entity. Once the BMW Group

becomes party to such a contract, the financial instru-

ment is recognised either as a financial asset or as a finan-

cial liability.

Financial assets are accounted for on the basis of the

settlement date. On initial recognition, they are measured

at acquisition cost, including transaction costs.

Subsequent to initial recognition, available-for-sale and

held-for-trading financial assets are measured at their

fair value. When market prices are not available, the fair

value of available-for-sale financial assets is measured

using appropriate valuation techniques e.g. discounted

cash flow analysis based on market information avail-

able at the balance sheet date.

Available-for-sale assets include financial assets, securi-

ties and investment fund shares. This category includes

all non-derivative financial assets which are not classified

as “loans and receivables” or “held-to-maturity invest-

ments” or as items measured “at fair value through profit

and loss”.

Loans and receivables which are not held for trading,

held-to-maturity financial investments and all financial

assets for which published price quotations in an active

market are not available and whose fair value cannot be

determined reliably, are measured, to the extent that they

have a fixed term, at amortised cost, using the effective

interest method. When the financial assets do not have a

fixed term, they are measured at acquisition cost.

In accordance with IAS 39 (Financial Instruments: Recog-

nition and Measurement), assessments are made regu-

larly as to whether there is any objective evidence that a

financial asset or group of assets may be impaired. Im-

pairment losses identified after carrying out an impair-

ment test are recognised as an expense. Gains and losses

on available-for-sale financial assets are recognised di-

rectly in equity until the financial asset is disposed of or

is determined to be impaired, at which time the cumula-

tive loss previously recognised in equity is included in

net profit or loss for the period.

With the exception of derivative financial instruments,

all receivables and other current assets relate to loans

and receivables which are not held for trading and they

are measured at amortised cost. Receivables with matu-

rities

of over one year which bear no or a lower-than-mar-

ket

interest rate are discounted. Appropriate impairment

losses are recognised to take account of all identifiable

risks.

Receivables from sales financing comprise receiv-

ables

from retail customer, dealer and lease financing.

Impairment losses on receivables relating to financial

services business are recognised using a uniform method-

ology that is applied throughout the Group and meets

the requirements of IAS 39. This methodology results in

the recognition of impairment losses on individual assets

and groups of assets. If there is objective evidence of im-

pairment, the BMW Group recognises impairment losses

on the basis of individual assets. Within the customer

retail business, the existence of overdue balances or the

incidence of similar events in the past are examples of

such objective evidence. In the event of overdue receiv-

ables, impairment losses are always recognised individu-

ally based on the length of period of the arrears. In the

case of dealer financing receivables, the allocation of the

dealer to a corresponding rating category is also deemed

to represent objective evidence of impairment. If there

isno objective evidence of impairment, impairment

losses are recognised on financial assets using a portfolio

approach based on similar groups of assets. Company-

specific loss probabilities and loss ratios, derived from

historical data, are used to measure impairment losses on

similar groups of assets.

The recognition of impairment losses on receivables

relating to industrial business is also, as far as possible,

based on the same process applied to financial services

business.

Impairment losses (write-downs and allowances) on re-

ceivables are always recorded on separate accounts and

derecognised at the same time the corresponding receiv-

ables are dercognised.

Items are presented as financial assets to the extent that

they relate to financing transactions.

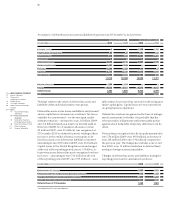

Derivative financial instruments are only used within

the BMW Group for hedging purposes in order to reduce

currency, interest rate, fair value and market price risks

from operating activities and related financing require-

ments. All derivative financial instruments (such as inter-

est, currency and combined interest /currency swaps as

well as forward currency and forward commodities con-

tracts) are measured in accordance with IAS 39 at their

fair value, irrespective of their purpose or the intention

for which they are held. The fair values of derivative finan-

cial instruments are measured using market information

and recognised valuation techniques. In those cases

where hedge accounting is applied, changes in fair value

are recognised either in income or directly in equity un-