BMW 2010 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2010 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

12 GROUP MANAGEMENT REPORT

12 A Review of the Financial Year

14 General Economic Environment

18 Review of Operations

41 BMW Group – Capital Market

Activities

44 Disclosures relevant for takeovers

and explanatory comments

47 Financial Analysis

47 Internal Management System

49 Earnings Performance

51 Financial Position

53 Net Assets Position

55 Subsequent Events Report

55 Value Added Statement

57 Key Performance Figures

58 Comments on BMW AG

62 Internal Control System and

explanatory comments

63 Risk Management

70 Outlook

ment opportunities. Prices of both non-ferrous and pre-

cious metals also rose, in some cases substantially. The

price of oil increased from US dollar 80 per barrel at the

start of the year to US dollar 92 on the last day of trading.

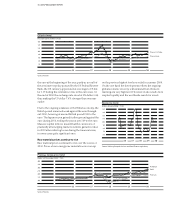

Car markets in 2010

Thanks to the worldwide recovery, the market for pas-

senger cars and light commercial vehicles again grew

sharply in 2010, rising from 63.8 million to 69.6 million

units (+9.2%). China increasingly confirmed its position

the as largest car market, the designation it had gained

in 2009. The Chinese market as a whole leapt from

13.6million to 18.1 million units (+32.4%), while the

USA, formerly the world’s largest car market, grew

byarobust but still significantly lower rate of 11.1%

withsales up from 10.4 million units to 11.6 million

units.

The differing expiry times of the various stimulus

pro-

grammes previously in place across the European Union

created a very diverse picture on national markets.

Overall, demand fell throughout the region by a further

5.5% in 2010 to 13.4 million vehicles, mainly due to the

slump in passenger car sales in Germany following the

expiry of the scrappage bonus scheme at the end of 2009.

Despite positive economic developments, the number

ofnewly registered passenger vehicles fell by about one

quarter to 2.9 million units. The French and Italian car

markets also contracted for the same reason. Sales of

passenger cars in France fell by 2.2% to 2.3 million units

and in Italy by 9.2% to 2.0 million units.

Most of the other countries managed to record slight

growth. New vehicle sales in the UK, for instance, rose by

1.8% to 2.0 million units and in Spain by 3.1% to

almost

1 million units. On the other hand, Eastern European

EUcountries recorded a further decline, with vehicle

sales

down by 3.2% to 0.8 million units.

The Japanese car market benefited from the scrappage

scheme that remained in place into 2010, with vehicle

sales up by 7.5% to 5.0 million.

Emerging markets performed very positively in 2010,

albeit at different rates. In Russia, the market grew by

one-

third to reach 1.8 million vehicles, partially offsetting

theslump experienced in 2009. The Indian market also

registered a similar high growth rate (2.8 million units;

+35.7%). Bycontrast, the car market in Brazil grew by only

8% to 3.2 million units.

Motorcycle markets in 2010

The world’s motorcycle markets in the 500 cc plus class

relevant for the BMW Group were 11.7% down on the

previous year. In Europe most markets registered lower

figures than those of the previous year (–10.3%). The

German market for 500 cc plus motorcycles fell by 7.2%.

Shortfalls against the previous year were also recorded

in

Italy (–14.8%), France (–7.1%) and the UK (–17.8%)

.

Spain was the only market to show an upward trend, re-

bounding with a 3.0% increase in response to the ex-

tremely steep drop recorded the previous year. The mar-

kets for 500 cc plus motorcycles also failed to recover in

the USA (– 14.2%) and Japan (–6.3%) in 2010. There are

no reliable figures available for the engine-capacity seg-

ments relevant for the Husqvarna brand, as most of these

motorcycles are used for sporting and off-road activities

and therefore not included in registration statistics.

Financial Services market in 2010

The financial services sector also benefited from the

relatively speedy end to the worldwide recession. Even

so, the effects of the crisis could still be felt in 2010.

Substantial write-downs by banks and more rigorous

equity and liquidity requirements due to Basel III

regula-

tions dominated the financial system. Greece and Ireland

were obliged to accept financial support from the EU and

the International Monetary Fund. Although the money

and capital markets reacted nervously to these develop-

ments,

risk spreads only widened for a short period of

time. Overall, risk spreads narrowed slightly in 2010, with-

out

returning to the levels prevailing before the crisis.

Reference interest rates in most industrial countries re-

mained at historically low levels during 2010. The Bank

of Japan lowered its overnight interest rate in October

bya further 20 basis points, thus ranging from 0% to

0.10%. China, on the other hand, raised its reference rate

during the year by 25 basis points, to 5.81% and has

implemented further measures to subdue inflationary

pressures. Similarly, the central banks of Canada and

Australia raised

their reference rates in autumn by 25 ba-

sis points to 1.00%

and 4.75% respectively. In contrast,

the prospect of continuing low reference rates in the euro

region caused interest rates for contracts with medium-

term maturities to fall slightly.