BMW 2010 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2010 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

12 GROUP MANAGEMENT REPORT

12 A Review of the Financial Year

14 General Economic Environment

18 Review of Operations

41 BMW Group – Capital Market

Activities

44 Disclosures relevant for takeovers

and explanatory comments

47 Financial Analysis

47 Internal Management System

49 Earnings Performance

51 Financial Position

53 Net Assets Position

55 Subsequent Events Report

55 Value Added Statement

57 Key Performance Figures

58 Comments on BMW AG

62 Internal Control System and

explanatory comments

63 Risk Management

70 Outlook

are identified, measured, monitored, evaluated and

managed in the BMW Group on the basis of recognised

standards and regulations that generally apply world-

wide in this line of business. Risk management is based

on concepts, methods and procedures developed and

continuously being updated within the regulated bank-

ing sector, e.g. the “Minimum Requirements for Risk

Management” (MaRisk) applicable in Germany.

The main categories of risk relating to the provision of

financial services are credit and counterparty risk, residual

value risk, interest rate risk, liquidity risk and operating

risks. We have developed internal methodologies and

techniques that comply with national and international

standards and regulatory requirements such as BaselII to

measure credit, residual value and interest rate risks on

the one hand and operational risks on the other. Internal

guidelines are also in place to manage liquidity risk and

ensure compliance with regulatory requirements.

Credit risks arise in conjunction with lending to retail

customers

(leasing, credit financing) and commercial

customers

(dealers, fleet customers, importers). Counter-

party risks arise on financial transactions with banks and

financial institutions entered into to refinance business

and manage risk. Advanced scoring and rating models

are employed to assess customers’ creditworthiness as

part of the risk management process for lending. Lending

is based on a conservative evaluation of col lateral

(nor-

mally the financed vehicle or object).

The recoverability of the value of collateral is continu-

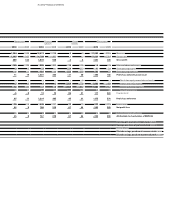

ously checked and measured in order to assess the level

of unsecured risks. Stress tests and back-testing proce-

dures ensure that the measurement of our portfolios is

up to date. Modern credit-value-at-risk methods, incorpo-

rating binding and fixed limits for credit risks, are used

for measurement purposes. These limits are regularly

reviewed every quarter. In order to minimise risk, we em-

ploy typical banking instruments such as retrospective

collateral, multiple collateral, retention of vehicle docu-

ments and higher upfront payments.

In addition, close and regular contact with borrowers, a

good understanding of the leased or financed vehicles

involved (including subsequent disposal of the asset)

and prudent measurement of collateral all help to mini-

mise risk substantially. Lending based on typical bank-

ing sector criteria and guidelines together with principles

derived from MaRisk, such as segregation of duties be-

tween front-office and back-office functions, dual control

at all stages of the credit decision, risk-based upfront

payments and mandatory authorisation matrices, are

integral components of the Group’s risk-based credit

processes.

All process steps, such as segregation of duties, or the use

of techniques to recognise risks at an early stage, are

required to be applied worldwide. Appropriate testing is

carried out to ensure that the systems are up to date and

working properly. Local, regional and centralised credit

audits are regularly performed to test compliance with

lending guidelines applicable throughout the Group, credit

processes and the underlying IT systems.

We continue to develop standardised credit decision

processes for the BMW Group worldwide and are con-

stantly endeavouring to improve the quality of credit

applications, the Group’s rating methodology and

pro-

cedures used to select employees within the worldwide

counterparty risk network.

Risk criteria with worldwide applicability, such as retail

customer arrears, bad debt ratios, the expense for allo-

cations to bad debt allowances and the proportion of

dealer financing volumes subject to problems are calcu-

lated and analysed on a monthly or quarterly basis and

used in the context of proactive risk management. This

information is provided to local, regional and centralised

management along with appropriate recommendations

for action as the basis for decision-making. The measures

taken enabled us to present, measure and manage credit

risk more transparently in 2010 and to reduce its level

accordingly. The provision for credit risks in the field of

dealer financing was raised in 2010 as a consequence of

the delayed effect of the financial crisis. This field is only

likely to return to anywhere near normal levels after a

delay of one to three years.

All credit risk decisions relating to international dealers,

importers and fleet customers are made in a three-stage

credit decision process. Alongside the total credit amount

(before and after deduction of collateral), the credit rat-

ing

allocated and the requirement to comply with stipu-

lated credit risk guidelines provide the basis for this

process.

The final decision is made by the national

, re-

gional or global credit committee, and the back-office

input to the relevant committees cannot be overruled.

Specific and general allowances are recognised at the ap-

propriate amounts to cover identified risks.