BMW 2010 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2010 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

12 GROUP MANAGEMENT REPORT

12 A Review of the Financial Year

14 General Economic Environment

18 Review of Operations

41 BMW Group – Capital Market

Activities

44 Disclosures relevant for takeovers

and explanatory comments

47 Financial Analysis

47 Internal Management System

49 Earnings Performance

51 Financial Position

53 Net Assets Position

55 Subsequent Events Report

55 Value Added Statement

57 Key Performance Figures

58 Comments on BMW AG

62 Internal Control System and

explanatory comments

63 Risk Management

70 Outlook

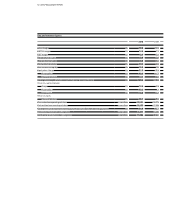

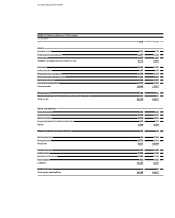

Comments on Financial Statements of BMW AG

The financial statements of BMW AG are drawn up in

accordance with the German Commercial Code (HGB)

and the German Stock Corporation Act (AktG). The pro-

visions of the German Accounting Law Modernisation

Act (BilMoG) were applied for the first time in the finan-

cial

year 2010. Prior year figures have not been restated.

Application of the BilMoG requirements had an impact

on extraordinary items in the income statement and

revenue reserves in the balance sheet.

BMW AG develops, manufactures and sells cars and

motorcycles manufactured by itself and foreign

sub-

sidiaries. These vehicles are sold through the Company’s

own branches, independent dealers, subsidiaries and

importers. The number of cars manufactured at German

and foreign plants in 2010 rose by 17.7% to 1,481,253

units. The workforce of BMW AG decreased by 705 to

69,518 employees at 31 December 2010, primarily as

aresult of natural employee fluctuation, pre-retirement

part-time working arrangements and voluntary employ-

ment contract termination agreements.

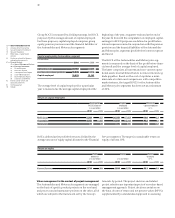

Widespread economic recovery and model life cycle fac-

tors resulted in strong sales volume growth, which was

reflected in a 20.5% growth in revenues. The most sig-

nificant

increase was recorded in Asia. Sales to Group

sales companies accounted for euro 32.6 billion or ap-

proximately

71.2% of total revenues of euro 45.8 billion.

The increase in cost of sales was less pronounced than

the increase in revenues, mainly due to reduced material

costs. As a consequence, gross profit increased by euro

3.3 billion to euro 8.6 billion.

The decrease in other operating income and expenses

and in the result on investments was attributable to re-

duced

income from Group companies and the lower

level of income from the reversal of provisions.

The profit from ordinary activities increased from euro

605 million to euro 2,337 million.

Extraordinary income and expenses mainly contain

items relating to the first-time application of BilMoG:

this gave rise to net extraordinary income of euro 274 mil-

lion

in 2010. Further information on the impact of

BilMoG is provided in the notes to the financial statements

of BMW AG.

The tax expense in 2010 comprises current year tax and

adjustments for previous years arising in connection

with intra-group transfer pricing arrangements. The re-

sulting

threat of a double taxation charge at Group level

is being avoided primarily by instigating bilateral appeal

proceedings.

After deducting the expense for taxes, the Company reports

a net profit of euro 1,506 million (2009: euro 202 million).

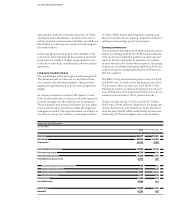

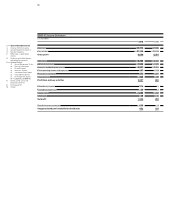

Investments went up from euro 1,303 million at the end of

2009 to euro 1,875 million at 31 December 2010, mainly

as a result of capital increases made at the level

of BMW

Bank GmbH, Munich, following a cash contribution

from BMW AG and the transfer of an investment by way

of non-cash contribution. The merger of BMW Ingenieur-

Zentrum GmbH, Dingolfing, and hence the

automatic

transfer of assets and liabilities of BMW Ingenieur-

Zen-

trum GmbH + Co oHG, Dingolfing, to BMW AG, Munich,

had the effect of reducing investments.

Capital expenditure on intangible assets and property,

plant and equipment amounted to euro 1,582 million

(2009: euro 1,667 million), 5.1% lower than in the pre-

vious

year. The main focus in 2010 was on product in-

vestments for production start-ups. In addition, property,

plant and equipment with a carrying amount of euro

703 million was transferred to BMW AG in conjunction

with the restructuring measure referred to above. Depreci-

ation

and amortisation amounted to euro 1,540 million.

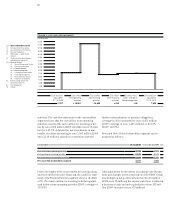

In order to secure obligations resulting from pre-retire-

ment part-time work arrangements and a part of the

Company’s pension obligations, assets were transferred

to BMW Trust e.V., Munich, in conjunction with Contrac-

tual Trust Arrangements (CTA). The assets concerned

comprise mainly holdings in investment fund assets and

a receivable resulting from a so-called “Capitalisation

Transaction” (Kapitalisierungs geschäft). A further tranche

of pension obligations was externalised in 2010. Follow-

ing the implementation of BilMoG, fund assets have

been offset for the first time against the related guaran-

teed obligations. The resulting surplus of assets over

liabilities is reported in the BMW AG balance sheet on

the line “Surplus of pension and similar plan assets over

liabilities”.

Equity rose by euro 1,734 million to euro 7,088 million.

The first-time application of BilMoG resulted in a euro

407 million increase in reserves. The equity ratio im-

proved from 21.7% to 29.1%.

The amount recognised in the balance sheet for pension

provisions fell to euro 24 million. This was attributable

to the first-time offsetting of pension obligations against

assets transferred to BMW Trust e.V., Munich, as part of

the process of externalising pension obligations.

External liabilities to banks and from commercial paper

programmes were reduced during the financial year. In the

opposite direction, liabilities to subsidiaries in conjunction

with intra-group financing arrangements increased.