BMW 2010 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2010 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

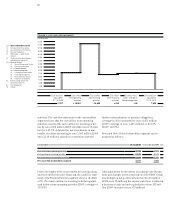

47 GROUP MANAGEMENT REPORT

Analysis of the Group Financial Statements

Group Internal Management System

Taking into account the interests and rights of capital pro-

viders represents the basis for value-based management

within the BMW Group. Only companies generating

profits on a sustainable basis that exceed the cost of equity

and debt capital employed are capable of ensuring con-

tinuous growth, an increase in value for capital providers,

jobs and, in the final analysis, corporate independence.

As part of the process of developing the Group’s manage-

ment system, “economic value added” has been intro-

duced at Group level as a new key performance indicator.

Value created represents a logical development of the

A positive value contribution means that a company is

earning more than its cost of capital. An increase or de-

crease in value contribution is an important measure of

financial success.

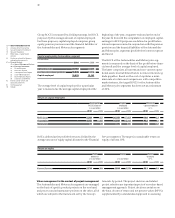

Cost of capital percentage for capital employed

The cost of capital percentage is calculated as a weighted

average of equity and debt capital costs using the standard

weighted average cost of capital (WACC) approach. Equity

capital costs are determined using the capital asset pric-

ing model (CAPM) and are based on the risk-free interest

rate plus the risk premium required by investors. The

risk premium is calculated on the basis of the market risk

premium and a beta factor. The beta factor is a measure

of a stock’s volatility in relation to the market. Interest

rates on debt capital are calculated as the average inter-

est rates relevant for long-term debt and pension obliga-

tions. The average cost of capital is calculated on the

basis of a long-term targeted capital structure, thus en-

suring stability in the way the business is managed in

the long term.

method currently in use for managing the efficient use of

capital based on the “return on capital employed” (ROCE).

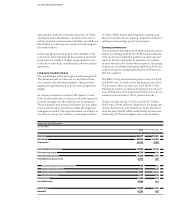

Economic value = (

ROCE Group – cost of capital rate)

added Group x capital employed

The economic value added can also be presented as

earnings less the cost of capital.

Economic value = earnings amount–cost of capital=earnings

added Group amount–(cost of capital ratex capital

employed)

Return on capital used to measure value on a

periodic basis

Specific earnings and rate of return indicators are used

tomanage operational performance at segment and

Group level and measure performance by reporting

period. The period-related targets are monitored and

managed on a long-term basis in order to ensure that

earnings can develop at a steady pace. In line with the

method applied at Group level, the return on capital

employed is used as a profitability indicator for the Auto-

mobiles and Motor cycles segments. The Financial

Services segment is managed on the basis of the return

on equity (ROE). The ROE performance indicator is

important for the value-based management of the Finan-

cial Services segment because it focuses on equity as a

resource with limited availability and prioritises the effi-

cient utilisation of capital.

Profit before interest expense and tax

ROCE Group = Capital employed

ROCE

Automobiles

Profit before financial result

and Motorcycles = Capital employed

ROE Financial

Profit before tax

Services = Equity capital

Cost of capital rate (before tax)

in %

2010 2009

BMW Group 12 12

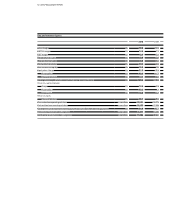

in euro million Earnings amount Cost of capital (EC + DC) Economic value added Group

2010 2009 2010 2009 2010 2009

BMW Group 5,203 922 3,187 3,351 2,016 – 2,429