BMW 2010 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2010 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282

|

|

99 GROUP FINANCIAL STATEMENTS

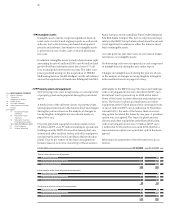

in euro million 31. 12. 2010 31. 12. 2009

within one year 4,303 4,257

between one and five years 3,766 3,428

later than five years 1 1

Leased products 8,070 7,686

21

22

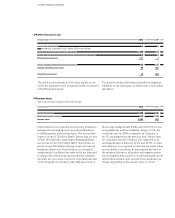

Leased products

The BMW Group, as lessor, leases out assets (predomi-

nantly own products) as part of its financial services busi-

ness.

Minimum lease payments of euro 8,070 million

(2009: euro 7,686 million) from non-cancellable operating

leases fall due as follows:

Contingent rents of euro 47 million (2009: euro 39 mil-

lion), based principally on the distance driven, were

recognised in income. The agreements have, in part, ex-

tension and purchase options as well as price escalation

clauses.

Changes in leased products during the year are shown in

the analysis of changes in Group tangible, intangible and

investment assets on pages 96 et seq.

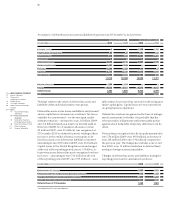

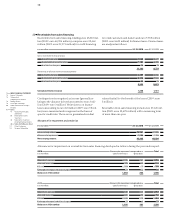

Investments accounted for using the equity method

and other investments

Investments accounted for using the equity method in-

clude the BMW Group’s interests in BMW Brilliance

Automotive Ltd., Shenyang, SGL Automotive Carbon

Fibers GmbH & Co. KG, Munich, SGL Automotive Carbon

Fibers Verwaltungs GmbH, Munich, and SGL Auto-

motive Carbon Fibers LLC, Dover, DE (all joint ventures)

and in Cirquent GmbH, Munich. The aggregated inter-

ests of the Group are as follows:

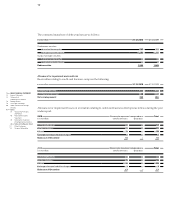

Other investments relate primarily to investments in

non-consolidated subsidiaries, investments in other

companies and non-current marketable securities.

Additions to investments in non-consolidated sub-

sidiaries

relate primarily to the foundation of BMW India

Financial Services Pvt. Ltd., New Delhi, and to a capital

increase at the level of Husqvarna Motorcycles S. r. l.,

Cassinetta di Biandronno.

The write-downs on investments in affiliated companies

relates primarily to investments in the Husqvarna Group.

The new strategic direction being taken for these invest-

ments gave rise to an impairment loss of euro 178

mil-

lion, reflecting the fact that the recoverable amount (value

in use) was lower than the relevant carrying amounts.

Most ofthis

expense was recorded by the Automobile

segment. Fair

values were calculated by discounting

future cash flows

using a risk-adjusted interest rate of

12.0% (unchanged

from the previous year).

Changes in investments in non-consolidated subsidiar-

ies also reflect the capital increase, impairment and first-

time consolidation of the Husqvarna Group.

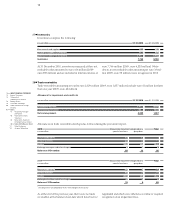

A break-down of the different classes of other invest-

ments disclosed in the balance sheet and changes during

the year are shown in the analysis of changes in Group

tangible, intangible and investment assets on pages 96

etseq.

in euro million 31. 12. 2010 31. 12. 2009

Disclosures relating to the income statement

Income 1,240 835

Expenses –1,142 – 797

Profit 98 38

Disclosures relating to the balance sheet

Non-current assets 318 222

Current assets 572 287

Equity 271 164

Non-current liabilities 36 15

Current liabilities 583 330

Balance sheet total 890 509