BMW 2010 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2010 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.55 GROUP MANAGEMENT REPORT

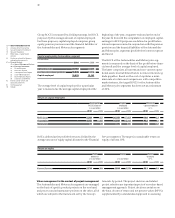

fair value measurement of derivative financial instru-

ments

(– euro 520 million) and marketable securities

(– euro 16 million). The dividend payment reduced

Group equity by euro 197 million.

The Authorised Capital created at the Annual General

Meeting held on 14 May 2009 in conjunction with the

employee share scheme was partially used during the

financial year under report to issue shares of preferred

stock to employees, increasing subscribed capital by

euro 0.5 million. An amount of euro 18 million was

transferred to capital reserves in conjunction with this

share capital increase. Other items reduced equity by

euro 3 million.

The equity ratio of the BMW Group improved overall by

1.7 percentage points to 21.2%. The equity ratio of the

Automobiles segment was 40.9% (2009: 41.7%) and that

of the Financial Services segment was 7.1% (2009: 6.0%).

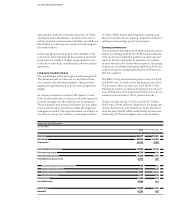

Pension provisions decreased by 47.4% to euro 1,563 mil-

lion. In the case of pension plans with fund assets, the

fair value of fund assets is offset against the defined

benefit obligation. The decrease was mainly due to the

transfer of a further tranche of pension obligations to

BMW Trust e.V., Munich, in conjunction with Contractual

Trust Arrangements (CTAs). Lower interest rates in Ger-

many had the effect of increasing the provision.

Other provisions increased by euro 783 million (+16.4%)

to euro 5,547 million. Within other provisions, provisions

for personnel-related expenses went up by euro 432 mil-

lion, provisions for other obligations by euro 207 million

and provisions for on-going operational expenses by

euro 144 million.

Financial liabilities increased by 1.7% to euro 62,353 mil-

lion, mostly due to exchange rate factors. Within financial

liabilities, derivative instruments increased by 83.9% to

euro 2,010 million, liabilities from customer deposits by

7.6% to euro 10,689 million and bonds by 2.0% to euro

27,568 million. Working in the opposite direction, liabili-

ties to banks decreased by 15.6% to euro 7,740 million

and asset-backed-financing liabilities were down by 3.9%

to euro 7,506 million.

Trade payables amounted to euro 4,351 million and were

thus 39.4% higher than one year earlier.

Other liabilities increased by euro 1,572 million to euro

7,822 million.

Overall, the earnings performance, financial position and

nets assets of the BMW Group improved significantly dur-

ing

the financial year under report.

Compensation report

The compensation of the Board of Management com-

prises both a fixed and a variable component. In addi-

tion, benefits are also payable at the end of members’

mandates, primarily in the form of pension benefits.

Further details, including an analysis of remuneration

by individual, are disclosed in the Compensation Report,

which can be found in the Corporate Governance sec-

tion of theAnnual Report on pages 140 et seq. The

Compensation Report is a sub-section of the Manage-

ment Report.

Subsequent events report

No events have occurred after the balance sheet date

which could have a major impact on the earnings

performance,

financial position and nets assets of the

BMW Group.

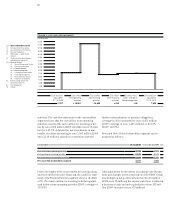

Value added statement

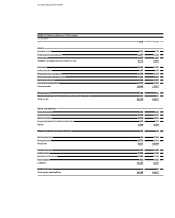

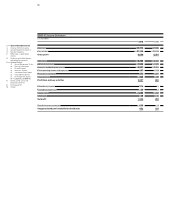

The value added statement shows the value of work per-

formed less the value of work bought in by the BMW

Group during the financial year. Depreciation and amor-

tisation, cost of materials and other expenses are treated

as bought-in costs in the value added calculation. The

allocation statement applies value added to each of the

participants involved in the value added process. It

should be noted that the gross value added amount

treats depreciation as a component of value added

which, in the allocation statement, is treated as internal

financing.

Net value added by the BMW Group in 2010 increased by

42.7% to euro 14,902 million, reflecting the fact that the

value of work performed rose significantly faster than the

value of work bought in.

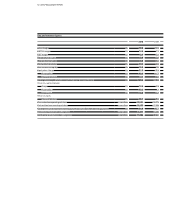

The bulk of the net value added (48.8%) is applied to em-

ployees. The proportion applied to providers of finance

fell to 15.9%, mainly due to the further easing of pressure

on international capital markets. The government / pub-

lic sector (including deferred tax expense) accounted

for13.6%. The proportion of net value added applied to

shareholders, at 5.7%, was higher than in the previous

year. Other shareholders take a 0.1% share of net value

added. The remaining proportion of net value added

(15.9%) will be retained in the Group to finance future

operations.