BMW 2010 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2010 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282

|

|

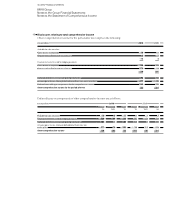

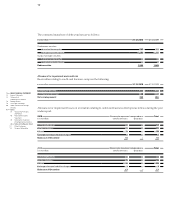

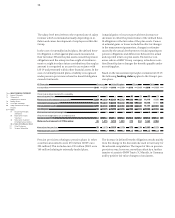

105 GROUP FINANCIAL STATEMENTS

in euro million 31. 12. 2010 31. 12. 2009

1 – 30 days overdue 148 149

31 – 60 days overdue 41 49

61 – 90 days overdue 15 26

91 – 120 days overdue 11 28

More than 120 days overdue 39 69

254 321

Some trade receivables were overdue for which an impairment loss was not recognised. Overdue balances are analysed

into the following time windows:

Receivables that are overdue by between 1 and 30 days

do not normally result in bad debt losses since the over-

due nature of the receivables is primarily attributable to

the timing of receipts around the month-end. In the case

of trade receivables, collateral is generally held in the

form of vehicle documents and bank guarantees so that

the risk of bad debt loss is extremely low.

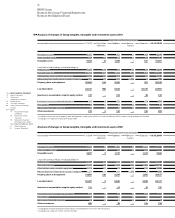

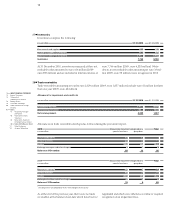

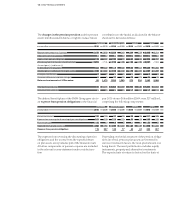

Cash and cash equivalents

Cash and cash equivalents of euro 7,432 million (2009: euro 7,767 million) comprise cash on hand and at bank, all

with a maturity of under three months.

Equity

Number of shares issued

At 31 December 2010 common stock issued by BMW AG

was divided into 601,995,196 shares with a par value of

one euro. Preferred stock issued by BMW AG was divided

into 53,163,412 shares with a par value of one euro. Un-

like the common stock, no voting rights are attached to

the preferred stock. All of the Company’s stock is issued

to bearer. Preferred stock bears an additional dividend of

euro 0.02 per share.

In 2010, a total of 499,590 shares of preferred stock was

sold to employees at a reduced price of euro 26.99 per

share in conjunction with an employee share scheme.

These shares are entitled to receive dividends with effect

from the financial year 2011. 1,540 shares of preferred

stock were bought back via the stock exchange in order

to service the Company’s employee share scheme.

Issued share capital increased by euro 0.5 million as a

result of the issue to employees of 498,050 shares of non-

voting preferred stock. The Authorised Capital of BMW

AG amounted to euro 4 million at the end of the report-

ing period. The Company is authorised to issue shares of

non-voting preferred stock amounting to nominal euro

5million prior to 13 May 2014. The share premium of

euro 18 million arising on the share capital increase in

2010 was transferred to capital reserves.

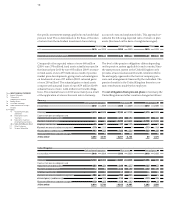

The effect of applying IFRS 2 (Share-Based Payments)

to the employee share scheme is not material for the

Group.

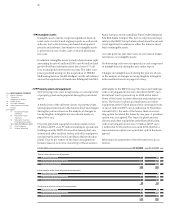

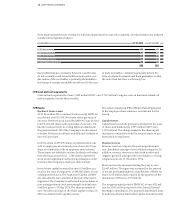

Capital reserves

Capital reserves include premiums arising from the issue

of shares and totalled euro 1,939 million (2009: euro

1,921 million). The change related to the share capital

increase in conjunction with the issue of shares of pre-

ferred

stock to employees.

Revenue reserves

Revenue reserves comprise the post-acquisition and

non-distributed earnings of consolidated companies. In

addition, revenue reserves include both positive and

negative goodwill arising on the consolidation of Group

companies prior to 31 December 1994.

Revenue reserves increased during the year to euro

23,447 million. The figure was increased by the amount

of the net profit attributable to shareholders of BMW AG

(euro 3,218 million) and reduced by the payment of the

dividend for 2009 (euro 197 million).

The unappropriated profit of BMW AG of euro 852 mil-

lion for 2010 will be proposed to the Annual General

Meeting for distribution. The proposed distribution must

be authorised by the shareholders at the Annual General

29

30