BMW 2010 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2010 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

126

74 GROUP FINANCIAL STATEMENTS

74 Income Statements

74 Statement of

Comprehensive Income

76 Balance Sheets

78 Cash Flow Statements

80 Group Statement of Changes

in Equity

81 Notes

81 Accounting Principles

and Policies

89 Notes to the Income

Statement

95 Notes to the Statement

of Comprehensive Income

96 Notes to the Balance Sheet

117 Other Disclosures

133 Segment Information

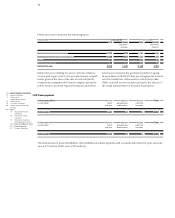

in euro million 31. 12. 2010 31. 12. 2009

Euro / Chinese Renminbi 265 201

Euro / US Dollar 103 174

Euro / British Pound 184 188

Euro / Japanese Yen 30 17

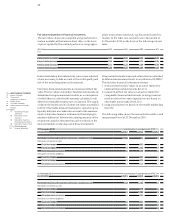

Market risks

The principal market risks to which the BMW Group is

exposed are currency risk and interest rate risk.

Protection against such risks is provided in the first in-

stance

though natural hedging which arises when the

values of non-derivative financial instruments have

matching maturities and amounts (netting). Derivative

financial instruments are used to reduce the risk remain-

ing after netting. Financial instruments are only used

tohedge underlying positions or forecast transactions.

The scope of permitted transactions, responsibilities,

financial reporting procedures and control mechanisms

used for financial instruments are set out in internal

guidelines. This includes, above all, a clear separation

ofduties between trading and processing. Currency and

interest rate risks are managed at a corporate level.

Further disclosures relating to risk management are pro-

vided in the Group Management Report.

Currency risk

As an enterprise with worldwide operations, business is

conducted in a variety of currencies, from which currency

risks arise. Since a significant portion of Group revenues

are generated outside the euro currency region and the

procurement of production material and funding is also

organised on a worldwide basis, the currency risk is an

extremely important factor for Group earnings.

At 31 December 2010 derivative financial instruments

were in place to hedge exchange rate risks, in particular

for the currencies Chinese renminbi, US dollar, British

pound and Japanese yen. The hedging contracts comprise

mainly option and forward currency contracts.

A description of how these risks are managed is provided

in the Group Management Report on pages 63 et seq.

The BMW

Group measures currency risks using a cash-

flow-at-risk

model.

The starting point for analysing currency risk with this

model is the identification of forecast foreign currency

transactions or “exposures”. At the end of the reporting

period, the principal exposures for the coming year were

as follows:

In the next stage, these exposures are compared to all

hedges that are in place. The net cash flow surplus repre-

sents an uncovered risk position. The cash-flow-at-risk

approach involves allocating the impact of potential

exchange rate fluctuations to operating cash flows on the

basis of probability distributions. Volatilities and corre-

lations serve as input factors to assess the relevant proba-

bility distributions.

The potential negative impact on earnings for the current

period is computed on the basis of current market prices

and exposures to a confidence level of 95% and a holding

period of up to one year for each currency. Aggregation

of these results creates a risk reduction effect due to corre-

lations between the various portfolios.

The following table shows the potential negative impact

for the BMW Group – measured on the basis of the cash-

flow

-at-risk approach – attributable at the balance sheet

date to unfavourable changes in exchange rates for the

principal currencies.

in euro million 31. 12. 2010 31. 12. 2009

Euro / Chinese Renminbi 6,256 3,119

Euro / US Dollar 3,888 3,696

Euro / British Pound 3,056 2,446

Euro / Japanese Yen 1,086 902