BMW 2010 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2010 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

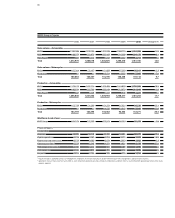

12 GROUP MANAGEMENT REPORT

12 A Review of the Financial Year

14 General Economic Environment

18 Review of Operations

41 BMW Group – Capital Market

Activities

44 Disclosures relevant for takeovers

and explanatory comments

47 Financial Analysis

47 Internal Management System

49 Earnings Performance

51 Financial Position

53 Net Assets Position

55 Subsequent Events Report

55 Value Added Statement

57 Key Performance Figures

58 Comments on BMW AG

62 Internal Control System and

explanatory comments

63 Risk Management

70 Outlook

Strong recovery after crisis

The global economy recovered well in 2010 from the

economic collapse caused by the international economic

and financial crisis. The principal factors driving the

up-

swing out of the deepest recession since the Second World

War were massive state-funded stimulus programmes

and the highly expansionary monetary policies pursued

by the world’s major central banks.

The situation was also aided by the fact that most of the

emerging markets in Asia and Latin America had suffered

significantly lower drops in growth than the industrial-

ised countries during the crisis and therefore propped up

the global economy as it swiftly returned to its previous

growth pattern. One of the overall effects of the crisis was

therefore a further shift in economic power towards Asia.

China’s economy grew very strongly again at a rate of

10.3% in 2010. Against this background, many asset prices

continued to rise and there is still a danger of overheating,

particularly on certain regional property markets.

In the USA, the economy recovered from the contraction

experienced in 2009, although by American standards the

upswing was relatively modest at 2.9%. One reason for

this was low consumer spending in the USA, primarily at-

tributable to high unemployment, the faltering property

market and high levels of private debt (albeit falling some-

what).

Markets in the euro zone developed highly diversely in

2010 and the average growth rate was 1.7%. With the ex-

ception of Germany, most major countries were unable

to achieve more than moderate growth. The southern

European countries and Ireland fared poorly after a loss

ofconfidence in their state bonds and the resulting politi-

cal turmoil. While Spain and Ireland stagnated, Greece

was forced to go through yet another year of recession.

Germany was the only country that really took off, record-

ing strong economic growth of 3.6%. The upturn was

largely attributable to improved export figures, but also

assisted by increasingly robust domestic demand driven

by investment expenditure. Although unemployment

dropped to it lowest level for almost 20 years, consumer

spending remained moderate.

The British economy climbed somewhat more slowly out

of recession, with the property market stabilising at a

low level. The sharp rise in unemployment, high levels of

private debt and the resulting weak domestic demand

only allowed a moderate growth rate of 1.7%.

Japan registered very robust growth in 2010, equalling

that of Germany. The economy profited enormously from

the global economic upswing on the one hand (despite

the strong yen), and a return to greater consumer

spending on the other, enabling Japanese gross national

product (GNP) to rise by 4.1%.

Asian and Latin American emerging markets, which had

stood up well during the crisis, were mostly able to

match

or even exceed their long-term growth rates in

2010. India and Brazil, for example, recorded growth

rates of 8.7% and 7.6% respectively. By contrast, most

Eastern European countries grew at significantly lower

rates than in the years prior to the financial crisis. This

was particularly true for Russia with a growth rate of 4.0%.

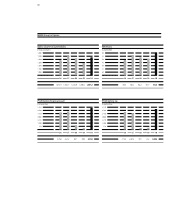

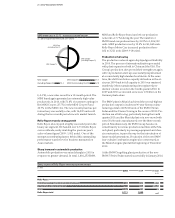

US dollar and yen stronger, British pound remains weak

The value of the US dollar against the euro increased

significantly over the course of the year, with wide fluctu-

ations along the way. After standing at US dollar 1.44 to

General Economic Environment

Exchange rates compared to the Euro

(Index: 30 December 2005 = 100)

140

130

120

110

100

90

80

06 07 08 09 10

Source: Reuters

British Pound

Chinese

Renminbi

Japanese Yen

US Dollar